Among the best issues about redeeming journey rewards is strategizing get absolutely the fattest return per level. Airline miles and resort factors may be value exponentially greater than merely redeeming your rewards for money again, relying on how you utilize them.

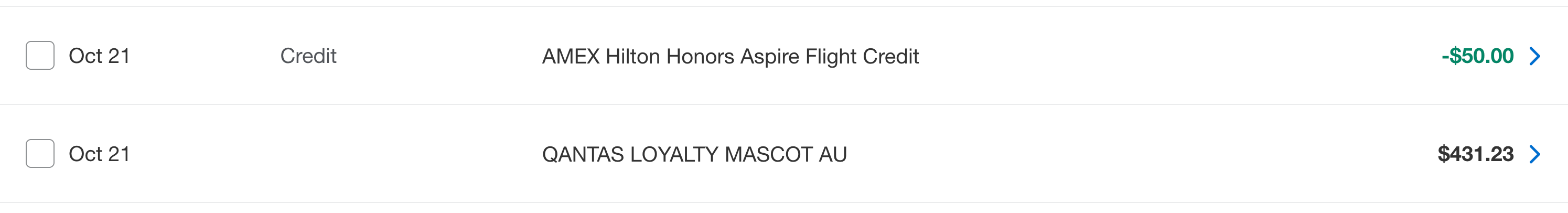

However do you know you can get outsize worth on your assertion credit, too? I used an up-to-$50 journey credit score from my Hilton Honors American Categorical Aspire Card to e book nearly $100 in flights. Right here’s the way it labored.

What’s the Amex Hilton Aspire quarterly airline credit score?

The Amex Hilton Aspire comes with as much as $200 in annual assertion credit for flight purchases — doled out in up-to-$50 increments every quarter. American Categorical states that these credit are good for “flight purchases made straight with an airline or by way of AmexTravel.com utilizing your Hilton Honors American Categorical Aspire Card.”

You don’t have to make use of the complete credit score every quarter to set off reimbursement. However it’s essential to notice that these credit are use-it-or-lose-it; any portion of the credit score that goes unredeemed can be forfeited.

These are a few of the most easy and easy-to-use assertion credit you’ll discover on a rewards bank card.

Why (and the way) I redeemed my Amex Hilton Aspire airline credit score for factors

To set the stage, my household of three wanted flights from New York’s John F. Kennedy Worldwide Airport (JFK) to John Glenn Columbus Worldwide Airport (CMH). The most affordable nonstop route was a steep $350 per particular person. Even award flights have been exorbitant, with one exception: American Airways seats booked by way of its companion airline, Qantas.

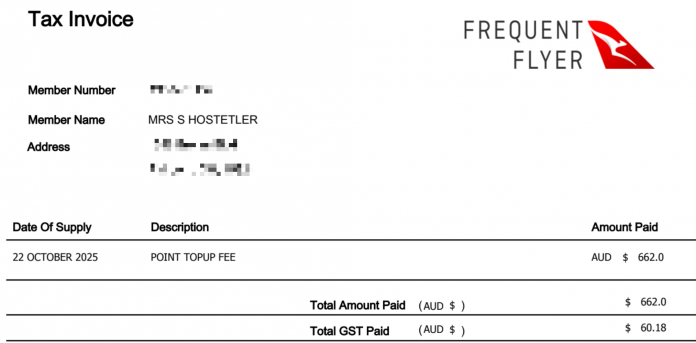

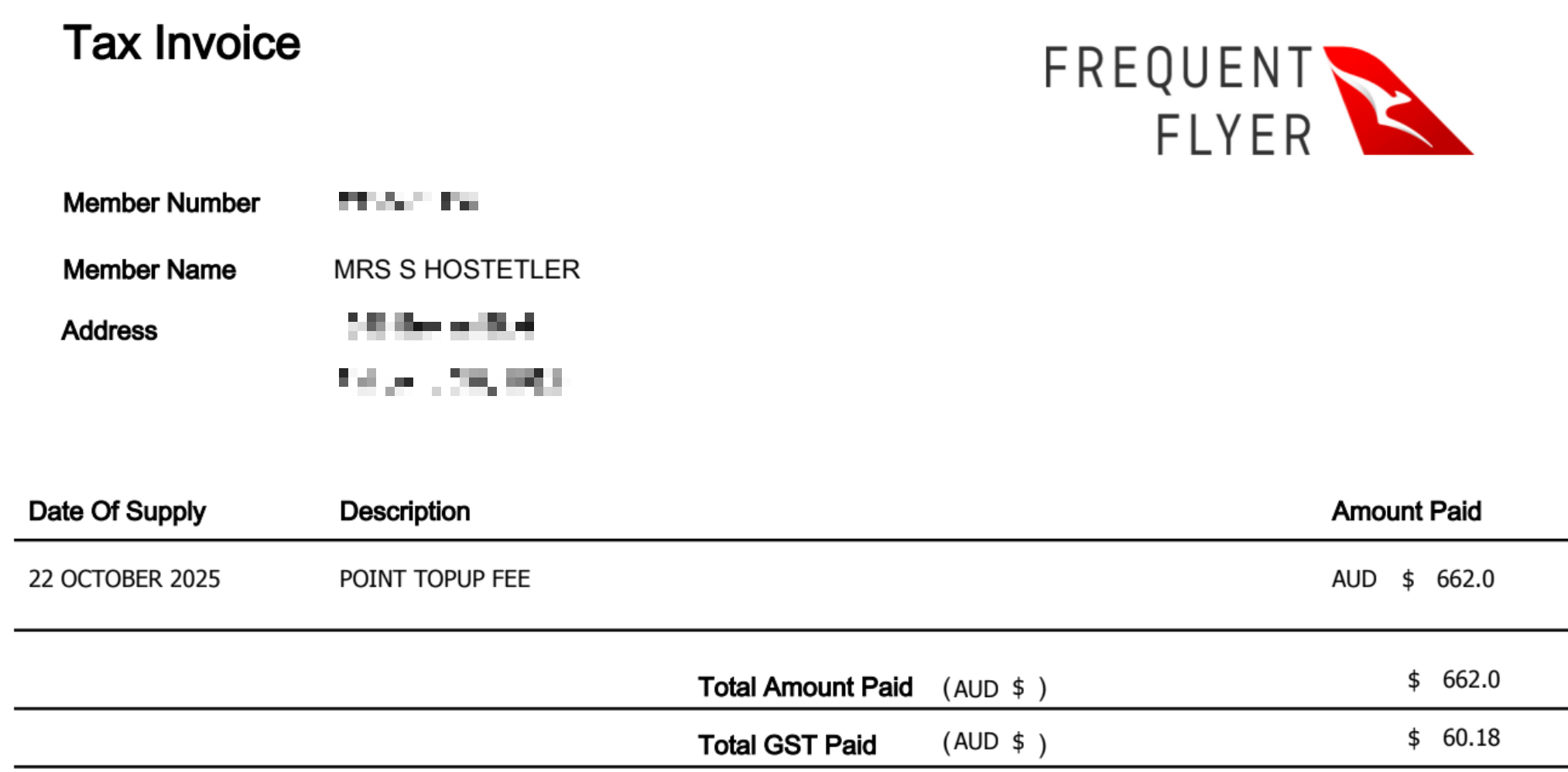

The awards value 9,200 Qantas Frequent Flyer factors every. By buying 21,000 factors, I might mix them with my present modest stash of seven,000 Qantas factors to e book three seats. Buying 21,000 factors value me 662 Australian {dollars} (or $431.23, on the time).

Utilizing my Amex Hilton Aspire to pay for these factors triggered the cardboard’s quarterly up-to-$50 airline assertion credit score. In different phrases, I paid simply $381.23 out of pocket.

Simplifying the mathematics

I paid $431 to buy 21,000 Qantas factors, which suggests every level value 2.05 cents. Subsequently, one seat at an award value of 9,200 factors prices a complete of $194.20 ($188.60 plus $5.60 in taxes and costs). If I subtract the $50 Hilton Aspire airline credit score, I paid about $144 for one seat, in comparison with the money ticket value of $350.

Reward your inbox with the TPG Each day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

So, how do I quantify my financial savings from this credit score? It’s true sufficient that this credit score saved me a flat $50. However by utilizing it to buy 2,440 Qantas factors as a substitute of merely redeeming it for a $350 American Airways buy, I bought a a lot larger worth from it.

Right here have been my two choices:

- Pay $350 money for the American Airways seat: Utilizing my card assertion credit score would have saved me $50, bringing my out-of-pocket spending to $300 — offsetting 14% of my flight value.

- Pay $194.20 for an award flight (9,200 Qantas factors plus $5.60 in taxes): Utilizing my $50 credit score reimbursed me for two,440 Qantas factors — offsetting 26% of my flight value.

All to say, I obtained 3.74 cents per Qantas level: ($350 money fare – $5.60 in charges) / 9,200 factors (award value per seat) = 3.74 cents.

Which means the two,440 Qantas factors I purchased with my $50 Amex Hilton Aspire credit score have been value $91.25 (2,440 x 0.0374). That’s a whopping 82% extra worth from my assertion credit score by buying factors as a substitute of paying money for my fare.

Do different airways qualify?

It’s value repeating that the Amex Hilton Aspire’s airline credit score is, based on American Categorical, meant for use for “flight purchases made straight with an airline or by way of AmexTravel.com.”

Many airways promote their rewards by way of an internet site known as Factors.com. This isn’t an airline web site — so if you happen to’re focused on shopping for miles with an airline that makes use of Factors.com as the purpose of sale, your Amex Hilton Aspire credit score will nearly actually not work (I haven’t examined this myself).

That mentioned, the credit score ought to work with an airline that sells miles straight. For instance, American Airways handles the sale of its personal miles, so it ought to set off the up-to-$50 credit score.

Potential work-around for different airways

Whereas a clunky course of, it could even be potential to purchase miles from airways that use Factors.com to course of factors and miles purchases. A handful of carriers assist you to purchase miles as a top-up through the reserving course of.

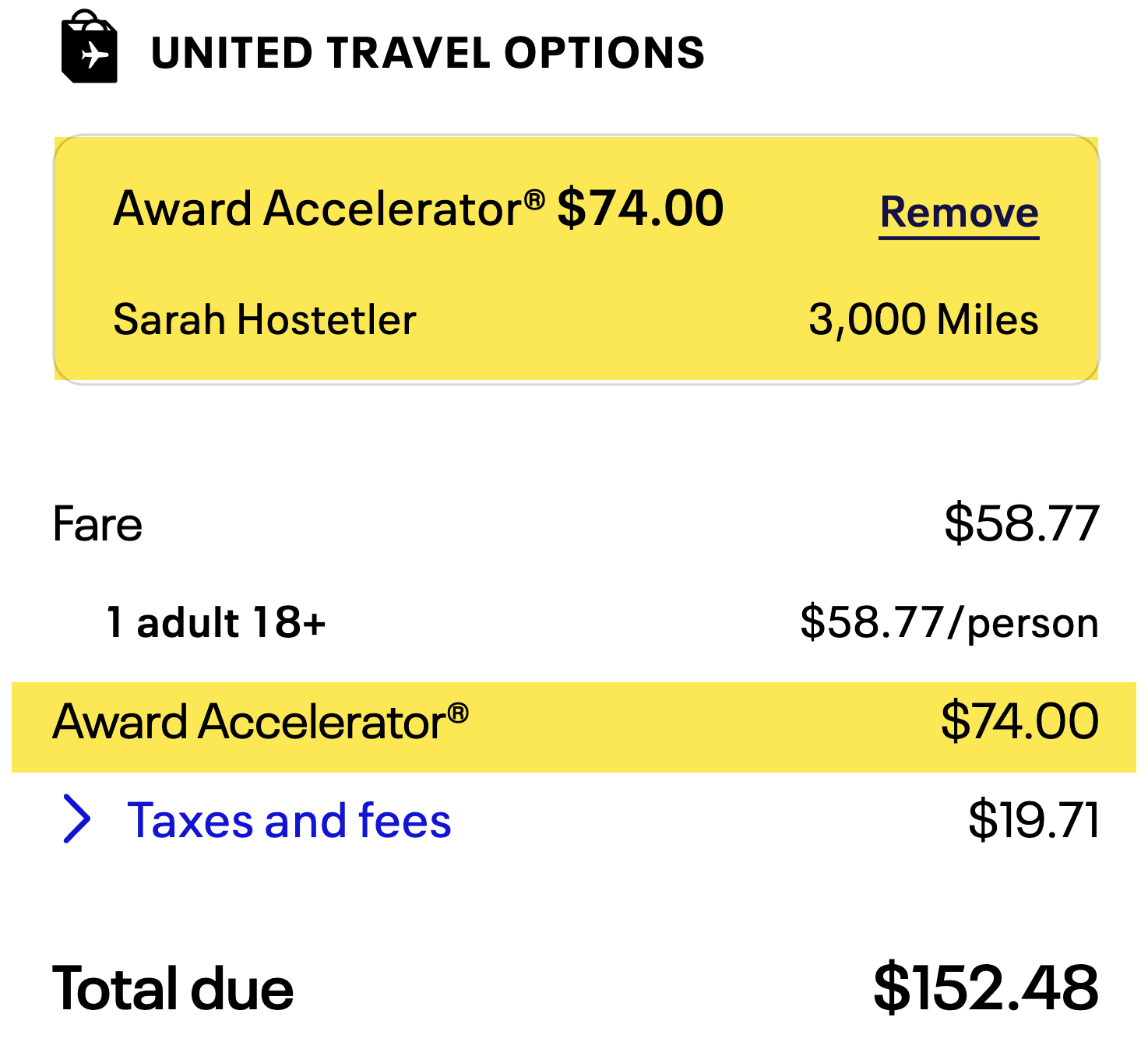

For instance, United Airways all the time extends its “Award Accelerator” choice at checkout, permitting you so as to add some miles onto your invoice at checkout (as a substitute of shopping for from Factors.com). This could code as a United Airways buy. So long as you’ve not booked a primary economic system flight, you’ll have the ability to cancel your flight to obtain journey credit score — and your miles buy ought to stay in your account.

Amex Hilton Aspire has different nice perks

The cardboard’s as much as $200 in annual airline credit score is way from the one advantage the Amex Hilton Aspire has to supply. For its $550 annual payment (see charges and costs), you’ll additionally get:

- Annual free evening rewards: Upon account opening (and after every cardmember anniversary), obtain a free evening certificates for the standard room at almost any Hilton resort. Observe that as a cardholder, you’ll be able to earn as much as three free evening certificates yearly.

- Computerized Diamond elite standing: Obtain Hilton’s present top-tier standing, which comes with meals and beverage privileges, 100% bonus factors on paid Hilton stays, room upgrades (when obtainable), and extra.

- Up-to-$400 annual Hilton resort credit score: Obtain as much as $200 in reimbursement for bills at eligible Hilton resort properties biannually (for use for issues like room price, meals, spa, and so on.).

- Annual Clear Plus membership credit score: Obtain as much as a $209 annual assertion credit score towards a Clear Plus membership, a program that may assist you minimize to the entrance of the road at Transportation Safety Administration checkpoints (enrollment required; topic to auto-renewal).

Try our Hilton Amex Aspire overview for extra info on this premium journey rewards card.

Backside line

The Hilton Honors American Categorical Aspire Card comes with a quarterly assertion of as much as $50 towards flight purchases made straight with an airline or by way of AmexTravel.com. However in some circumstances, you need to use it to purchase airline miles. This generally is a significantly better use of your card assertion credit score than merely redeeming it to cut back the money value of a flight.

Once more, simply be aware that your credit score probably received’t activate until you’re shopping for factors or miles straight from the airline (versus a third-party vendor like Factors.com).

For charges and costs of the Hilton Honors American Categorical Aspire Card, click on right here.