Banks love our cash. The extra capital they maintain, the extra they’ll use it to make more cash.

To get it, they’ll tempt us with perks—like waiving the annual price on a premium bank card, no month-to-month account upkeep charges, free security deposit field if we park sufficient money in a chequing account.

After all, that money will earn subsequent to nothing. And sure, it’s a chance value. Cash you can make investments elsewhere.

But when you know the way to work the system, these perks can outweigh the misplaced curiosity. Particularly whenever you’re dodging the steep annual charges on high-value journey bank cards.

Premium bank cards are a spine of any Miles & Factors technique. The trick is holding them with out paying full worth.

Let’s see how we are able to use these accounts to spice up our bank card good points.

All About Premium Financial institution Accounts

Each large financial institution has a premium tier.

Prime-tier chequing accounts often include an extended checklist of perks: limitless transactions, free ATM withdrawals, complimentary cheques, financial institution drafts, cash orders, and even a security deposit field.

Some prospects genuinely worth these extras and join premium banking with out even eager about bank cards.

What’s the attraction for travellers?

Even when you have no want for the opposite options of a premium banking package deal, bank card fans could discover sufficient worth within the annual price rebate alone.

Specifically, that is worthwhile as you search to lower the related prices for any playing cards you intend on holding long-term.

In spite of everything, first-year annual price rebate on a brand new card isn’t ceaselessly, and there are extra issues to remember than merely a welcome bonus.

Avid travellers can depend on their bank cards for journey insurance coverage. In case you guide a visit far upfront, you wish to be certain that you’ll maintain the cardboard you booked with by means of the length of the journey, in order that the insurance coverage stays legitimate. It’s sensible to designate a keeper card for this objective.

Additionally, it’s good in your credit score file to hold your oldest playing cards open, even when they don’t provide you with a lot on a regular basis worth anymore. If any of those are premium playing cards which you’ll’t or don’t wish to downgrade, you may eradicate the annual price whereas holding your credit score rating wholesome as you concentrate on newer playing cards in your portfolio.

To not point out, some playing cards with annual charges supply nice ongoing worth for each day use. Perhaps you’d like to keep up excessive earn charges at grocery shops. Or for those who ceaselessly make Aeroplan bookings on Air Canada flights, you’d profit from most well-liked pricing reductions as a Visa Infinite Privilege cardholder.

How does it work?

Premium financial institution accounts include excessive charges, round $30/month. After all, there’s no good purpose to pay $360/yr to waive a $120 bank card price (until you worth premium banking itself at $240).

The smarter transfer? Preserve the financial institution’s minimal steadiness—often round $6,000—they usually’ll waive the month-to-month account price.

From there, the play is straightforward:

- Get the premium checking account that provides a bank card price rebate.

- Maintain the required steadiness so that you’re not paying for the account.

- Take pleasure in your premium card free of charge.

Some banks additionally supply a partial rebate for seniors or college students, however these can’t be mixed with the total price waiver for holding a minimal steadiness, nor are they sufficient to take away charges completely on their very own. These reductions may be helpful for those who’re serious about premium banking for its personal sake, however not for those who’re solely chasing for a free bank card.

What are the drawbacks?

Earlier than committing a big money deposit to acquire a bank card price waiver, it’s essential to contemplate the alternative value.

With the funds idle in a chequing account, they gained’t earn curiosity or develop as they’d in a extra profitable financial savings or funding automobile.

Additionally, by parking the cash, you lose liquidity. Even for those who don’t plan on touching the steadiness, it’s much less accessible than a real emergency fund.

You may all the time transfer the cash out if you might want to, however you’d must undergo the trouble of downgrading or closing the chequing account and bank card, for those who’re not keen to start out paying ongoing charges.

Credit score Card Rebate Packages

Every of Canada’s main banks supply a number of methods to scale back bank card charges by means of their banking merchandise. Not all packages are created equal, nevertheless, and the small print of the charges, advantages, and necessities differ broadly.

BMO

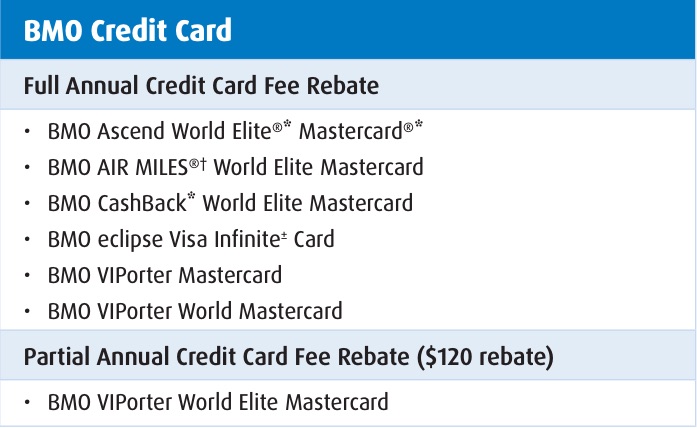

The Financial institution of Montreal gives two accounts that present a bank card price waiver:

Neither tier covers the BMO eclipse Visa Infinite Privilege* Card, even partially, nor do they prolong rebates to supplementary playing cards. That’s unlucky, since pairing the 2 eclipse playing cards could be a highly effective technique for maximizing rewards.

Between the 2 tiers, the top-tier Premium Plan is a greater proposition. Higher to go all-in for those who’re going to trouble in any respect.

BMO additionally gives a Household Bundle, permitting as much as 20 accounts on the identical deal with. This extends some premium perks—like limitless transactions—to family members.

Nevertheless, the bank card rebate solely applies to the first account holder.

A missed alternative, however nonetheless helpful if you wish to train youngsters about cash administration moderately than enlisting older youngsters to chase further AIR MILES.

Talking of enlisting, members of the Canadian Defence Group can get the Efficiency tier for no month-to-month price, with no minimal steadiness. With the $40 bank card rebate, that may carry your internet annual value to $80 for a keeper journey insurance coverage card, with no alternative value in your principal.

CIBC

CIBC gives two premium banking tiers: Sensible and Sensible Plus. Solely Sensible Plus features a bank card rebate.

- Sensible Account – $4,000 minimal steadiness waives the $16.696 month-to-month price, however no bank card rebate.

- Sensible Plus Account – $6,000 minimal steadiness waives the $29.95 month-to-month price, and supplies:

Alternatively, CIBC waives banking charges with $100,000 in eligible financial savings and investments. This fashion, your money isn’t sitting idle in chequing—it’s truly working for you. CIBC counts a variety of registered and non-registered accounts, whether or not managed or self-directed.

All kinds of funding automobiles can be found, together with registered and non-registered accounts, each managed and self-directed.

In case you go this route, you and your accomplice can double-count investments in joint accounts. So long as you each attain the $100,000 threshold as a sum of your individual particular person and joint belongings, you may each waive your premium banking charges.

Sensible Plus accountholders additionally get a $50 price rebate on as much as three approved customers. Which means supplementary playing cards are free with Visa Infinite, or diminished to $49 with Visa Infinite Privilege.

This may be particularly helpful with Aeroplan playing cards, since approved customers can hyperlink their very own Aeroplan quantity and nonetheless get perks like free checked baggage on Air Canada. It’s a helpful strategy to prolong advantages to household—and even pals you wish to nudge into the world of Miles & Factors.

For present cardholders seeking to later make the most of this chequing package deal, you’ll even obtain a pro-rated retroactive rebate for those who’ve already paid the bank card annual price.

Lastly, needless to say CIBC’s co-branded Aeroplan playing cards shine for insurance coverage protection on Aeroplan award tickets. The no-fee CIBC Aeroplan Visa Card doesn’t embrace a lot, however protection kicks in when you’re on the Infinite tier or greater—the place a waived price could make holding the cardboard far more enticing.

Nationwide Financial institution

Nationwide Financial institution gives three completely different tiers of chequing accounts: The Minimalist, The Linked, and The Complete.

Of those, The Linked and The Complete supply bank card annual price offsets.

- The Linked – $4,500 minimal steadiness waives the $15.95 month-to-month price. Offers a $30 annual credit score in direction of the annual price of an eligible bank card.

- The Complete – $6,000 minimal steadiness waives the $28.95 month-to-month price. Offers a $150 annual credit score in direction of the annual price of an eligible bank card.

Nationwide Financial institution takes a little bit of a unique method to offsetting bank card charges with an eligible chequing account, as you’ll get a credit score utilized to your assertion as a substitute of getting it waived outright.

Eligible playing cards embrace the Nationwide Financial institution® World Elite® Mastercard®, in addition to the Echo, Money Again, Syncro, Platinum, and World merchandise.

You’ll must open your bank card account after signing up for an eligible chequing account, and sadly the rebate doesn’t apply to supplementary playing cards. The rebate applies to the primary yr solely, that means that you would be able to’t profit from the price waiver yr after yr.

RBC

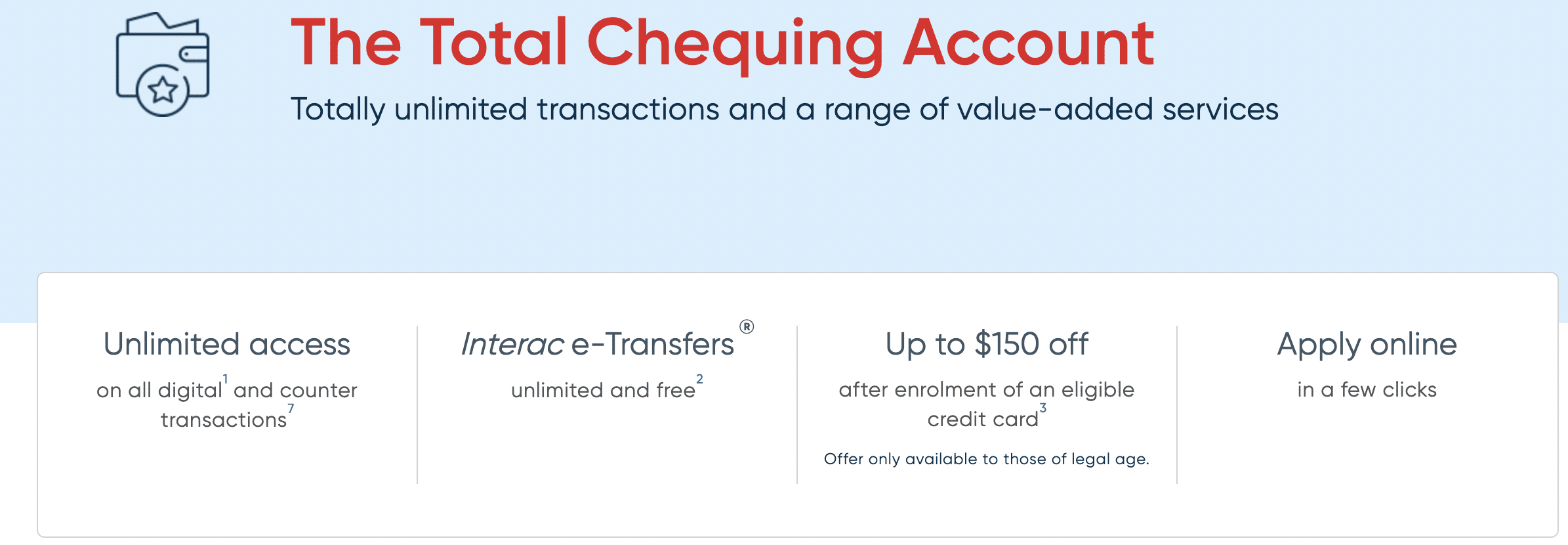

RBC has two tiers of banking packages with bank card price reductions: Signature No Restrict Banking at $16.95/month, or VIP Banking at $30/month.

Signature No Restrict Banking gives partial rebates that varies relying on the kind of bank card:

VIP Banking extends a $120 partial rebate on the RBC® Avion Visa Infinite Privilege†, and a full annual rebate on the opposite playing cards talked about above. The RBC® British Airways Visa Infinite† is a unusual case, as you will get the whole $165 price rebated right here.

In contrast to different banks, RBC doesn’t have an choice to waive chequing charges with a minimal steadiness. As a substitute, they provide a “Worth Program” with completely different qualification standards for account price rebates.

With the Worth Program, the Signature No Restrict Banking price can drop as little as $4/month, and the VIP Banking price can fall to $17.05/month.

To qualify, you’ll must:

- Maintain two or extra different eligible RBC merchandise (reminiscent of a mortgage, funding account, or bank card).

- Full a minimum of two actions every month (like a direct deposit, invoice fee, or pre-authorized fee).

Whereas the mortgage is a bit of massive ask for those who’re not arrange already, you may fulfill the funding requirement moderately simply with recurring pre-authorized contributions, a minimal $500 worth, or any quantity in an RBC Direct Investing account.

Even with these reductions, you’ll nonetheless pay one thing to keep up an RBC account.

And albeit, there’s not a lot attraction right here in case your solely aim is to avoid wasting on a bank card annual price.

Until you already use a number of RBC merchandise—or actually worth distinctive options like their cross-border banking—different banks usually supply stronger choices.

Scotiabank

Scotiabank gives two ranges of premium banking: the mid-range Most well-liked Package deal and the top-tier Final Package deal.

- Most well-liked Package deal – $4,000 steadiness waives the $16.95 month-to-month price. Features a first-year card rebate as much as $150.

- Final Package deal – $6,000 steadiness waives the $30.95 month-to-month price. Consists of an ongoing card rebate as much as $150.

Playing cards eligible for a price waiver embrace their core roster of the Scotiabank Gold American Categorical® Card, Scotiabank Passport® Visa Infinite* Card , Scotiabank Passport® Visa Infinite Privilege* Card, Scotiabank Momentum® Visa Infinite* Card, and Scotiabank Worth Visa Card. Most of those choices present an array of long-term attraction, together with excessive earn charges on groceries and eating places, lounge passes, and no international transaction charges.

The Most well-liked Package deal grants a full annual price waiver on one card as much as $150, however just for the primary yr. That is nonetheless an enchancment in comparison with different banks, the place it’s often not price going for the mid-range chequing account for under a partial price waiver.

One technique could be to open a Most well-liked account in your first yr with the cardboard, then improve to Final within the second yr for an additional $2,000 minimal steadiness.

Additionally, for those who open the chequing account after the bank card, Scotiabank will nonetheless provide you with a full retroactive rebate on the bank card. That is positively a step up from CIBC’s pro-rated incentive.

Certainly, it’s fairly uncommon to see a giant financial institution provide you with flexibility with the timing of your cash actions, whereas nonetheless awarding the total advantages that include your premium dedication.

TD

TD largely follows the identical construction as Scotiabank. On the mid-range degree, Limitless Chequing requires a $4,000 steadiness to waive $16.95/month, with a first-year rebate of $139. On the prime,

All-Inclusive Banking requires a $6,000 steadiness to waive $29.95/month, with an ongoing $139 rebate yearly.

TD gives two premium chequing accounts that include bank card price rebates:

- Limitless Chequing – $4,000 minimal steadiness waives the $17.95 month-to-month price. Offers a first-year rebate of as much as $139 on an eligible TD bank card†.

- All-Inclusive Banking – $6,000 minimal steadiness waives the $30.95 month-to-month price. Offers an ongoing annual rebate of as much as $139 on an eligible TD bank card†.

With each accounts, the rebate is accessible on any one in every of TD’s Visa Infinite or Visa Platinum playing cards, together with the TD® Aeroplan® Visa Infinite* Card, the TD® Aeroplan® Visa Platinum* Card, and the TD First Class Journey® Visa Infinite* Card.

In follow, the Limitless Chequing account’s first-year rebate is a little bit of a moot level, since most TD playing cards already include a first-year annual price rebate—aside from the Privilege card.

With the All-Inclusive Banking account, the TD® Aeroplan® Visa Infinite Privilege* Card is eligible for a partial rebate ($139 of the cardboard’s $599 annual price).

All-Inclusive Banking additionally offers a $75 rebate for one approved person.

The TD® Aeroplan® Visa Infinite Privilege* Card card has a hefty $599 annual price, however with the All-Inclusive Banking Plan you’ll shave off $139 for the first cardholder and one other $75 for a supplementary card. That brings the full to $584 for 2 playing cards.

This may be very helpful for households travelling collectively. For instance, if a dad holds the Privilege card and provides mother as a further cardholder, each get full entry to perks like Maple Leaf Lounges and Cafés, precedence boarding, and precedence safety at choose airports.

Which means a household of 4 might entry lounges with simply these two playing cards—without having to all the time journey collectively to share the advantages. Every grownup holds their very own Privilege card and might use the perks independently.

Comparability of Premium Financial institution Accounts

As you may see, the variations are fairly nuanced. Right here’s a fast breakdown of the important thing factors for every financial institution:

Conclusion

Premium financial institution accounts with bank card price rebates could be a sensible strategy to minimize down the price of holding worthwhile playing cards long-term.

Sure, you’ll must park a piece of money in a chequing account that earns little to no curiosity. And sure, there’s a chance value.

However for those who’re strategic, the trade-off could be price it—particularly whenever you’re holding onto playing cards for journey insurance coverage, sturdy earn charges, or perks like lounge entry.

Each financial institution constructions its rebates in a different way. Some solely cowl a part of the price, others prolong it to supplementary playing cards, and some solely apply within the first yr.

The secret’s matching the correct account with the correct card—and ensuring you’re truly popping out forward.

Used correctly, these price rebates can prevent tons of of {dollars} a yr whereas holding your Miles & Factors technique sturdy.

† Phrases and situations apply. Consult with the cardboard issuer’s web site for full, up-to-date data. Affordable efforts are made to keep up accuracy of knowledge.