The discharge of the brand new iPhone 17 lineup is simply across the nook, with pre-orders beginning on September 12, 2025.

The brand new iPhones are available 4 variants: the iPhone 17, iPhone Air, iPhone 17 Professional, and iPhone 17 Professional Max, with costs starting from $1,129–2,949 (all figures in CAD).

In the event you’re planning to get one, you’ve obtained a chance to earn some nice rewards through the use of the proper bank card. Plus, relying on which card you utilize, you might also have the ability to get insurance coverage protection in your iPhone at no extra price.

On this article, let’s check out how one can leverage your bank cards to maximise your rewards and insurance coverage advantages in your iPhone buy.

Shopping for an iPhone 17 Outright

Fairly than queuing outdoors an Apple Retailer, the simplest method to purchase an iPhone is on-line. By shopping for on-line, you might also have the ability to use a procuring portal to earn extra rewards on prime of what you’ll earn together with your bank card.

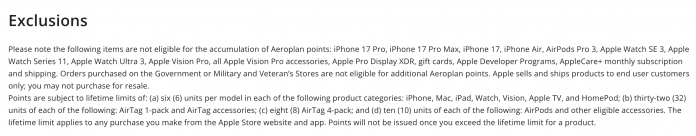

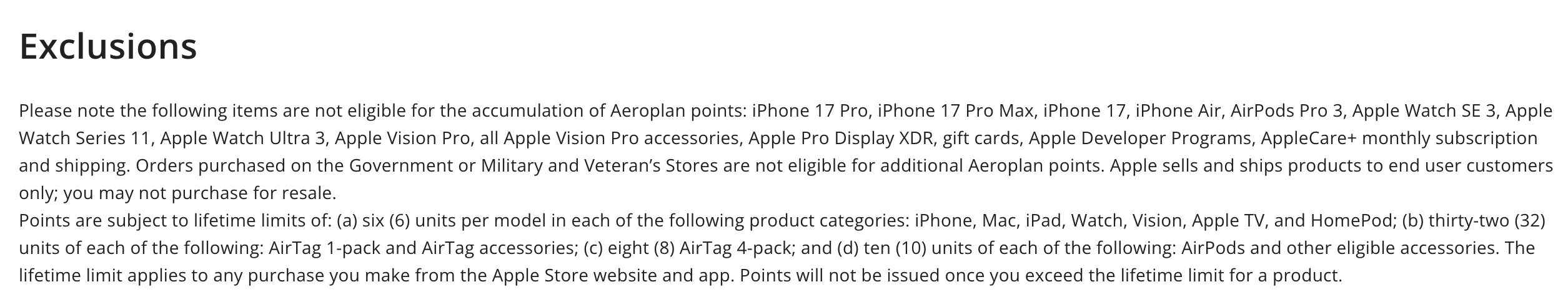

Nevertheless, new iPhones bought throughout launch are sometimes excluded, so make sure to rigorously learn the phrases and situations on every procuring portal:

On the time of writing, the WestJet Rewards eStore doesn’t point out something about iPhone 17 exclusions. That mentioned, all the time double-check the phrases on launch day in case you plan to buy by way of a portal.

In the event you don’t want the most recent iPhone and go for the iPhone 16 as an alternative, portals like Aeroplan eStore can nonetheless earn you bonus rewards, particularly throughout bonus occasions that go as excessive as 10x.

The rewards you’ll earn by the net procuring portals are on prime of what you’ll earn together with your bank card; subsequently, you must also strategize which card you’ll use for the acquisition so as to maximize the rewards you get.

For the reason that iPhone is a comparatively giant buy, it might be fairly helpful in serving to you meet a big minimal spending requirement for a bank card welcome bonus.

In the event you’re out there for a brand new bank card, you will get a run down of the welcome bonuses you may work on in our submit on the finest bank card presents for the month.

You might additionally strategize by selecting a card that permits you to earn one of the best rewards. Typically talking, electronics earn a card’s base-rate rewards (like most different retail classes); thus, it is best to select a card that has an excellent baseline incomes price for normal purchases.

For instance, the TD® Aeroplan® Visa Infinite Privilege* Card earns 1.25 Aeroplan factors per greenback spent on retail purchases. Alternatively, think about the Enterprise Platinum Card from American Specific, which earns 1.25 Membership Rewards factors per greenback spent, or the RBC® Avion Visa Infinite Privilege†, which earns 1.25 Avion factors per greenback spent.

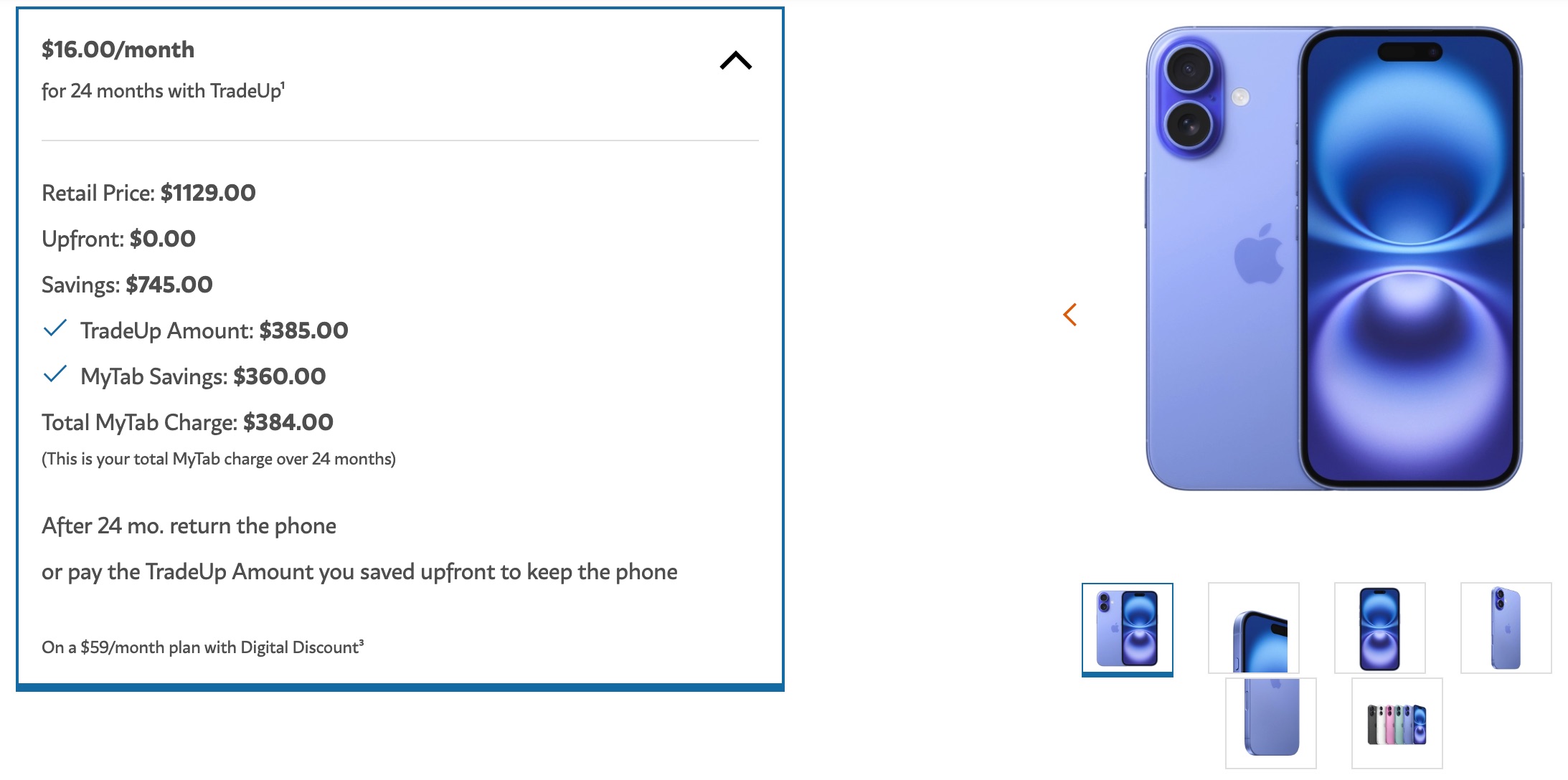

Shopping for an iPhone 17 as A part of a Cellphone Plan

Canadian carriers will all quickly provide iPhone plans in lockstep trend. By way of presents for most of the people, they’ll attempt to match what every service is doing; nonetheless, in case you’ve already been with a service for a very long time, you would possibly qualify for a retention provide that you could leverage across the new iPhone.

One of the best ways to go about establishing an excellent cellphone plan for the iPhone 17 is to ask your present supplier for one of the best deal they will present you, after which ask the competing suppliers what they will provide, citing what was supplied by your present supplier.

An iPhone plan, like different cellphone plans, is structured such that the rebated price of the cellphone is damaged down into month-to-month installments, which you pay alongside the month-to-month service price.

Since your funds will probably be billed month-to-month, you gained’t have a lump-sum cost to your bank card, so the acquisition gained’t go far to fulfill a minimal spending requirement for a welcome bonus.

Nevertheless, since your telecom plan is charged as month-to-month recurring funds, there nonetheless are methods to repeatedly earn beneficial rewards.

A number of Canadian bank cards provide elevated incomes charges on recurring invoice funds, similar to your cellphone invoice, so there are methods to show this month-to-month expense into some respectable rewards.

We’ve written a information to the finest bank cards for recurring invoice funds, and you may test it out to search out the best choice for you. For this text, we’ll have a look at a pair playing cards from this checklist that will be good selections to make use of when shopping for an iPhone as a part of a cellphone plan.

One robust choice is the Scotia Momentum® Visa Infinite Card*, which earns 4% money again on all recurring invoice funds.

It typically comes with a welcome bonus of 10% money again as much as a specific amount, and importantly, it contains cellular gadget insurance coverage—good for safeguarding an expensive new iPhone.

Scotia Momentum® Visa Infinite* Card

- Earn 10% money again within the first three months, as much as $200 whole money again for spending $2,000

- Plus, earn 4% money again on groceries and recurring invoice funds

- Additionally, earn 2% money again on gasoline and transit

- Minimal earnings: $60,000 private or $100,000 family

- Annual payment: $120 (waived for the primary 12 months)

One other card value contemplating is the Rogers Pink World Elite® Mastercard®. This no-fee card earns 2% money again on all purchases, together with recurring invoice funds, in case you’re a Rogers, Fido, or Shaw buyer.

It additionally presents 50% extra worth when making use of rewards to Rogers, Fido, or Shaw purchases.

Rogers Pink World Elite® Mastercard®

- Earn limitless 3% money again on U.S. greenback purchases.†

- Earn limitless 2% money again on eligible non U.S. greenback purchases–solely for eligible Rogers, Fido or Shaw prospects.†

- Non-customers earn limitless 1.5% money again on eligible non U.S. greenback purchases.†

- Plus, earn 50% additional cash again each time you redeem for Rogers, Fido or Shaw purchases.†

- Minimal earnings: $80,000 private or $150,000 family

- Annual payment: $0

As a cardholder, you too can buy a brand new cellphone by the Equal Fee Plan at 0% curiosity, making it a sensible selection in case you’re already within the Rogers ecosystem.

Credit score Card Insurance coverage Advantages Relevant to a New iPhone

Utilizing the proper bank card to purchase your new iPhone not solely allows you to earn rewards and financial savings, however you may additionally get pleasure from free insurance coverage protection that may present some peace of thoughts.

There are three related insurance coverage advantages which will come together with your bank card: cellular gadget insurance coverage, buy safety, and prolonged safety/guarantee.

Cellular Gadget Insurance coverage

That is probably the most related sort of protection for iPhones, because it protects towards unintended harm (suppose cracked screens or water harm) and mechanical breakdowns.

Ordinary insurance policies learn as follows:

If a cellular gadget is misplaced, stolen or suffers a mechanical breakdown or unintended harm, the insurer will reimburse you the lesser of its restore or alternative price, not exceeding the depreciated worth of your cellular gadget at date of loss, much less the deductible, to a most of $1,000.

Most different playing cards providing cellular gadget insurance coverage solely cowl as much as $1,000, however there are two standout playing cards that go over this restrict:

- Air France KLM World Elite Mastercard® (issued by Brim) – Presents as much as $1,500 in protection, probably the most beneficiant advantages in Canada. It even applies partial protection in case you solely pay a part of the cellphone’s price with the cardboard. In the event you already maintain this card, it’s the one to make use of.

- RBC® Avion Visa Infinite† – Additionally covers as much as $1,500 for cellular units. Whereas it doesn’t permit partial-pay safety, it’s backed by RBC’s help community, which some could discover extra dependable than Brim’s customer support.

Credit score Playing cards with As much as $1,500 Cellular Gadget Insurance coverage

Buy Safety Insurance coverage

Typical bank card buy safety insurance coverage wording is as follows:

Buy safety protection robotically, and with out registration, protects most new insured objects bought anyplace on this planet for 90 days from the date of buy within the occasion of loss, theft, or harm in extra of different insurance coverage, supplied the complete buy worth is charged to the account.

If an insured merchandise is misplaced, stolen or broken, you may be reimbursed the lesser of the restore or alternative price, not exceeding the unique buy worth charged to the account.

The element that must be emphasised from the above is that you will need to cost the whole lump-sum price of the cellphone to the cardboard with a view to obtain buy safety protection. Thus, this profit gained’t apply in case you purchase the iPhone as a part of a cellphone plan because you’ll be breaking its price into month-to-month installments reasonably than paying for it suddenly.

That mentioned, there are playing cards that do present this protection even if you’ve solely paid a portion of the iPhone with the cardboard. One such card is the Air France KLM World Elite Mastercard® – although if the cellphone will get misplaced or stolen, you’ll solely be reimbursed for the portion paid for with the cardboard.

Buy safety insurance coverage is a function of most bank cards, even lower-tier playing cards; nonetheless, insurance policies range by most legal responsibility restrict, so in selecting which card to make use of in your iPhone, ensure to learn the small print of its insurance coverage coverage.

Prolonged Guarantee

Prolonged guarantee advantages normally learn as follows:

Prolonged guarantee protection gives the cardmember with double the interval of restore companies in any other case supplied by the unique producer’s guarantee, to a most of 1 extra 12 months, on most insured objects bought anyplace on this planet when the complete buy worth is charged to the account.

Prolonged guarantee advantages are restricted to the lesser of the restore price and the unique buy worth charged to the account.

iPhones include a one-year restricted guarantee from Apple, and your card’s prolonged guarantee profit will double that.

Nevertheless, Apple’s restricted guarantee solely covers inherent defects with the product and never unintended harm, similar to cracked screens. Due to this fact, you may also want prolonged guarantee safety, similar to AppleCare+ or the same service supplied by your cellular supplier.

Prolonged guarantee can nonetheless be helpful, however for true gadget safety, cellular gadget insurance coverage is way extra sensible.

Conclusion

Shopping for an iPhone 17 is an enormous expense, however the proper bank card may also help you earn rewards and get helpful protections.

Whether or not you purchase outright or by a cellphone plan, you may maximize your return with factors, money again, or insurance coverage advantages.

The hot button is to align your iPhone buy with a card technique that matches your objectives, whether or not that’s hitting a welcome bonus, incomes elevated rewards, or making certain your gadget is protected.

Take pleasure in your iPhone 17!