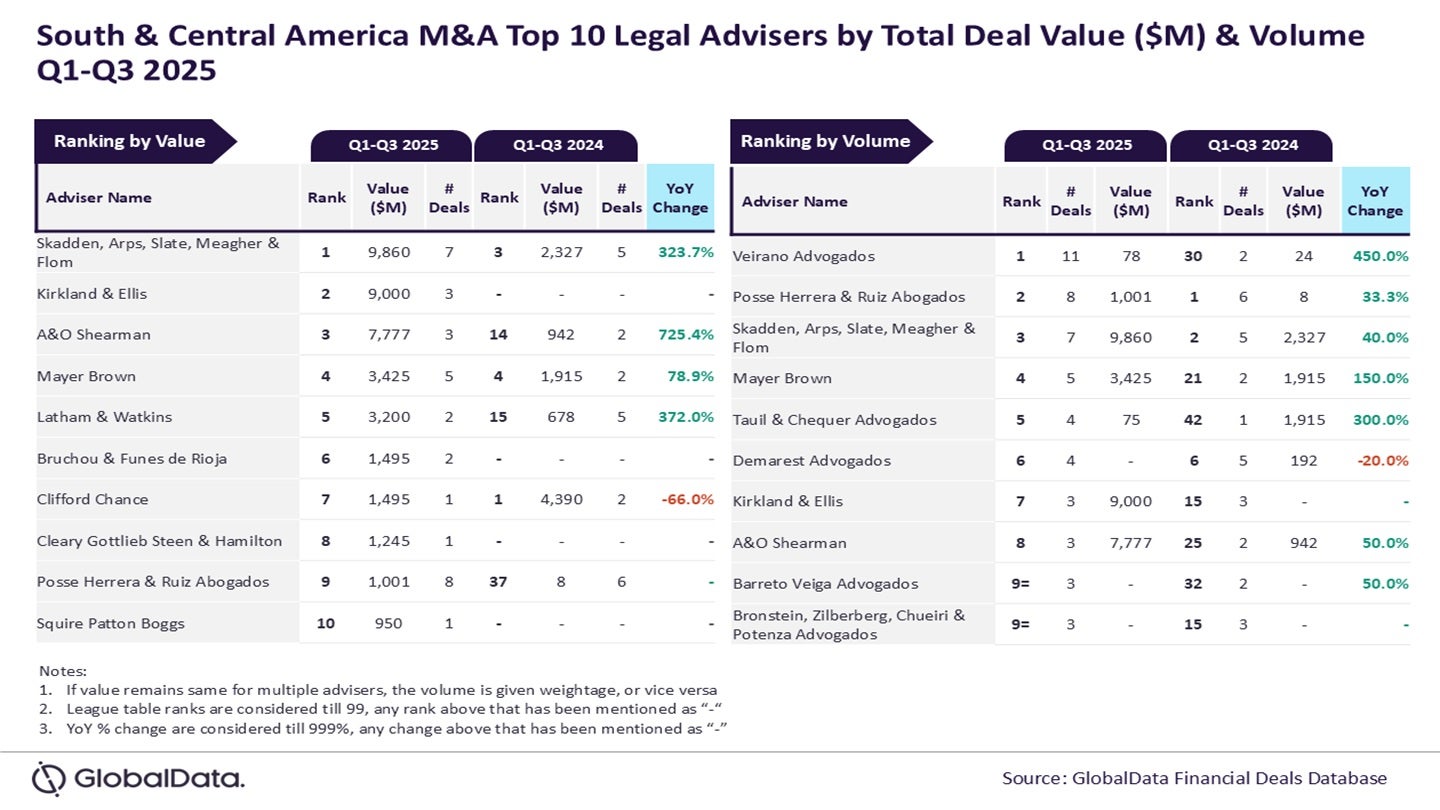

Within the realm of mergers and acquisitions (M&A), Skadden, Arps, Slate, Meagher & Flom, and Veirano Advogados have emerged as the highest authorized advisers within the South & Central American area for the primary three quarters (Q1-Q3)of 2025, in response to GlobalData, a knowledge and analytics agency.

As per GlobalData’s Monetary Offers Database evaluation, Skadden, Arps, Slate, Meagher & Flom secured the foremost place based mostly on deal worth, having suggested on transactions totalling $9.9bn.

Entry deeper business intelligence

Expertise unmatched readability with a single platform that mixes distinctive information, AI, and human experience.

Then again, Veirano Advogados claimed the highest spot in deal quantity, taking part in 11 offers.

GlobalData lead analyst Aurojyoti Bose stated: “Veirano Advogados was the one authorized adviser to hit double-digit deal quantity throughout Q1-Q3 2025. Because of this, the Brazil-based agency registered an enormous leap in its rating by quantity from the thirtieth place throughout Q1-Q3 2024 to the highest spot throughout Q1-Q3 2025.

“In the meantime, the full worth of offers suggested by Skadden, Arps, Slate, Meagher & Flom registered greater than 4x year-on-year leap and subsequently its rating by this metric improved from the third place to the highest place. Three of the seven offers suggested by Skadden, Arps, Slate, Meagher & Flom throughout Q1-Q3 2025 had been billion-dollar offers. The involvement in these big-ticket offers helped it lead the desk by worth.”

Shut on the heels of the chief in deal worth was Kirkland & Ellis, with its advisory function in offers amounting to $9bn. It was adopted by A&O Shearman with $7.8bn, Mayer Brown with $3.4bn, and Latham & Watkins with $3.2bn.

When it comes to quantity, Posse Herrera & Ruiz Abogados took the second place with involvement in eight offers. Skadden, Arps, Slate, Meagher & Flom featured on this class with seven offers. Mayer Brown and Tauil & Chequer Advogados rounded out the record with 5 and 4 offers, respectively.

GlobalData’s league tables are based mostly on the real-time monitoring of 1000’s of firm web sites, advisory agency web sites and different dependable sources accessible on the secondary area. A devoted workforce of analysts displays all these sources to assemble in-depth particulars for every deal, together with adviser names.

To make sure additional robustness to the info, the corporate additionally seeks submissions of offers from main advisers.