Beginning November 5, 2025, WestJet and RBC will introduce a collection of modifications to each the WestJet RBC® World Elite Mastercard‡ and the WestJet RBC® Mastercard‡.

These are the primary main updates since 2019, designed to make the playing cards extra aggressive in Canada’s journey rewards market, although some modifications include new strings connected.

It’s additionally encouraging to see that RBC and WestJet are actively investing of their co-branded playing cards.

Just lately, they launched the brand new WestJet RBC® World Elite Mastercard‡ for Enterprise, and now they’re refreshing the private playing cards too, demonstrating ongoing dedication to their co-branded playing cards and adapting to Canada’s fast-changing bank card panorama.

Let’s have a look into particulars of every card.

What’s Altering with the WestJet RBC® World Elite Mastercard‡

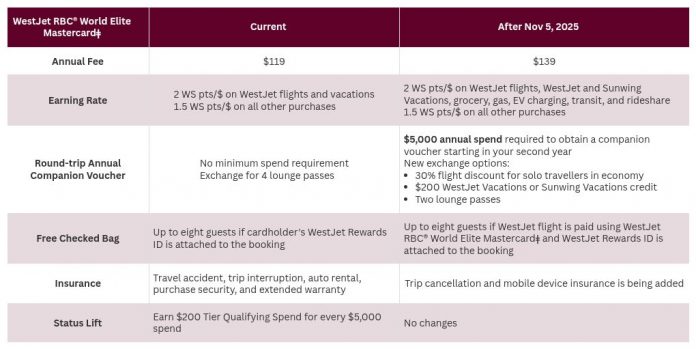

The World Elite card is seeing each enhancements and a slight payment bump. The annual payment will rise from $119 to $139, which isn’t nice, nevertheless it’s nonetheless fairly customary for playing cards within the Visa Infinite and World Elite tier.

On the incomes aspect, cardholders will now get 2 WestJet factors per greenback spent on WestJet flights, WestJet and Sunwing Holidays, in addition to on groceries, gasoline, EV charging, transit, and rideshares.

This can be a massive step ahead in making the cardboard extra rewarding for day-to-day spending, although the absence of eating and Costco purchases appears like a missed alternative.

Every part else continues to earn at 1.5 WestJet factors per greenback spent, which stays aggressive.

The round-trip annual companion voucher can also be being reworked. Beginning within the second 12 months, you’ll must spend $5,000 yearly to unlock it.

The excellent news is that this threshold is comparatively low and achievable for many cardholders.

Plus, WestJet is including flexibility.

As a substitute of simply utilizing the voucher for a companion flight, now you can change it for a 30% low cost on a solo financial system ticket, a $200 credit score for WestJet or Sunwing Holidays, or two lounge passes.

A Observe on Timing for Companion Vouchers

The brand new $5,000 annual spend requirement solely applies beginning together with your second-year voucher and onwards. Your first voucher as a brand new cardholder isn’t affected.

In the event you’re a present cardholder and also you obtain your voucher earlier than November 5, 2025, your subsequent voucher (issued in 2026 in your traditional anniversary date) may even come with none spend requirement.

The identical goes for new candidates: should you apply now and obtain your first voucher earlier than November 5, 2025, your second-year voucher will nonetheless be issued mechanically, with no spending threshold.

Alternatively, in case your voucher date falls after November 5, 2025 (say, November 20), then your subsequent one in 2026 would require $5,000 in spending between November 21, 2025, and November 20, 2026.

In the event you’ve been on the fence about this card, now could be the time to behave — making use of this month (September 2025) ensures you lock in not simply your first voucher, but additionally your second one and not using a spend requirement.

Insurance coverage protection is getting a lift too, with Journey Cancellation and Cell System insurance coverage added to the present bundle.

In the meantime, the primary checked bag profit is being tweaked.

Your ticket should be paid with the cardboard for it to use, leaving some ambiguity about whether or not it really works on bookings absolutely paid with OTAs.

Leisure travellers possible received’t discover a lot distinction, nevertheless it’s unclear how this may work for these travelling on company-issued tickets booked by way of company portals, or for anybody redeeming versatile factors equivalent to Avion factors in direction of WestJet flights through the RBC Air Journey Redemption Schedule.

What’s Altering with the WestJet RBC® Mastercard‡

The entry-level WestJet card retains its $39 annual payment, however provides new on a regular basis accelerators.

You’ll now earn 1.5 WestJet factors per greenback spent on WestJet flights, WestJet and Sunwing Holidays, eating places and meals supply, and digital subscriptions, whereas all different purchases proceed to earn 1 WestJet factors per greenback spent.

Just like the World Elite, the companion voucher now comes with a minimal spend requirement.

You’ll must spend $2,500 on the cardboard annually to obtain it beginning within the second 12 months.

The voucher additionally will get extra versatile, with the choice to swap it for a 25% low cost on a solo financial system ticket or 5,000 WestJet factors that don’t expire.

Insurance coverage can also be improved with the addition of Cell System insurance coverage, which is surprisingly uncommon for a card at this payment stage.

These modifications are purely optimistic, since the whole lot is an enchancment whereas the annual payment stays the identical.

The one tweak is the $2,500 spend requirement for the companion voucher after 12 months one, however even then, the bar could be very modest.

My Sincere Ideas on These Updates

Total, these modifications push each playing cards right into a stronger on a regular basis spending position.

The addition of groceries, gasoline, transit, eating places, and subscriptions as bonus classes will make them much more rewarding to really preserve in your pockets.

The payment enhance on the World Elite isn’t supreme, nevertheless it retains the cardboard priced consistent with opponents.

And whereas the minimal spend necessities on the companion vouchers would require monitoring, the thresholds are comparatively low, and admittedly, most cardholders will hit them with out a lot effort.

Nonetheless, there are drawbacks.

The change to the free checked bag profit provides some uncertainty to what was as soon as an easy perk, and the playing cards proceed to lack outsized redemption alternatives.

The brand new accelerators are the place issues get extra attention-grabbing.

On a regular basis earn on groceries, gasoline, and transit makes the World Elite rather more aggressive, however I can’t assist however discover the cut up in technique: the bottom card will get accelerated incomes in eating and meals supply however not grocery, whereas the World Elite will get multiplier in grocery however not eating.

Now, that is purely my very own hypothesis, nevertheless it virtually feels intentional.

Larger-income cardholders (those who qualify for World Elite) may be extra more likely to dine out and order supply, whereas base-card holders could also be extra centered on groceries and cooking at house.

If that’s the case, WestJet could possibly be attempting to attenuate the price of rewards payouts by steering every card towards barely completely different spending behaviours.

Once more, only a speculation, however an attention-grabbing one.

On the finish of the day although, in case your essential purpose is to maximise on a regular basis spend, the RBC ION+ Visa stays the higher play.

It earns 3x on groceries, eating, gasoline, and transit, all at a decrease annual payment, and you may nonetheless switch these factors 1:1 into WestJet Rewards.

Except you actually worth the checked bag profit or companion voucher, the ION+ is hard to beat.

Lastly, I feel WestJet missed the prospect so as to add one thing unique for cardholders, whether or not that’s most popular pricing, precedence Elevation Lounge entry, or reductions on seat choice and upgrades.

These little touches might have made the playing cards rather more compelling for frequent travellers.

Conclusion

The updates to the WestJet RBC playing cards present that RBC and WestJet aren’t letting their co-brand stagnate.

Between the brand new enterprise card, expanded earn classes, and extra versatile companion vouchers, these merchandise are clearly being positioned to remain related in a market that’s transferring shortly.

Sure, there are a couple of trade-offs just like the payment enhance, spend necessities, and a little bit of ambiguity with the checked bag perk.

And I nonetheless want WestJet had added one thing really unique for cardholders, whether or not that’s lounge entry, most popular pricing, or a small low cost on seat upgrades.

However general, this can be a significant refresh that makes the playing cards simpler to justify holding and really utilizing day after day.

For individuals who put regular spend on the playing cards, these updates are a web win, and a welcome signal that RBC and WestJet are severe about competing in Canada’s journey bank card house.