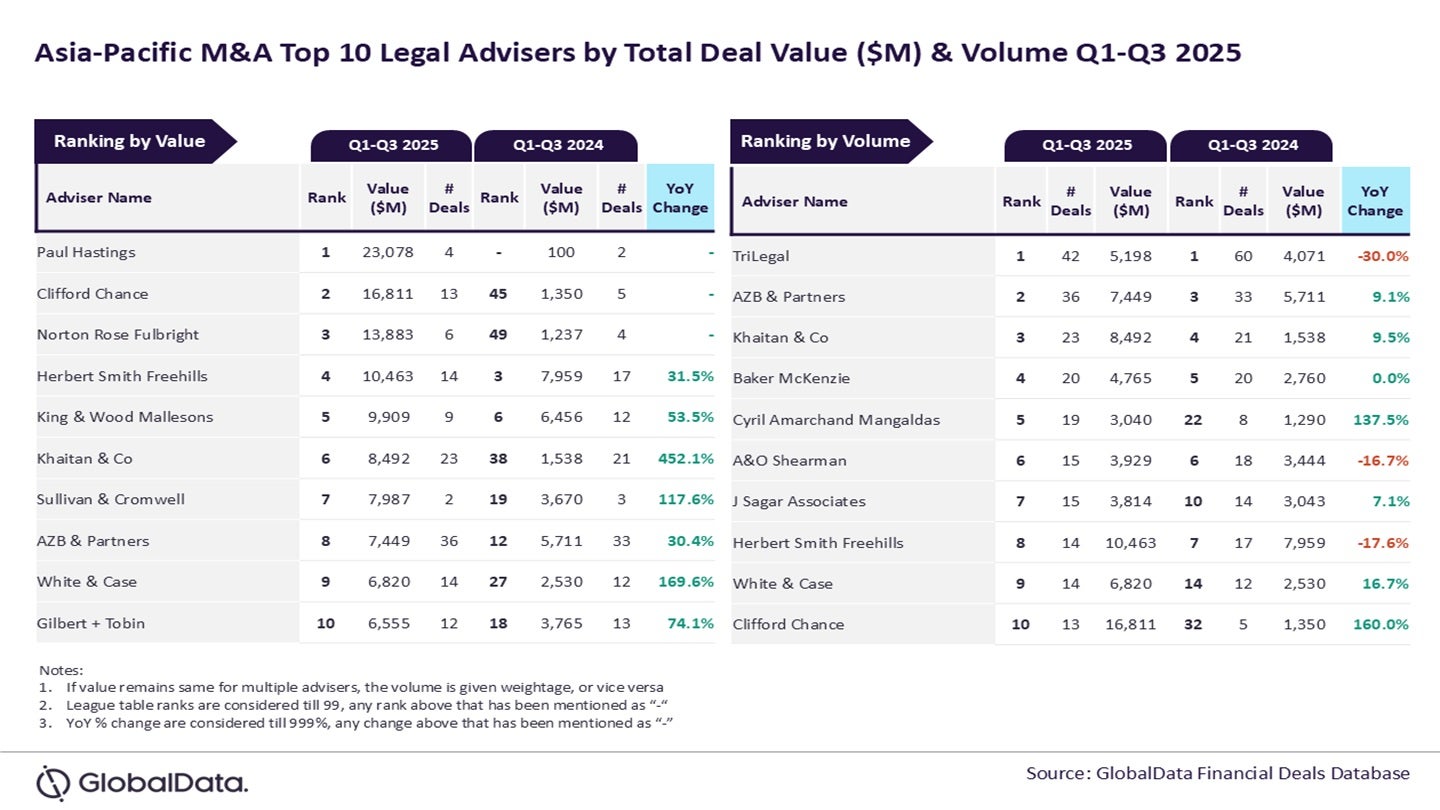

Paul Hastings and TriLegal have emerged because the main mergers and acquisitions (M&A) authorized advisers within the Asia-Pacific area for the primary three quarters (Q1-Q3) of 2025, in response to the most recent authorized advisers league desk launched by information and analytics agency GlobalData.

An evaluation of GlobalData’s monetary offers database revealed that Paul Hastings secured the highest spot when it comes to deal worth, offering counsel on transactions totaling $23.1bn.

Entry deeper trade intelligence

Expertise unmatched readability with a single platform that mixes distinctive information, AI, and human experience.

Then again, TriLegal distinguished itself when it comes to deal quantity, having suggested on 42 offers.

GlobalData lead analyst Aurojyoti Bose stated: “Paul Hastings was the only adviser to surpass $20 billion complete deal worth mark throughout Q1-Q3 2025. The involvement in $22.8 billion deal for the acquisition of majority stake in ports from CK Hutchison Holdings and Panama ports by a consortium of buyers performed a pivotal position for Paul Hastings in securing the highest spot by worth.

“In the meantime, TriLegal, which was the highest adviser by quantity throughout Q1-Q3 2024, managed to retain its management place by this metric throughout the reporting interval.”

Clifford Probability ranked second in deal worth, advising on transactions totalling $16.8bn. Following it had been Norton Rose Fulbright with $13.9bn, Herbert Smith Freehills with $10.5bn, and King & Wooden Mallesons with $9.9bn.

Then again, AZB & Companions secured the second spot in deal quantity, dealing with 36 transactions. It was adopted by Khaitan & Co with 23 offers, Baker McKenzie with 20 offers, and Cyril Amarchand Mangaldas with 19 offers.

GlobalData’s league tables are primarily based on the real-time monitoring of hundreds of firm web sites, advisory agency web sites and different dependable sources obtainable on the secondary area. A devoted crew of analysts screens all these sources to collect in-depth particulars for every deal, together with adviser names.

To make sure additional robustness to the information, the corporate additionally seeks submissions of offers from main advisers.