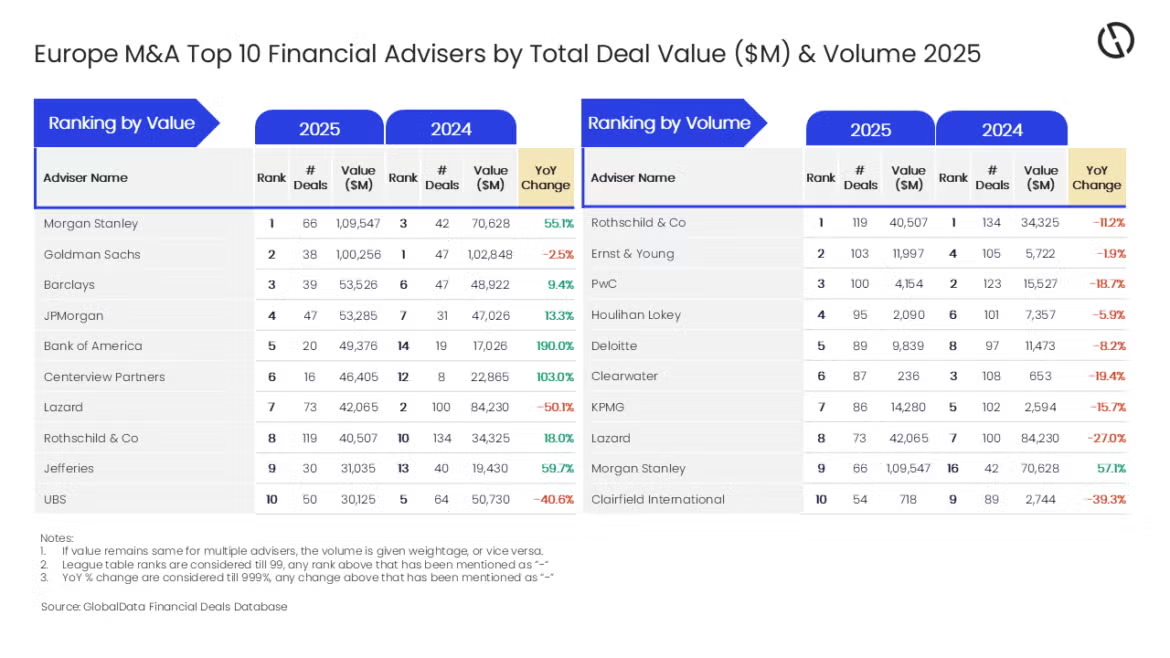

Morgan Stanley and Rothschild & Co have led the mergers and acquisitions (M&A) rankings for monetary advisers in Europe throughout 2025, primarily based on information from GlobalData’s newest league desk.

In line with GlobalData’s Monetary Offers Database, Morgan Stanley suggested on transactions with a mixed worth of $109.5bn in the course of the yr, topping the worth chart.

Entry deeper trade intelligence

Expertise unmatched readability with a single platform that mixes distinctive information, AI, and human experience.

Rothschild & Co led by quantity, with advisory on 119 transactions.

Goldman Sachs ranked second when it comes to whole deal worth, advising on $100.3bn price of offers.

The following three positions had been held by Barclays with $53.5bn in suggested offers, JPMorgan with $53.3bn, and Financial institution of America with $49.4bn.

By way of quantity, Ernst & Younger adopted Rothschild & Co with 103 transactions suggested.

PwC, Houlihan Lokey, and Deloitte rounded out the highest 5 with 100, 95 and 89 transactions, respectively.

GlobalData lead analyst Aurojyoti Bose mentioned: “Morgan Stanley was one of many solely two advisers to surpass $100 billion mark in whole deal worth throughout 2025. It suggested on 24 billion-dollar offers* and its involvement in these big-ticket offers helped it prime the chart by worth. Morgan Stanley additionally held the ninth place by quantity in 2025.

“In the meantime, Rothschild & Co was the highest adviser by quantity in 2024 and managed to retain its management place by this metric in 2025 as effectively, regardless of a drop within the whole variety of offers suggested by it. The truth is, majority of the highest 10 advisers by quantity skilled a drop within the variety of offers. Rothschild & Co additionally occupied the eighth place by worth in 2025.”

GlobalData’s league tables are primarily based on the real-time monitoring of hundreds of firm web sites, advisory agency web sites and different dependable sources out there within the secondary area. A devoted crew of analysts displays all these sources to collect in-depth particulars for every deal, together with adviser names.

To make sure additional robustness to the info, the corporate additionally seeks submissions of offers from main advisers.