Market Alternative Evaluation

Throughout the general public sector, few information troves are as massive and underutilized as unclaimed property information. In combination, the USA maintains $68+ billion in dormant property scattered throughout 50+ state treasuries, quasi-government places of work, and affiliated custodians. The result’s a sprawling constellation of searchable ledgers: proprietor names, last-known addresses, monetary establishments, quantities, date stamps, asset classes, and disposition codes. For information scientists, this appears to be like like an extended tail of messy however useful alerts. For product builders, it’s a market that naturally rewards integration, normalization, id decision, and high-quality consumer expertise. And for buyers, it’s a area with clear monetization paths: lead era for wealth restoration companies, premium matching accuracy for professionals, information merchandise for compliance groups, and embedded declare workflows for fintechs and monetary advisors.

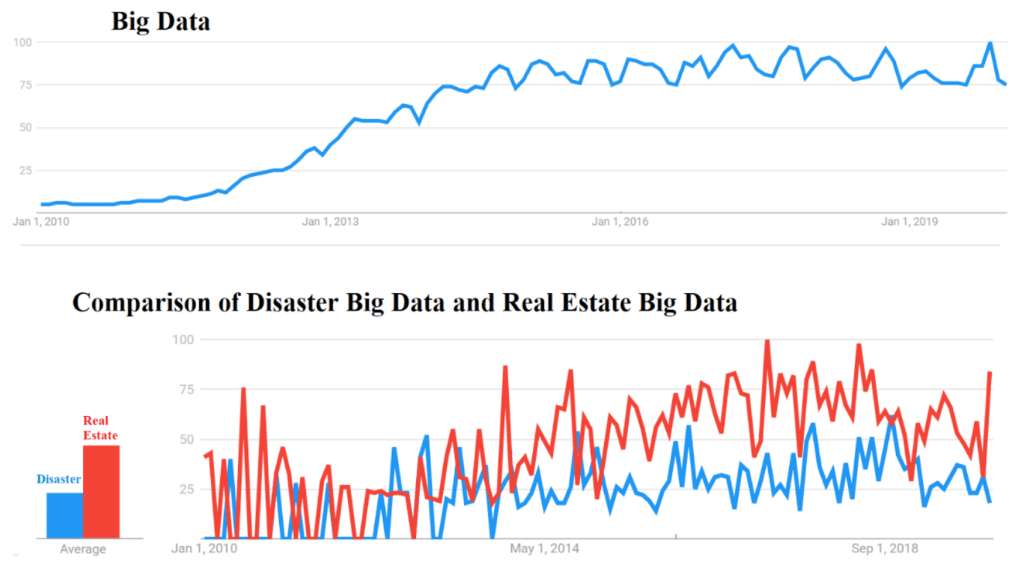

Determine. Rising huge information momentum during the last decade, with area volatility (catastrophe vs actual property) underscoring why $68B unclaimed property analytics is ripe for focused insights.

The chance spans a number of industries. Fintech can floor proactive alerts inside banking apps when customers are doubtless matched to dormant property. Civic tech can construct public-benefit tooling that will increase declare charges whereas reducing administrative friction. Insurtech and asset managers can cut back escheatment by detecting at-risk accounts early. Even advertising and marketing and analytics groups can make the most of these patterns to achieve a deeper understanding of mobility, life occasions, and demographic behaviors related to asset abandonment and restoration. Platforms like Declare Notify level to a practical mannequin: combination hundreds of thousands of information, unify schemas, and ship consumer-grade search that transforms uncooked ledgers into clear solutions.

Information Integration Technical Challenges

Schema standardization. Each state speaks a distinct dialect. Area names range, varieties drift, and optionally available fields proliferate. One dataset might break up first and final names; one other may retailer a single free-text proprietor subject. Handle constructions mirror legacy kinds. A viable platform should map dozens of supply schemas right into a canonical mannequin, with sturdy dealing with for nulls, a number of house owners, company entities, and historic revisions.

API limitations. Some states supply rate-limited APIs with auth keys and variable paging; others have brittle endpoints liable to upkeep home windows. A number of present search-only interfaces with restricted export options. Orchestration has to account for backoff, jitter, token refresh, and auto-recovery from partial pulls.

Information high quality variations. Count on typos, stale addresses, truncated names, and inconsistent date codecs. Confirmed pipelines lean on deterministic guidelines plus probabilistic matching to reconcile duplicates, merge close to matches, and rating confidence per candidate.

Actual-time processing. Holding information present is nontrivial as a result of states replace on completely different cadences. Efficient methods schedule incremental pulls, diff the brand new towards the warehouse, and propagate deltas by means of downstream indexes. Platforms like Declare Notify have adopted resilient ingestion and change-data processing to maintain search outcomes recent with out hammering fragile sources.

Machine Studying Purposes

Sample recognition. Unsupervised strategies can cluster abandonment signatures: employer modifications, interstate strikes, or banking churn. These clusters assist forecast the place unclaimed property will emerge and which cohorts are most definitely to get well them.

Fraud detection. Supervised classifiers, anomaly detection, and graph analytics can flag suspicious claiming patterns, equivalent to repeated makes an attempt throughout many small accounts or id attributes that fail cross-checks. Threat scores route high-risk instances to guide assessment with out degrading sincere consumer expertise.

Predictive modeling. Gradient boosting or generalized additive fashions can estimate the chance {that a} match is real and {that a} consumer will full a declare as soon as began. Prioritization improves when the mannequin pairs information alerts with behavioral telemetry from the search interface.

Pure language processing. Fuzzy title matching advantages from phonetic encodings, transliteration help, nickname dictionaries, and deal with normalization. NLP additionally assists with deduping company entities, parsing line noise in legacy fields, and reconciling variant spellings.

Behavioral analytics. Funnel evaluation quantifies the place customers drop off. If most abandon documentation add, the repair is UX and schooling. If the problem is comprehension, in-flow steerage reduces confusion. That is the place platforms like Declare Notify flip ML perception into UX influence.

ROI and Funding Evaluation

The economics are enticing. On the associated fee facet, engineering funding flows to information connectors, schema mapping, ML pipelines, and id decision. On the income facet, viable fashions embrace premium seek for energy customers, B2B entry for professionals, embedded restoration companies, and companion integrations. Governments save on help prices when claimants self-serve efficiently. Monetary advisors and fintechs improve buyer satisfaction by serving to reunite purchasers with property. Enterprise capital curiosity follows the place there’s recurring worth and defensible information moats. With hundreds of thousands of information and frequent updates, community and information results accrue to groups that frequently enhance matching accuracy and UX.

Future Purposes

Enlargement to adjoining verticals. Property tax auctions, court-ledger refunds, class-action distributions, and uncashed payroll checks share comparable information DNA. The identical ETL and ML stack can prolong horizontally.

Blockchain for provenance. Immutable audit trails might enhance chain-of-custody for claims, however interoperability and privateness constraints should be solved first. Count on hybrid fashions that anchor proofs whereas maintaining PII off-chain.

AI-driven notifications. With consumer consent, fashions can monitor life occasions that correlate with escheatment threat and proactively notify customers earlier than their property go dormant.

Fintech embedding. Banks and wealth platforms can add a white-label search that checks for unclaimed property throughout onboarding or annual evaluations. This positions restoration as a part of a holistic method to monetary well being.

Name to Motion

For information leaders, the playbook is evident: construct a sturdy integration layer, deal with information high quality as a product, and pair ML with humane UX. For policymakers and companions, collaborate with non-public platforms that may flip scattered ledgers into outcomes. If you’d like a working reference structure already serving to individuals discover cash they’re owed, discover how Declare Notify operationalizes these concepts at a client scale.