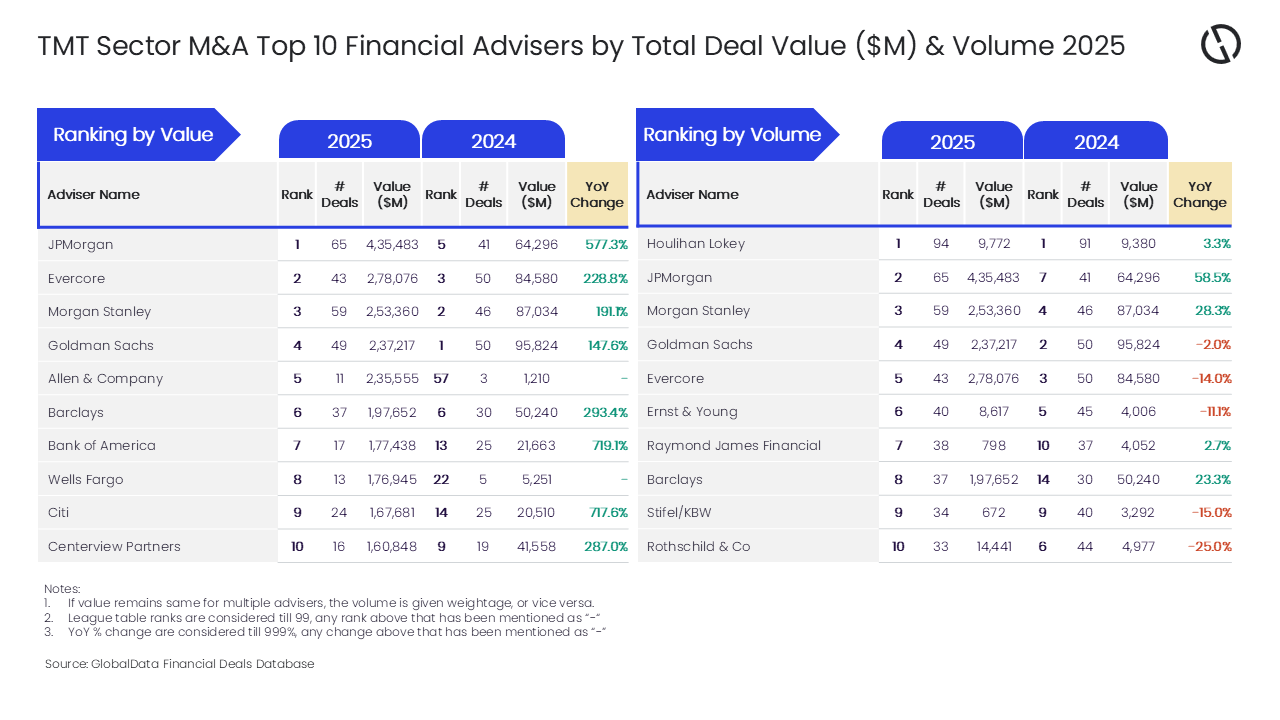

JPMorgan and Houlihan Lokey have been recognized because the main monetary advisers for mergers and acquisitions (M&A) inside the expertise, media, and telecom (TMT) sector in 2025, as per information from GlobalData.

In line with the newest league desk, JPMorgan secured the highest place regarding deal worth, having suggested on transactions amounting to $435.5bn. In the meantime, Houlihan Lokey led by way of the variety of offers, taking part in 94 transactions.

Entry deeper trade intelligence

Expertise unmatched readability with a single platform that mixes distinctive information, AI, and human experience.

GlobalData’s Monetary Offers Database offered the figures which present Morgan Stanley because the third-ranking adviser by deal worth, with transactions totalling $253.4bn. In shut succession, Goldman Sachs suggested on $237.2bn price of offers, whereas Allen & Firm dealt with $235.6bn.

By way of transaction quantity, Morgan Stanley additionally held the third spot with involvement in 59 offers. Goldman Sachs adopted with 49 transactions, and Evercore participated in 43 offers. This evaluation contains solely these offers valued at or above $1bn.

GlobalData lead analyst Aurojyoti Bose stated: “JPMorgan and Houlihan Lokey have been nicely forward of others within the league tables by worth and quantity, respectively. This may be understood from the truth that Evercore occupied the second place by way of worth by advising on $278.1bn price of offers, which is round 1.6x much less in comparison with the whole worth of offers suggested by JPMorgan.

“Throughout 2025, JPMorgan suggested on 32 billion-dollar offers that additionally included seven mega offers valued at greater than $10bn. These big-ticket offers helped it acquire a large lead by way of worth.

“In the meantime, Houlihan Lokey simply fell wanting hitting triple-digit deal quantity and was distantly adopted by JPMorgan that stood at a distant second by quantity with 65 offers.”

GlobalData’s league tables are based mostly on the real-time monitoring of 1000’s of firm web sites, advisory agency web sites and different dependable sources accessible within the secondary area. A devoted workforce of analysts screens all these sources to assemble in-depth particulars for every deal, together with adviser names.

To make sure additional robustness to the information, the corporate additionally seeks submissions of offers from main advisers.