One of many notable options on the Canadian-issued American Specific Platinum Card is the $200 annual eating credit score, which permits cardholders to get pleasure from a meal at an eligible restaurant and get an announcement credit score.

For those who’re in a position to make use of the $200 annual eating credit score on the Platinum Card, it’s a simple technique to scale back the efficient value of the $799 annual payment to $599.

On this article, we’ll go over all the pieces you have to know in regards to the $200 annual eating credit score, together with easy methods to register, the place you should utilize it, and far more.

American Specific Platinum Card

- Earn 80,000 MR factors upon spending $10,000 within the first three months

- Plus, earn 30,000 MR factors upon making a purchase order in months 15–17 as a cardholder

- Earn 2x MR factors on all eating and journey purchases

- Obtain an annual $200 journey credit score

- Obtain an annual $200 eating credit score

- Switch MR factors to Aeroplan, The British Airways Membership, Flying Blue, and different frequent flyer applications for premium flights

- Limitless airport lounge entry for you and one visitor at Precedence Go, Plaza Premium, Centurion, and different lounges

- Credit and rebates for day by day bills all year long with Amex Presents

- Bonus MR factors for referring household and pals

- Annual payment: $799

What Is the American Specific Platinum Card $200 Annual Eating Credit score?

The American Specific Platinum Card‘s $200 annual eating credit score was launched in September 2023, when main modifications hit the American Specific Platinum Card.

A part of the modifications included growing the cardboard’s annual payment from $699 to $799, and the eating credit score was launched to assist offset that enhance.

Every calendar 12 months, Platinum cardholders are eligible for a $200 assertion credit score upon making a qualifying buy of at the very least $200 at a taking part restaurant in Canada. Word that that is totally different from the Platinum Card’s $200 annual journey credit score, which resets each membership 12 months.

It’s vital to notice that the eating credit score will solely kick in on a transaction of at the very least $200. The eating credit score isn’t cumulative, which implies you received’t have the ability to make just a few smaller purchases and have it triggered.

Moreover, the $200 annual eating credit score is barely accessible to the first cardholder, and isn’t accessible on supplementary accounts.

It’s additionally vital to notice that the $200 annual eating credit score on the Canadian-issued American Specific Platinum Card is solely legitimate for dine-in providers at taking part institutions in Canada. Eating places outdoors Canada received’t set off the credit score, even when they’re legitimate for eating credit with Platinum Playing cards issued by different nations.

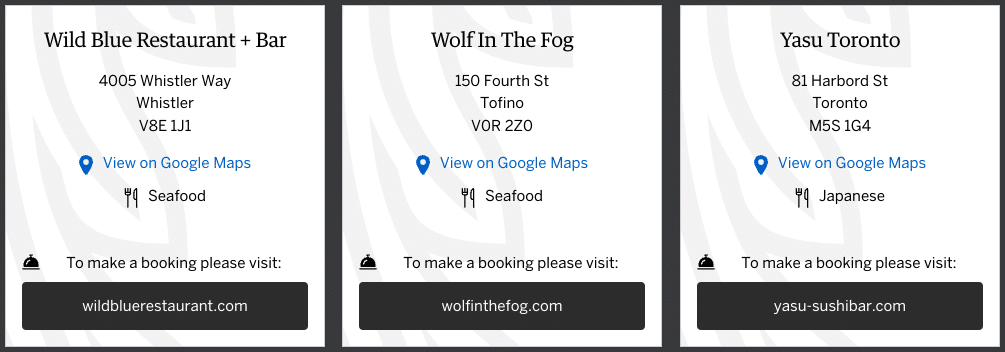

There are presently over 220 eligible eating places in Canada, that are principally concentrated in main metropolis centres; nevertheless, there are taking part eating places in smaller cities as properly, equivalent to Rimouski, Ucluelet, and Tofino, to call just a few.

The total checklist of eating places could be discovered on the American Specific web site.

American Specific Platinum Card

- Earn 80,000 MR factors upon spending $10,000 within the first three months

- Plus, earn 30,000 MR factors upon making a purchase order in months 15–17 as a cardholder

- Earn 2x MR factors on all eating and journey purchases

- Obtain an annual $200 journey credit score

- Obtain an annual $200 eating credit score

- Switch MR factors to Aeroplan, The British Airways Membership, Flying Blue, and different frequent flyer applications for premium flights

- Limitless airport lounge entry for you and one visitor at Precedence Go, Plaza Premium, Centurion, and different lounges

- Credit and rebates for day by day bills all year long with Amex Presents

- Bonus MR factors for referring household and pals

- Annual payment: $799

Use the American Specific Platinum Card’s $200 Annual Eating Credit score

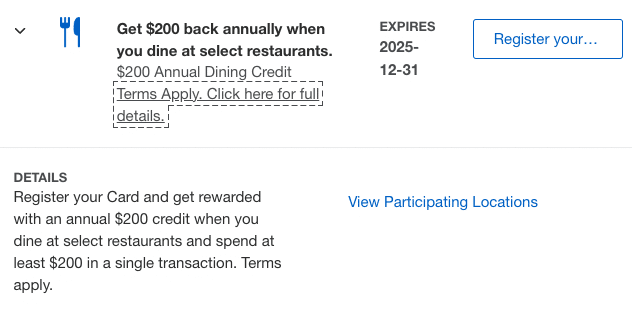

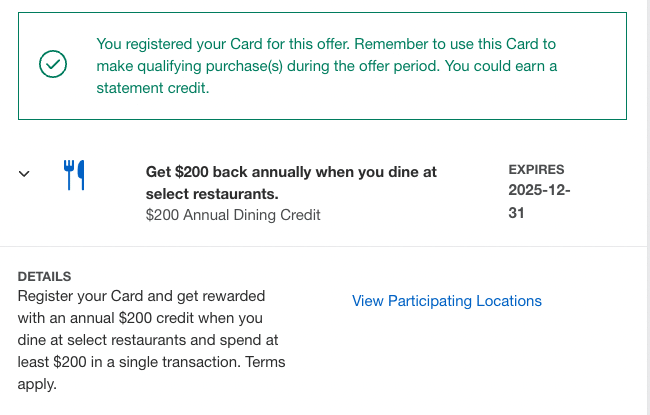

Initially, cardholders should manually register for the $200 annual eating credit score on the Amex Presents part of their account.

Registration can both be accomplished inside the American Specific cell app, or on the American Specific web site.

Merely log in to your American Specific account, choose your Platinum Card if in case you have a couple of Amex card, after which navigate to the Amex Presents part.

As soon as there, search for the $200 annual eating credit score, and hit “Register your card.”

After you’ve registered, all you have to do is pay for a invoice totalling at the very least $200 at any of the taking part eating places in Canada utilizing your Amex Platinum Card. As soon as the transaction posts to your account, you’ll obtain a $200 assertion credit score.

Remember the fact that the assertion credit take round 5 enterprise days to look, however they will take as much as 150 days from the provide finish date, as per the phrases and situations.

Nevertheless, assuming the $200 assertion credit score for eating behaves equally to assertion credit from many different Amex Presents, it ought to seem in your account inside just a few days.

After your preliminary enrolment, you received’t must manually add the provide from the Amex Presents web page in every subsequent 12 months . Quite, you’ll be mechanically re-enrolled, and the assertion credit score can be utilized to your account on any eligible transaction above $200 at one of many eligible venues.

Conclusion

The American Specific Platinum Card’s $200 annual eating credit score offers cardholders the chance to get pleasure from an announcement credit score after spending over $200 at a taking part restaurant in Canada.

This annual credit score was initially launched in late 2023 to assist offset the cardboard’s elevated annual payment value, which went from $699 to $799.

The $200 annual eating credit score joins the $200 annual journey credit score as one of many mainstay options on the American Specific Platinum Card. For those who’re in a position to benefit from the eating credit score, make certain to try the checklist of eating places, after which pay along with your Platinum Card for a considerably decreased invoice.