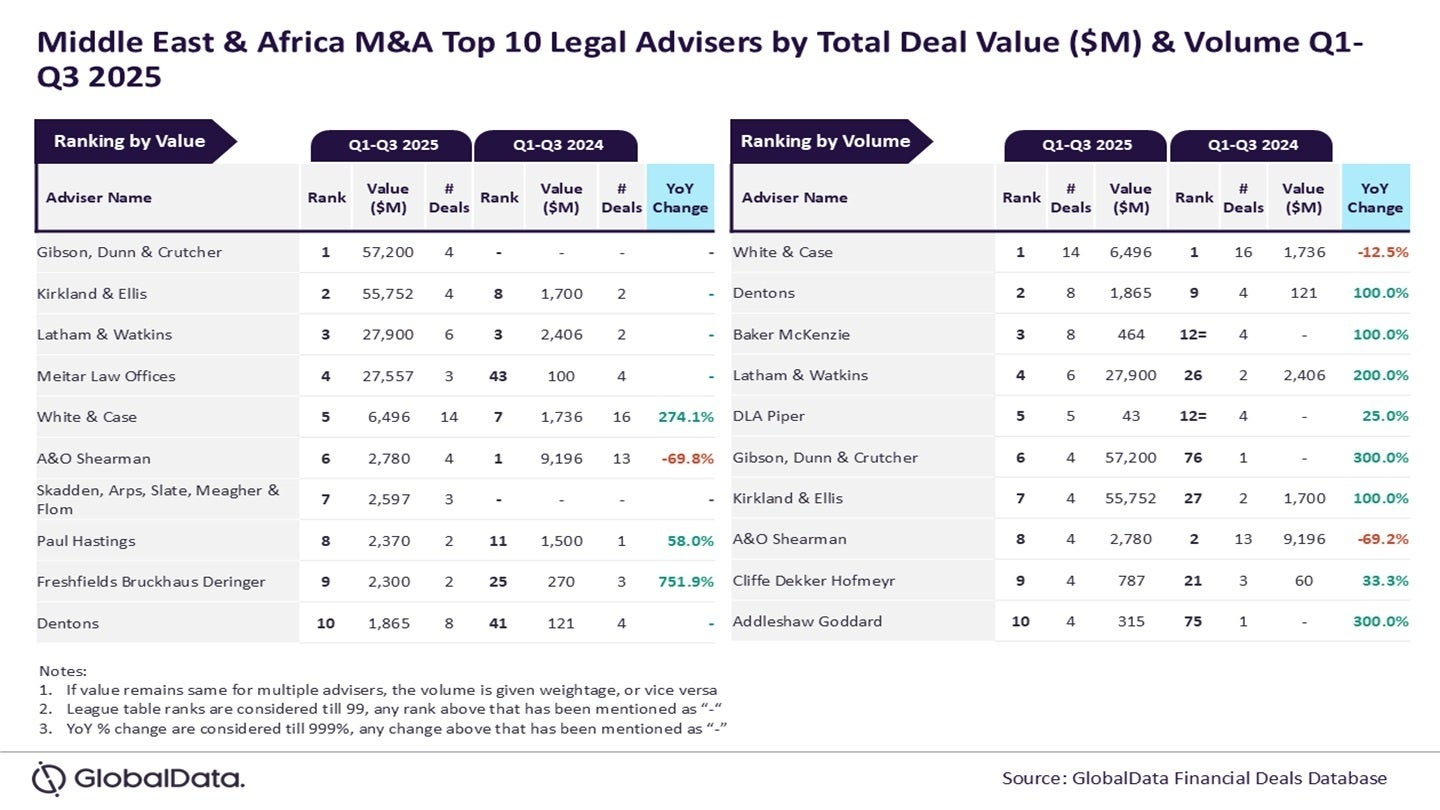

Gibson, Dunn & Crutcher and White & Case have emerged because the foremost authorized advisers for mergers and acquisitions (M&A) within the Center East & African (MEA) area for the primary three quarters (Q1-Q3) of 2025 by way of worth and quantity, respectively.

In response to the info from monetary offers database of GlobalData, an information and analytics agency, Gibson, Dunn & Crutcher secured the highest spot by worth, having suggested on offers amounting to $57.2bn.

Entry deeper trade intelligence

Expertise unmatched readability with a single platform that mixes distinctive knowledge, AI, and human experience.

Then again, White & Case claimed the main place by quantity, collaborating in a complete of 14 offers.

GlobalData lead analyst Aurojyoti Bose stated: “White & Case was the one adviser to hit double-digit deal quantity throughout Q1-Q3 2025. Other than main by quantity, it additionally occupied the fifth place by worth through the evaluate interval.

“In the meantime, Gibson, Dunn & Crutcher, regardless of advising on comparatively fewer variety of offers, managed to high the chart by worth. It’s noteworthy that two of the 4 offers suggested by Gibson, Dunn & Crutcher throughout Q1-Q3 2025 have been billion-dollar offers that additionally included a mega deal valued greater than $50bn. Involvement in these big-ticket offers helped it occupy the highest spot by worth.”

Kirkland & Ellis was the runner-up within the worth class, offering counsel on offers price $55.8bn. It was adopted by Latham & Watkins with $27.9bn, Meitar Regulation Places of work with $27.6bn, and White & Case with $6.5bn.

Within the quantity class, Dentons took the second spot, having suggested on eight offers. Though Baker McKenzie too suggested on eight offers, it took the third spot due to decrease deal worth.

Latham & Watkins suggested on six offers, whereas DLA Piper rounded out the record with 5 offers.

GlobalData’s league tables are primarily based on the real-time monitoring of 1000’s of firm web sites, advisory agency web sites and different dependable sources out there on the secondary area. A devoted workforce of analysts displays all these sources to assemble in-depth particulars for every deal, together with adviser names.

To make sure additional robustness to the info, the corporate additionally seeks submissions of offers from main advisers.