The Scotiabank Passport™ Visa Infinite Privilege* Card is Scotiabank’s top-tier journey card, aimed squarely at frequent travellers who worth consolation and comfort as a lot as factors.

You’re taking a look at a beneficiant welcome bonus, no international transaction charges, 10 annual lounge visits, and a $250 annual journey credit score, all wrapped into one steel Visa Infinite Privilege product.

On this overview, we’ll stroll by means of what the cardboard presents, the right way to get essentially the most worth from it, and who it truly is sensible for.

At a Look

- Annual payment: $599

- Supplementary cardholders: $199 per card

- Minimal annual earnings: $150,000 private, $200,000 family, or $400,000 in property beneath administration with Scotiabank

- Minimal credit score restrict: $10,000

- Estimated credit score rating: Glorious

- Ranking: 4/5

What we love: No international transaction charges, 10 annual lounge visits, $250 annual journey credit score, and powerful journey insurance coverage.

What we’d change: Elevate the bottom incomes price on non-bonused spend to raised match different playing cards in the identical Privilege tier.

Beneficiant Welcome Bonus

The Scotiabank Passport Visa Infinite Privilege Card at present presents a welcome bonus of as much as 100,000 Scene+ factors, sometimes structured in three chunks:

- A primary-phase bonus after assembly a modest spend within the first three months (30,000 Scene+ factors upon spending $3,000 within the first three months)

- A bigger chunk after reaching the next spend threshold throughout the first six months (45,000 Scene+ factors upon spending $20,000 within the first six months)

- A further bonus once you make at the very least one eligible buy across the card’s 14th month of membership (25,000 Scene+ factors once you make at the very least one eligible buy throughout the 14th month after account opening)

The primary installment of the bonus is easy, whereas the second requires extra planning – however in case you have giant natural bills (equivalent to lease through platforms like Chexy, tuition, or enterprise spend), it’s very achievable.

The ultimate 25,000-point portion is simple from a mechanics standpoint, however it does require you to hold the cardboard into the second 12 months and make a purchase order throughout the 14th month.

Personally, I’m not an enormous fan of this construction, since by that time you will have determined to cancel or downgrade. That mentioned, even when you select to not hold the cardboard into 12 months 2, you continue to stroll away with 75% of the whole bonus.

Welcome presents change ceaselessly. At all times test Scotiabank’s web site or our bank card database web page for the newest construction and minimal spend necessities.

For those who unlock solely the first-year parts, you’re taking a look at:

- 75,000 Scene+ factors from the welcome bonus, plus

- Roughly 20,000 Scene+ factors from the required spending, assuming a conservative common of 1 Scene+ level per greenback

That’s about 95,000 Scene+ factors, which we’d peg at $950 in worth at 1 cent per level – earlier than counting any class bonuses. Add within the $250 annual journey credit score, and also you’re at roughly $1,200 in worth within the first 12 months.

After subtracting the $599 annual payment, you’re left with round $600 in web worth in 12 months 1, earlier than factoring in financial savings from no international transaction charges or any worth you get from lounge entry.

Scotiabank Passport® Visa Infinite Privilege* Card

- Earn 30,000 Scene+ factors upon spending $3,000 within the first three months

- Plus, earn an extra 45,000 Scene+ factors upon spending $20,000 within the first six months

- And, earn an extra 25,000 Scene+ factors once you make at the very least one eligible buy throughout the 14th month of account opening

- Earn 3x Scene+ factors on eligible journey purchases

- Earn 2x Scene+ factors on eating and leisure purchases

- Visa Airport Companion membership with 10 free lounge visits per 12 months

- $250 annual journey credit score

- Redeem factors for an announcement credit score in opposition to any journey expense

- Minimal earnings: $150,000 private or $200,000 family

- Annual payment: $599

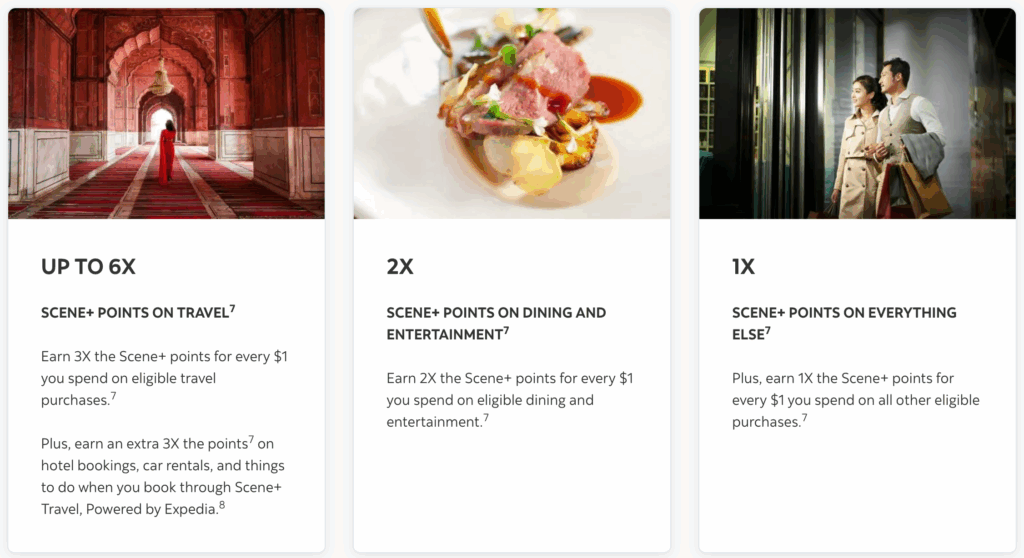

Robust Incomes Charges

On the incomes entrance, the cardboard retains issues easy however engaging for travellers. You’ll earn:

- 3 Scene+ factors per greenback spent on eligible journey purchases

- 2 Scene+ factors per greenback spent on eligible international eating and leisure

- 1 Scene+ level per greenback spent on all different purchases

For those who e book motels, automotive leases, or “issues to do” by means of Scene+ Journey, Powered by Expedia, you’ll earn an extra 3 Scene+ factors per greenback on these purchases, for a complete of 6 Scene+ factors per greenback on these particular classes.

Not like the Scotiabank® Gold American Categorical®* Card, the Scotiabank Passport™ Visa Infinite Privilege* Card‘s accelerated incomes works globally, not simply in Canada – and once you mix that with no international transaction charges, it turns into a really robust possibility for worldwide journey and on-line foreign-currency spending.

Moreoever, the Scotiabank Passport™ Visa Infinite Privilege* Card doesn’t cap your accelerated earn charges. So long as your purchases code accurately as journey, eating, or leisure, you’ll hold incomes at 3x or 2x with no annual ceiling.nual ceiling.

Given our 1 cpp valuation, this works out to an approximate 3% return on journey, 2% on eating and leisure, and 1% on the whole lot else, earlier than you take into account the cardboard’s different advantages.

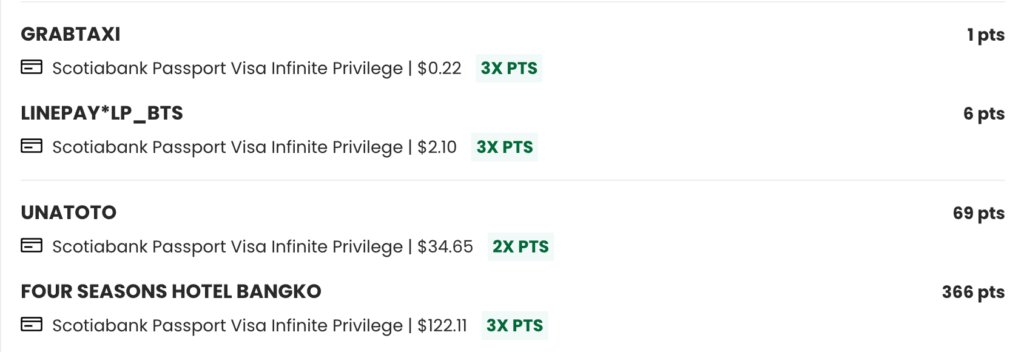

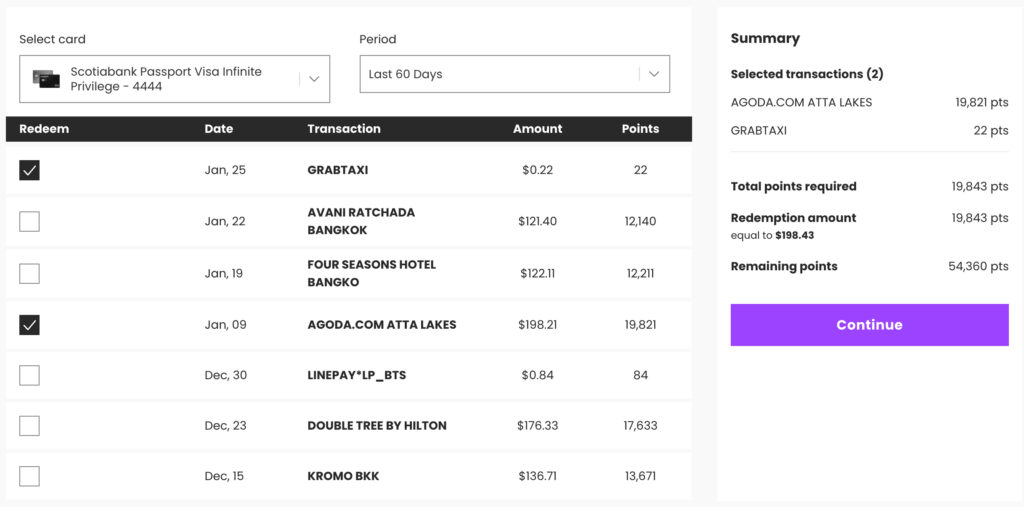

Versatile Scene+ Factors Redemption

Scene+ factors may not have the glitz of airline or lodge currencies, however they’re easy, versatile, and constantly priceless.

With the Scotiabank Passport Visa Infinite Privilege Card, you’ll earn Scene+ factors that may be redeemed at a hard and fast price of 1 cent per level towards a variety of purchases, together with flights, motels, automotive leases, excursions and actions, cruises, public transit, and even rideshare providers.†

For the Miles & Factors crowd, essentially the most compelling angle is the power to redeem Scene+ factors in opposition to any journey buy charged to the cardboard at 1 cent per level.† You’re not boxed into a selected airline, lodge chain, or reserving platform.

What actually units Scene+ aside is that you just don’t have to undergo a proprietary portal to get full worth. You possibly can:

- Ebook immediately together with your most well-liked airline, lodge, or cruise line

- Cost the expense to your Scotiabank Passport Visa Infinite Privilege Card

- Return and redeem Scene+ factors in opposition to that transaction inside 12 months

This setup avoids inflated portal costs, restricted availability, and the headache of coping with a third-party customer support rep when plans change.

Personally, the most important perk of reserving direct is that you just protect your lodge elite standing advantages – one thing most third-party bookings strip away.

Whether or not it’s room upgrades, free breakfast, or late checkout, you’ll nonetheless take pleasure in these perks once you e book with the lodge and easily wipe the cost with Scene+ factors afterward.

Some fixed-value applications (like TD Rewards) scale back the redemption price when you don’t e book by means of their very own portal, forcing you to decide on between elite advantages or most worth. Scene+ neatly avoids that trade-off: you get full worth and direct bookings on the similar time.

No, this isn’t this system to make use of for aspirational top quality flights or ultra-luxury lodge redemptions at outsized worth.

However for easy, versatile redemptions that match real-life journey spending, Scene+ does precisely what you need it to do.

Different Methods to Use Scene+ Factors

Outdoors of journey, Scene+ factors can be redeemed immediately at various companions, together with:

- Empire Firm grocery shops (Sobeys, Safeway, IGA, FreshCo, and so forth.)

- Cineplex, together with The Rec Room and Playdium

- Residence {Hardware}

- Recipe Limitless eating places (Harvey’s, Swiss Chalet, Montana’s, and so forth.)

On prime of that, you may redeem factors for reward playing cards, merchandise, and assertion credit, though these choices typically are available beneath the perfect journey redemption worth.

For many Scotiabank Passport Visa Infinite Privilege cardholders, the play is obvious:

- Use the cardboard closely for journey and on a regular basis spending

- Redeem Scene+ factors at 1 cent per level in opposition to any journey buy

- Deal with grocery, eating, leisure, and different associate redemptions as a pleasant backup once you’re not planning a visit however nonetheless need to trim day-to-day prices

Premium Journey Perks and Lounge Entry

That is the place the Scotiabank Passport™ Visa Infinite Privilege* Card begins to justify its premium annual payment.

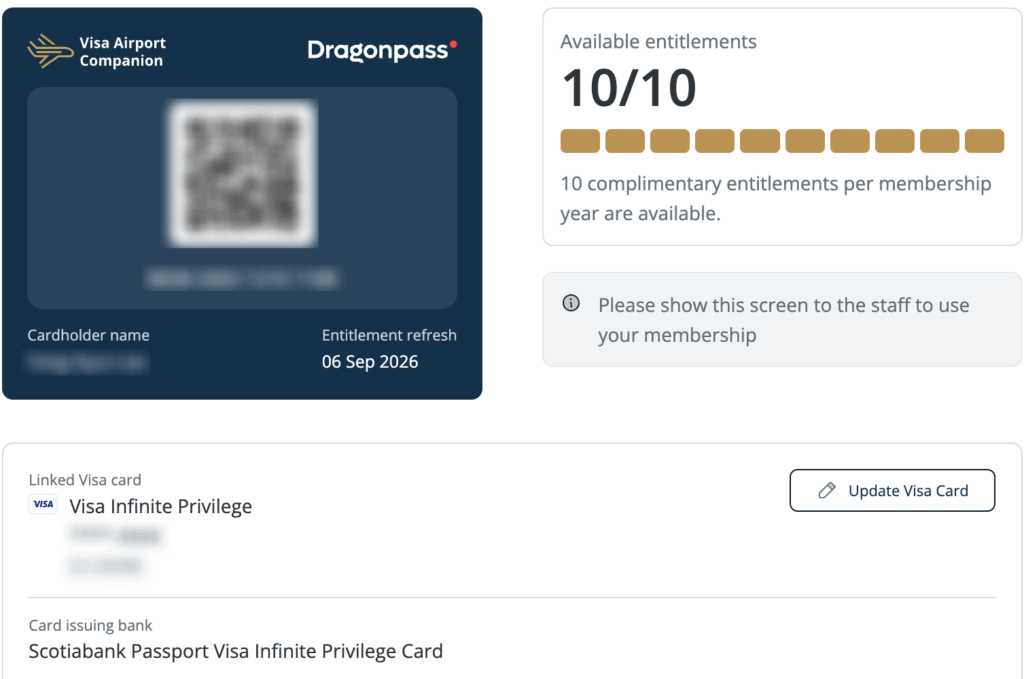

10 Complimentary Lounge Visits

Via the Visa Airport Companion Program (powered by DragonPass), you’ll get 10 complimentary lounge visits per membership 12 months.

With walk-up DragonPass visits typically pricing round US$35–40, utilizing all 10 passes can simply offset a big chunk of the annual payment by itself.

$250 Annual Journey Credit score

Annually, the first cardholder will get a $250 assertion credit score on the primary eligible journey reserving of $250+ made by means of Scene+ Journey, Powered by Expedia.

This is applicable to flights, motels, automotive leases, and trip packages, so long as you e book by means of the portal and cost the journey to your card.

For those who’re already utilizing Scene+ Journey for bookings, that is basically $250 off a visit each membership 12 months.

No International Transaction Charges

One of many standout options is that the cardboard doesn’t cost international transaction charges.

Most Canadian bank cards add a 2.5% markup to any buy in a non-CAD forex. With this card, you’ll solely pay the underlying Visa alternate price, which might simply prevent a whole lot of {dollars} a 12 months when you journey ceaselessly, e book motels in foreign exchange, or store on-line with worldwide retailers.

Visa Infinite Privilege Way of life Perks

On prime of the headline journey advantages, you’ll additionally benefit from the common Visa Infinite Privilege suite:

- Precedence safety lanes and check-in at choose Canadian airports

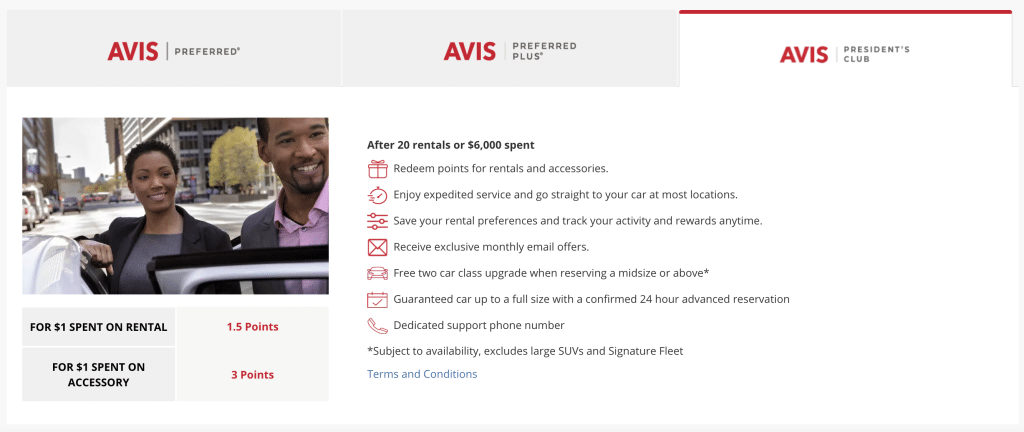

- Avis President’s Membership standing, with upgrades and precedence service

- Entry to the Visa Infinite Luxurious Resort Assortment and Relais & Châteaux advantages

- Wine nation perks, golf advantages, eating sequence occasions, and unique OpenTable reservations in choose cities

These aren’t advantages you’ll use each week, however when you lean into them earlier than journeys, they assist the cardboard really feel “premium” past simply the welcome bonus.

Complete Insurance coverage Protection

As you’d count on from a Visa Infinite Privilege product, insurance coverage protection is very strong. In keeping with Scotiabank’s certificates of insurance coverage, protection contains:

- Emergency medical insurance coverage: As much as $5 million in protection for surprising medical sickness or damage whereas touring, relevant for journeys as much as 31 days (10 days for vacationers aged 65+).

- Journey cancellation and interruption insurance coverage: As much as $2,500 per particular person for journey cancellation and $5,000 per particular person for journey interruption.

- Flight delay insurance coverage: Protection of as much as $1,000 per particular person for delays exceeding 4 hours.

- Misplaced and delayed baggage insurance coverage: As much as $1,000 per particular person for luggage delays or losses.

- Rental automotive collision and injury insurance coverage: Protection for rental autos with an MSRP of as much as $85,000, eliminating the necessity for expensive rental automotive insurance coverage.

- Resort housebreaking insurance coverage: As much as $1,000 in protection for stolen objects in case your lodge room is damaged into.

- Frequent service journey accident insurance coverage: Safety in case of unintended lack of life or dismemberment when the total price of journey is charged to the cardboard.

- Cellular gadget insurance coverage: Protection of as much as $1,000 for misplaced, stolen, or by accident broken smartphones and tablets, offered the total buy worth was charged to the cardboard.

- Buy safety: Protection for 180 days in opposition to theft, loss, or injury on most new purchases.

- Prolonged guarantee: Triples the unique producer’s guarantee, as much as two extra years.

For those who’re somebody who prefers to self-insure by means of bank cards as an alternative of shopping for standalone insurance policies for every journey, this card checks basically each field.

At all times overview the newest certificates of insurance coverage for exact protection limits, age restrictions, and definitions earlier than counting on any profit.

Who Ought to Get This Card?

The Scotiabank Passport Visa Infinite Privilege Card is not designed for everybody – and that’s okay.

It’s finest suited to:

- Frequent travellers who fly a number of instances a 12 months and can truly use all 10 lounge passes and the $250 journey credit score

- Huge spenders in journey and eating, who can comfortably meet the welcome supply’s spend thresholds with out forcing additional purchases

- International travellers and digital nomads who worth no FX charges and value-back on each international transaction

- Excessive-income households that meet the Privilege-tier earnings or asset necessities

For those who solely take one journey a 12 months, hardly ever go to lounges, or favor to deal with airline-specific applications like Aeroplan, this card might really feel like overkill relative to its $599 annual payment.

My Take: Is It a Keeper?

From my perspective, the greatest miss on this card is the base incomes price on non-bonused spend.

Lots of competing Privilege-tier merchandise, just like the RBC® Avion® Visa Infinite Privilege‡ Card or the CIBC Aventura® Visa Infinite Privilege* Card, supply 1.25 factors per greenback spent incomes as a baseline on all purchases.

If Scotiabank had pushed the Passport Visa Infinite Privilege to 1.25 Scene+ factors per greenback on uncategorized spend, I’d be very tempted to maintain it long-term as my fundamental premium Visa.

Nevertheless, I’m extra inclined to deal with this as a powerful first-year play, then:

If your individual spend sample could be very journey/dining-heavy and you like the Scene+ ecosystem, you may be completely comfortable holding this card; but when loads of your spend falls into “the whole lot else,” that 1x base earn is difficult to disregard at this worth level.

Conclusion

The Scotiabank Passport™ Visa Infinite Privilege* Card is a true premium journey card: huge welcome bonus, wealthy journey perks, no FX charges, and a severe insurance coverage package deal – all of which might greater than justify the annual payment when you journey typically and play to its strengths.

Nevertheless, the cardboard’s excessive earnings/asset necessities and $599 payment imply it’s not an off-the-cuff alternative. You’ll need to run the numbers on:

- How reliably you may meet the welcome supply’s spending thresholds

- What number of lounge visits you’ll truly use

- Whether or not you’ll constantly set off the $250 annual journey credit score

For those who’re a frequent traveller who values consolation, flexibility, and predictable fixed-value redemptions, this card can simply turn out to be your go-to premium Visa for each on a regular basis spending and large journeys alike.

If not, you might be higher served by its extra accessible siblings – and hold this one on the radar for when your journey patterns (and earnings) scale up.