Bank cards provide greater than only a approach to spend cash and earn factors. One main good thing about many playing cards is insurance coverage on journey bookings and high-ticket purchases.

Don’t be stunned for those who discover insurance coverage to be a really dry and dense subject – in spite of everything, the satan is within the particulars, and evaluating totally different insurance policies isn’t at all times that easy. This information ought to make it easier to perceive the character of what you’re coated for as a cardholder, and what to search for as you analysis your choices.

You’ll see cautious language all through. Insurance policies differ by issuer and card, so at all times learn the precise certificates of insurance coverage (COI) hooked up to your card.

Credit score Card Insurance coverage Overview

Why Do Credit score Playing cards Supply Journey Insurance coverage?

You’ll discover that many playing cards’ insurance coverage insurance policies place an emphasis on journey. That’s as a result of premium bank cards have a tendency to focus on travellers, and journey insurance coverage is a helpful perk to assist justify excessive annual charges.

Journey has so many shifting elements: ticketing, transportation, baggage, lodging, distinctive civil situations, to not point out issues that may occur at residence like accidents or medical emergencies. It’s no shock that issues can and infrequently do go awry, and it’s good to be insured for peace of thoughts so you’ll be able to chill out and luxuriate in your journey.

You solely “use” journey insurance coverage when travelling, which makes it simple to neglect till you actually need it. With out embedded protection, you’d be shopping for a standalone coverage for every journey (or an annual plan).

Don’t anticipate finding residence, vehicle, or life insurance coverage on bank cards. You’re by yourself for these. In case you have a house, automotive, or (clearly) a life, you do want these to be protected day by day. You wouldn’t need these forms of protection to be tied to a bank card account, which is short-term within the grand scheme of issues.

Find out how to Use Credit score Card Insurance coverage

It’s good to designate a long-term keeper card for any bookings or purchases for which you’re relying on the insurance coverage coverage. Your protection will lapse once you cancel the bank card or in case your account is not in good standing.

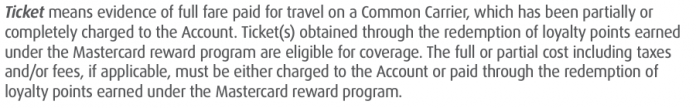

Many insurance policies require you to cost half—or typically all—of the eligible expense to the cardboard. The wording varies:

- Some require the “full price” to be charged to the cardboard (unhealthy information for award journey).

- Just a few specify a minimal proportion of the journey price (e.g., 75%) have to be paid with the cardboard.

- Others cowl award tickets so long as you cost the taxes/charges to the cardboard (higher).

Should you fly on award bookings, the price of the ticket could have a factors part, and a (hopefully small) money part which you’d pay with a bank card. It’s essential to know which bank cards lengthen insurance coverage on award tickets.

Any card that requires the full price of the journey to be paid on it wouldn’t be legitimate for insurance coverage, as a result of the factors part is paid individually – it comes out of your frequent flyer account, not your bank card.

In case you have any doubts in any respect, at all times evaluation the insurance coverage certificates your self. It’s essential to not depend on an insurance coverage coverage below the idea that you simply’re coated, solely to later discover out that you simply’ve misinterpreted the fantastic print.

Insurers will not be your buddy and can battle tooth and nail to not need to pay out – and you may’t sweet-talk your means via a misunderstanding like you’ll be able to with a bank card annual price waiver.

Relating to getting a declare began, the earlier the higher – maybe even when you’re nonetheless travelling. Earlier than your journey, put together an inventory of the cellphone numbers to name for every kind of incident. The listing could turn out to be fairly unwieldy for those who’re utilizing totally different bank cards for several types of protection, so it’s greatest to be organized prematurely.

And naturally, you’ll want to offer proof of any losses you’re claiming. Hold your receipts, and take pictures of any injury as quickly as you’ll be able to.

Who Is Lined?

Clearly, the first cardholder is roofed.

Some insurance policies lengthen protection to the first cardholder’s partner or dependent kids. Partner is fairly simple. Dependent kids mainly refers to minors, undergraduate college students, or adults with a everlasting incapacity.

Some bank cards additionally present insurance coverage for secondary cardholders. A few of these playing cards could present it for the secondary cardholder’s partner and kids, on some forms of protection.

Typically, protection for the partner and kids is just legitimate in the event that they’re travelling with the cardholder, however with some bank cards they might be insured in the event that they’re travelling individually.

Every coverage has most payable advantages. There tends to be a separate restrict for every insured particular person, in addition to a complete restrict for the complete incident.

Forms of Credit score Card Insurance coverage Protection

Emergency Medical Help

As Canadians, we’re all too acquainted with our worldwide fame for reasonably priced well being care. Alternatively, we regularly hear horror tales of medical payments overseas.

Emergency medical help is designed to fill that hole, so that you simply’re roughly supported simply as you’ll be if the damage occurred at residence.

These insurance policies cowl costs like hospital companies, emergency dental bills, early return (if obliged by a doctor), or the return of your stays within the worst-case state of affairs. Some insurance policies additionally provide a per diem in case your return is delayed by your damage. You may additionally be coated for some medical care once you return residence.

Emergency medical help is for unintentional and unexpected occasions. Pre-existing situations, routine care, damage ensuing from criminal activity, high-risk adrenaline sports activities, and elective procedures will not be coated.

On the brilliant facet, that is the one insurance coverage coverage that kicks in simply by being a cardholder. You don’t need to pay for any portion of your journey with the cardboard, since most insurance policies cowl you as quickly as you allow your house province, and till your return.

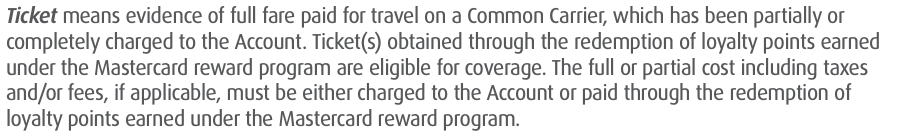

Protection is just legitimate for a sure variety of days of journey, after which you’d want to purchase further days of insurance coverage. If a card covers journeys as much as 15 days and you are taking an extended journey, you is likely to be coated for the primary 15 days, otherwise you may want to purchase insurance coverage for the remainder of your journey to ensure that the primary 15 days of protection to be legitimate in any respect – it varies by bank card.

Seniors over 65 years of age sometimes aren’t coated by these insurance policies, though some bank cards provide protection for older individuals on shorter journeys.

Widespread Service Accident

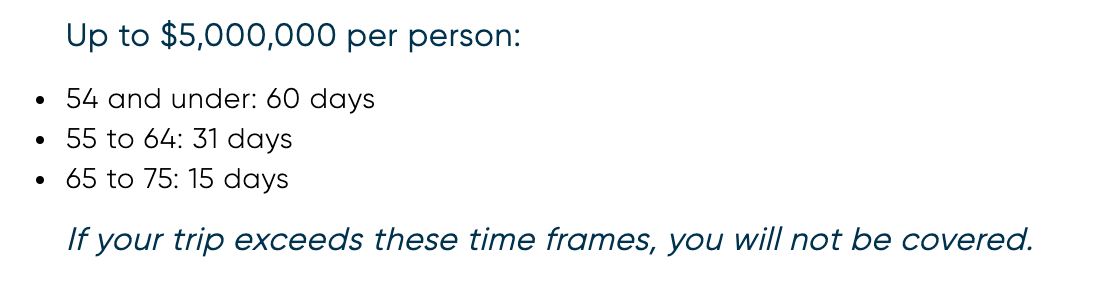

Widespread carriers are public vessels that transport ticketed passengers. Widespread provider accident insurance policies shield you in case you endure a everlasting bodily damage in an accident whereas on a airplane, practice, bus, or boat.

This can be a bit totally different than emergency medical help, which is to your medical bills. Widespread provider accident insurance coverage pays a lump sum as compensation relying on the particular nature of the damage. Every insurance coverage certificates has an in depth breakdown of the advantages for every kind of loss.

Journey Cancellation & Journey Interruption

Now we’re stepping into some conditions that you simply’re extra prone to face.

Journey cancellation is once you’re unable to start your journey as deliberate. Journey interruption refers to conditions if you end up delayed in attending to your subsequent vacation spot (take notice for those who e book multi-stop tickets), or when it’s a must to come residence early.

Beneath these insurance policies, you’ll be eligible to recoup the prices of any non-refundable pay as you go bookings that you simply’ll be unable to take pleasure in. Journey that may be rebooked on one other date or refunded as a voucher received’t be coated.

You may additionally be reimbursed for transportation prices if you have to make alternate preparations to return residence or proceed your journey. For instance, for those who had a three-stop journey, and a civil struggle broke out at your second vacation spot when you had been at your first, the insurer would pay any surcharges to route you on to your third cease and bypass the second (though not essentially in enterprise class or in your most popular airline).

Moreover, some insurance policies could present a per diem for meals, native transportation, lodging, and communication (important cellphone calls) when you scramble to salvage your interrupted journey.

Journey insurance coverage doesn’t cowl discretionary selections – you’ll be able to’t simply change your plans and get a refund. There are particular causes that need to trigger your cancellation or interruption, however they’re fairly broad.

These could embrace sickness (your self or a member of the family), jury responsibility, a authorities journey advisory, in case your airline or lodging goes bankrupt, injury to your house, involuntary lack of employment, a shock being pregnant… you get the thought.

In any occasion, you’ll nonetheless need to know methods to make alternate journey preparations your self. Insurance coverage simply offers you the liberty to make sure a easy journey with out worrying about the fee.

Flight & Baggage Delays

Flight delay insurance coverage is a bit totally different than journey interruption. It particularly refers to a missed connection as a consequence of a late incoming flight, whereas journey interruption has a wider vary of causes in a roundabout way associated to the flight itself.

On this case, you’d be coated for the prices of lodging, native transportation, and necessities like clothes, toiletries, and different sundry objects that you simply want in consequence.

Nothing fairly ruins a trip like exhibiting up with out your baggage. Delayed baggage insurance coverage covers the prices of any necessities, like clothes and toiletries, that you have to change. These may very well be issues you have to take pleasure in your journey or upon your return residence, relying on when your baggage is delayed. Nevertheless, lodging and native transportation prices will not be coated.

These coverages don’t kick in till your onward journey or baggage has been delayed for a minimal period of time, often 4 to 6 hours. Usually they’ll solely apply for in a single day delays, the place finding out alternate plans for the night time is an actual inconvenience. However relying on the timing of your delay, you may not less than rating a free meal!

There’s additionally separate protection for misplaced, broken, or stolen baggage. If the incident happens whereas the luggage is in transit on a standard provider, you might be insured for the worth of its contents, as much as a specified most.

Automobile Leases

There are a couple of several types of insurance coverage on rental vehicles:

- Collision insurance coverage is the most typical. This insures the worth of the automotive within the occasion of bodily injury sustained in an accident. These insurance policies are all extraordinarily comparable, and are legitimate on leases as much as a sure variety of days and vehicles as much as a sure worth.

- Theft insurance coverage is often coated below collision insurance coverage. This refers back to the theft or lack of the complete car or any of its elements, relatively than injury to it.

- Accident insurance coverage is much less widespread. It’s much like widespread provider accident insurance coverage, which doesn’t cowl non-public automotive leases.

Collision and theft insurance policies are nearly at all times the identical on all bank cards that supply them. You get protection for leases as much as 48 days, and you should buy further days for longer journeys. Automobiles are insured for a retail value as much as $65,000, or $85,000 with some premium bank cards.

For the bank card’s collision insurance coverage coverage to kick in, you’ll want to say no the rental firm’s collision injury waiver once you decide up the automotive to start the rental.

Additionally, these insurance policies sometimes don’t embrace third get together legal responsibility insurance coverage, which might cowl private damage to the opposite driver or injury to the opposite automotive within the occasion of an accident. You could be coated by your automotive insurance coverage coverage at residence, however for those who don’t personal a automotive, you’d have to purchase this individually.

Lastly, these insurance policies have quite a few exclusions. They don’t cowl luxurious vehicles, antiques, off-roading, bikes, vehicles, RVs, or different non-standard passenger motor autos. You additionally received’t be coated if illegal velocity or intoxication are components in a crash, or if an uninsured driver is on the wheel.

Private Results & Housebreaking

Some bank cards shield the worth of your private belongings in case they’re stolen or broken by a nasty actor. There could also be separate insurance policies for rental automotive housebreaking, lodge room housebreaking, misplaced baggage (as described above), or an all-around coverage, relying on the character and site of the loss.

Rental automotive housebreaking particularly is fascinating. Even when a rental automotive is insured in opposition to injury or theft, your possessions within the automotive received’t be protected until you even have this sort of insurance coverage.

Sure high-value objects could also be excluded or restricted, like jewellery or furs.

Prolonged Guarantee & Buy Safety

Getting away from journey now, many bank cards provide safety for objects you’ve bought utilizing the cardboard. These insurance policies additionally seem on mid- and top-tier playing cards that don’t essentially goal the journey market, resembling money again Visa Infinite or World Elite playing cards.

Many objects include a producer’s guarantee for defects and untimely put on and tear, good for a sure period of time after your buy. In case your bank card has this protection, it’ll lengthen the producer’s guarantee, on the identical phrases.

Often, these insurance policies double the size of the producer’s protection, as much as one further 12 months (some premium playing cards could triple the size, as much as two years). There are a couple of quirks, like if the unique guarantee is longer than 5 years, you might must register the prolonged guarantee with the insurance coverage supplier.

For different points like loss, theft, or unintentional injury not coated by the guarantee, bank cards provide buy safety for a shorter time period, often 90 days.

There are usually limits on the variety of claims you may make, or complete lifetime advantages, per account.

Cell Gadget Safety

Consider this as an enhanced model of buy safety, however particularly for cellphones and tablets.

Most insurance policies cowl your machine for as much as $1,000, for 2 years after buy. That is often primarily based on the depreciated worth of the machine, not the price of repairs or replacements.

An increasing number of bank cards are providing cell machine safety. We use our telephones every day, and for no matter cause they’re extra prone to break. It’s good to see an improved coverage for the very issues that many individuals would really profit from having insured.

Should you purchase your cellphone outright, you have to make the acquisition with the bank card. Should you’re on a contract as a substitute, you have to pay your month-to-month instalments with the bank card, in addition to any upfront price.

Value Safety

Should you purchase an merchandise together with your bank card, and discover it at a lower cost shortly thereafter, you’re eligible to assert the distinction for those who can present proof. Some shops themselves provide a price-matching coverage, however this may be useful for every little thing else.

Maybe as a result of it’s so beneficiant and comparatively simple to assert, value safety shouldn’t be a quite common coverage to see provided by bank cards.

What About Stability Safety Insurance coverage?

Whenever you activate a brand new bank card, many banks provide the possibility to simply accept or decline stability safety insurance coverage. That is utterly totally different than the journey and buy insurance coverage routinely granted to all cardholders.

Stability safety insurance coverage is a small cost you pay every month, in trade for limiting your liabilities in case you’re ever unable to pay your bank card stability. It’s charged as a proportion of the day by day stability of your credit score account, so paying down your assertion early received’t cut back the price.

But it surely simply quantities to an pointless price. You shouldn’t be utilizing a bank card for those who don’t plan on paying your stability in full each month. And you may’t default in your money owed for those who by no means carry a stability, so there’s nothing so that you can insure.

I at all times decline stability safety insurance coverage, and it is best to too! It’s merely not one thing you’ll ever want or profit from.

Conclusion

Whenever you’re excited for an enormous journey, it’s by no means enjoyable excited about what may go flawed in case the worst occurs. But it surely’s higher to be protected than sorry, and it’s essential to concentrate on how you should utilize bank card insurance coverage to navigate points each massive and small.

In case you have an lively bank card technique, it’s helpful to concentrate on how one can construct journey insurance coverage into your award journey system. Remember to evaluation our really useful bank cards for journey insurance coverage on award tickets.