American Categorical has constructed its popularity on delivering distinctive worth to cardholders, or no less than, that’s what they used to do constantly.

Welcome bonuses have change into frustratingly predictable. Sufficient, positive, however hardly the thrilling incentives that after made opening new playing cards really feel worthwhile.

The Amex Affords programme has adopted an analogous trajectory. Whereas it stays superior to rivals, the times of beneficiant, universally accessible promotions are clearly within the rearview mirror.

The unique Store Small with its simple $50 potential? That stage of accessibility feels nearly quaint now.

Nonetheless, dismissing Amex Affords solely could be untimely. The programme continues to ship significant worth for cardholders who perceive learn how to work inside its more and more focused framework.

The secret is adapting your expectations and technique to match immediately’s actuality fairly than pining for the golden age that’s clearly handed.

What Are Amex Affords?

Amex Affords are particular promotions provided to present cardholders.

It’s designed to offer further rewards on high of normal incomes charges and welcome bonuses.

You will get Amex Affords on playing cards that earn all kinds of varieties of rewards, together with Membership Rewards, Aeroplan factors, Bonvoy factors, or money again.

The Construction of an Amex Provide

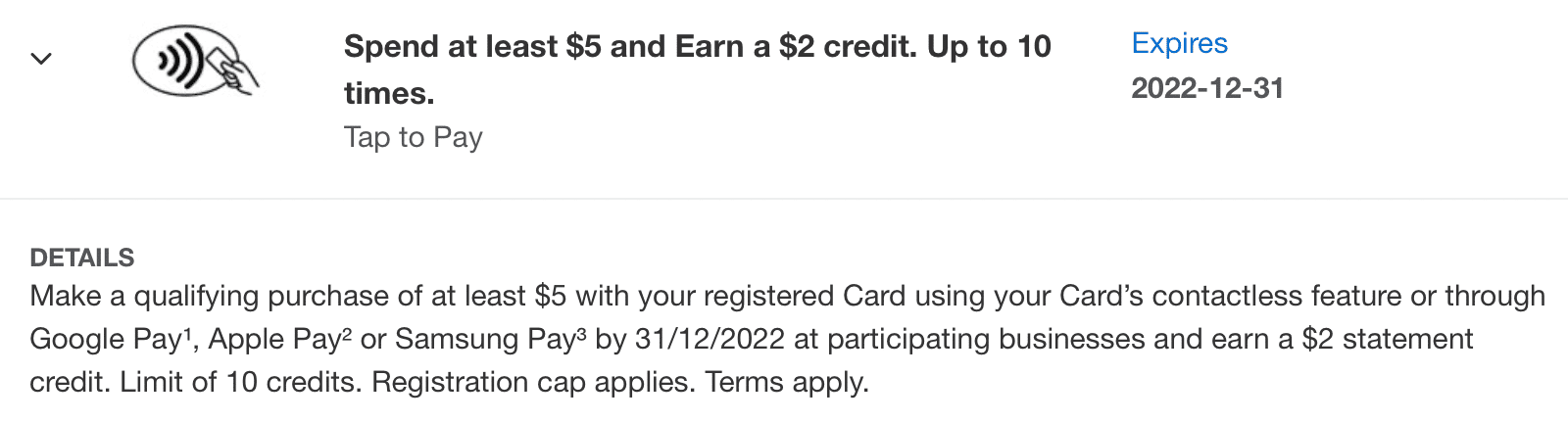

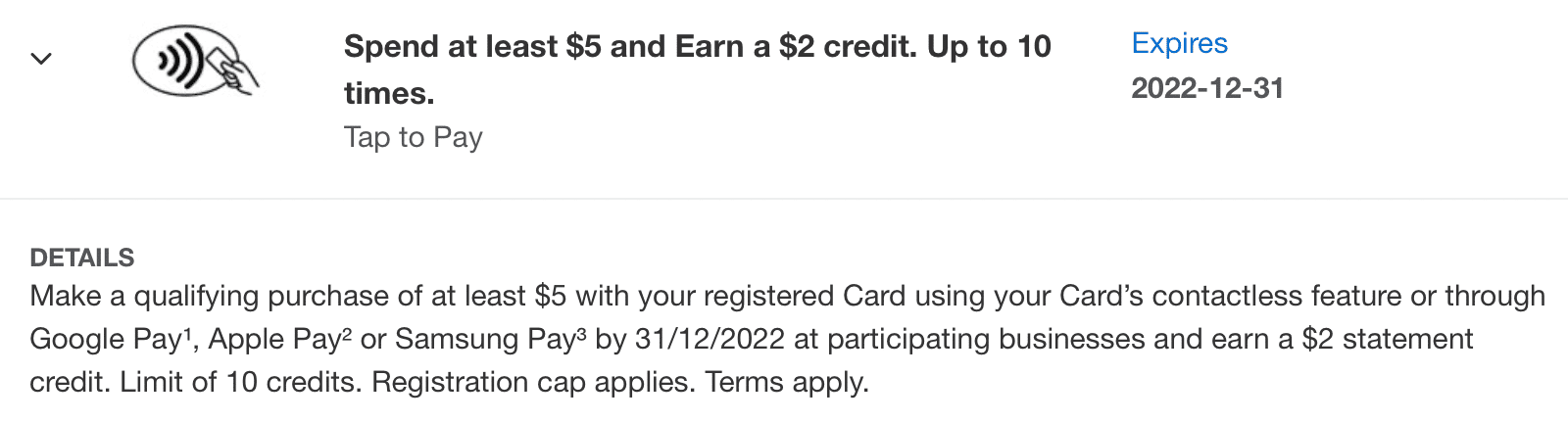

There are two most important methods an Amex Provide’s necessities are structured: lump sum bonuses and boosted earn charges.

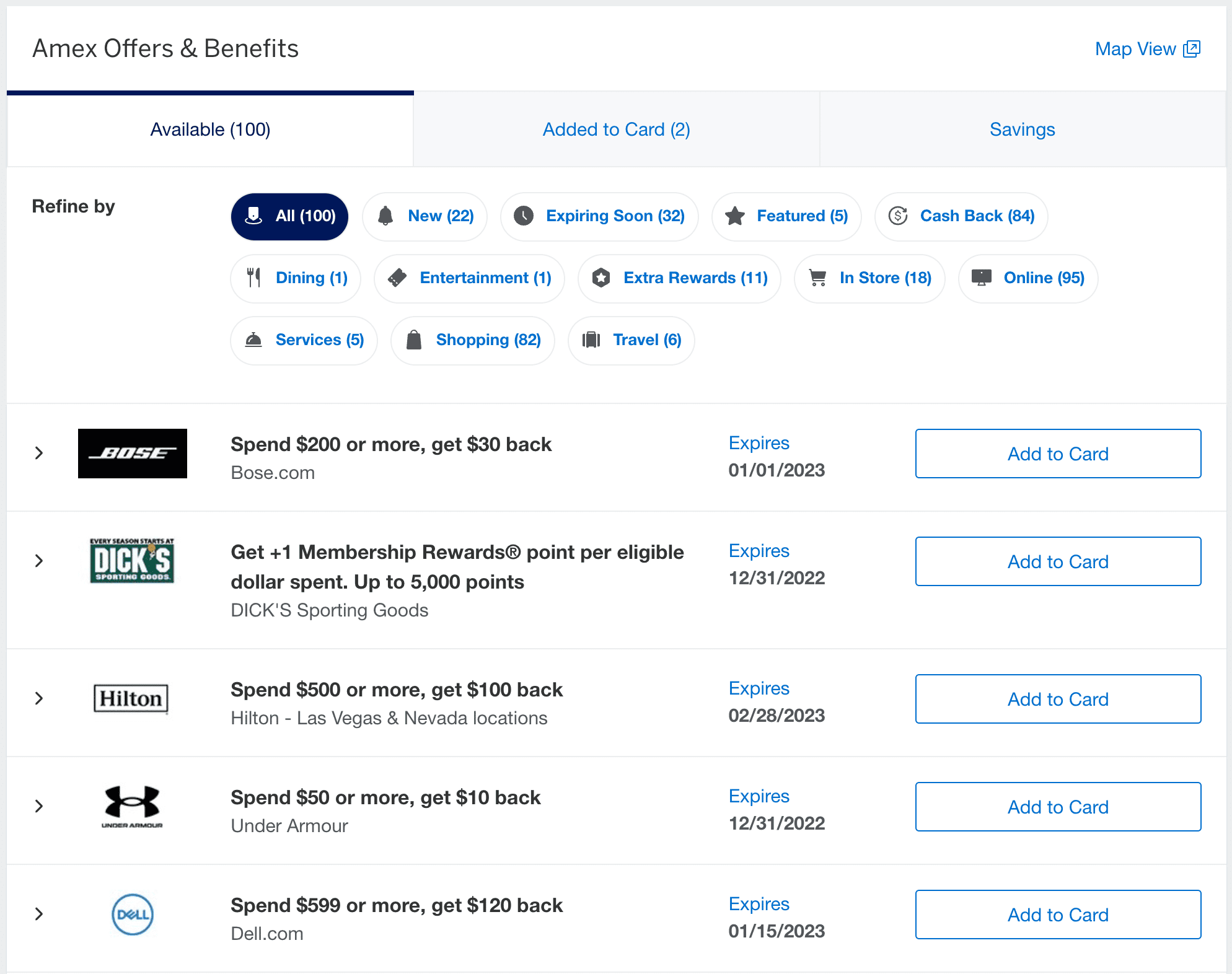

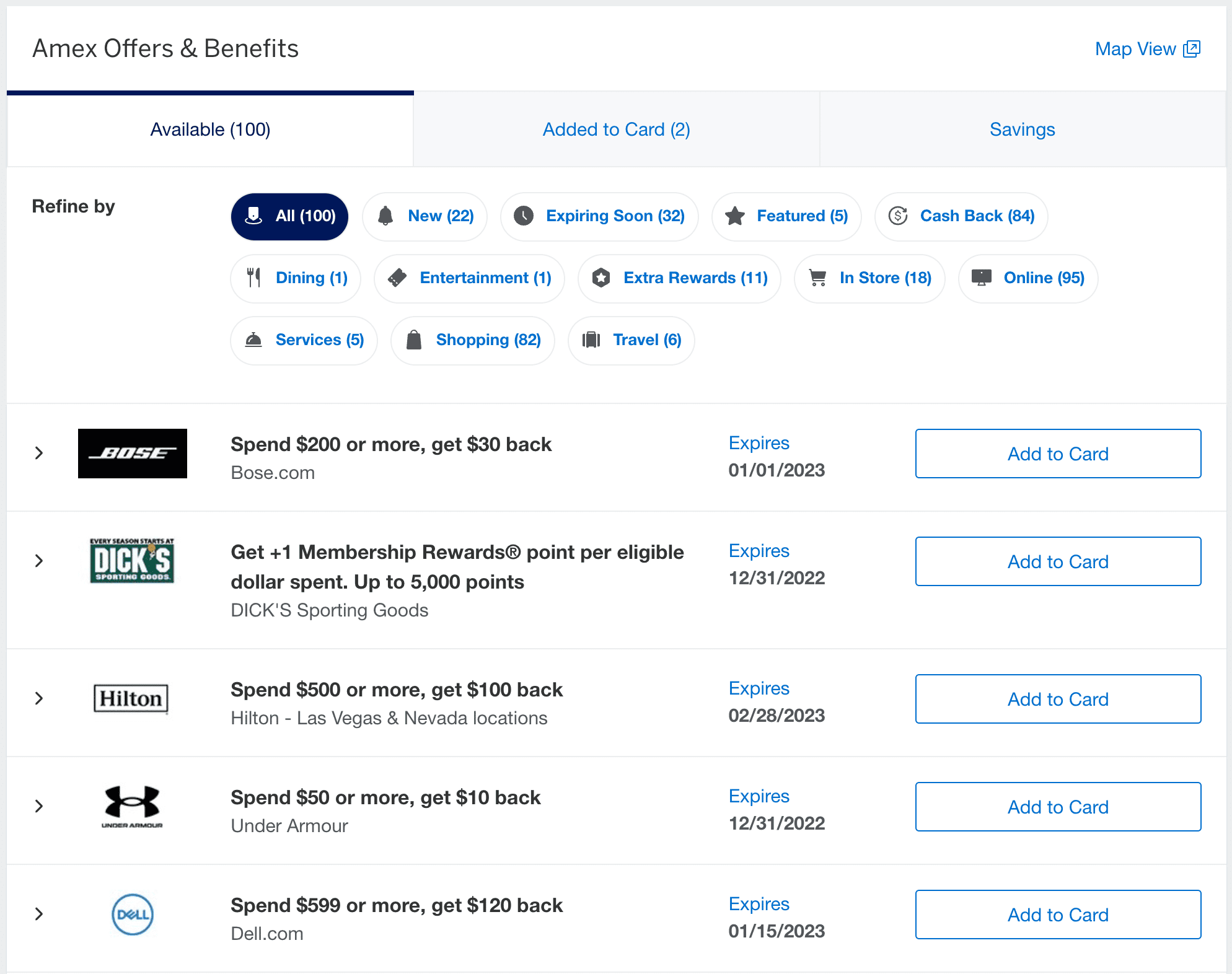

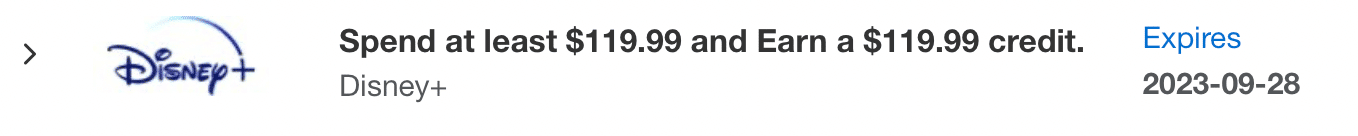

Often known as “Spend X, Get Y,” lump-sum bonuses set off whenever you meet a required spend at an eligible service provider. These can vary from a meagre $5–10 credit score to subsidizing an honest chunk of a purchase order price a whole lot.

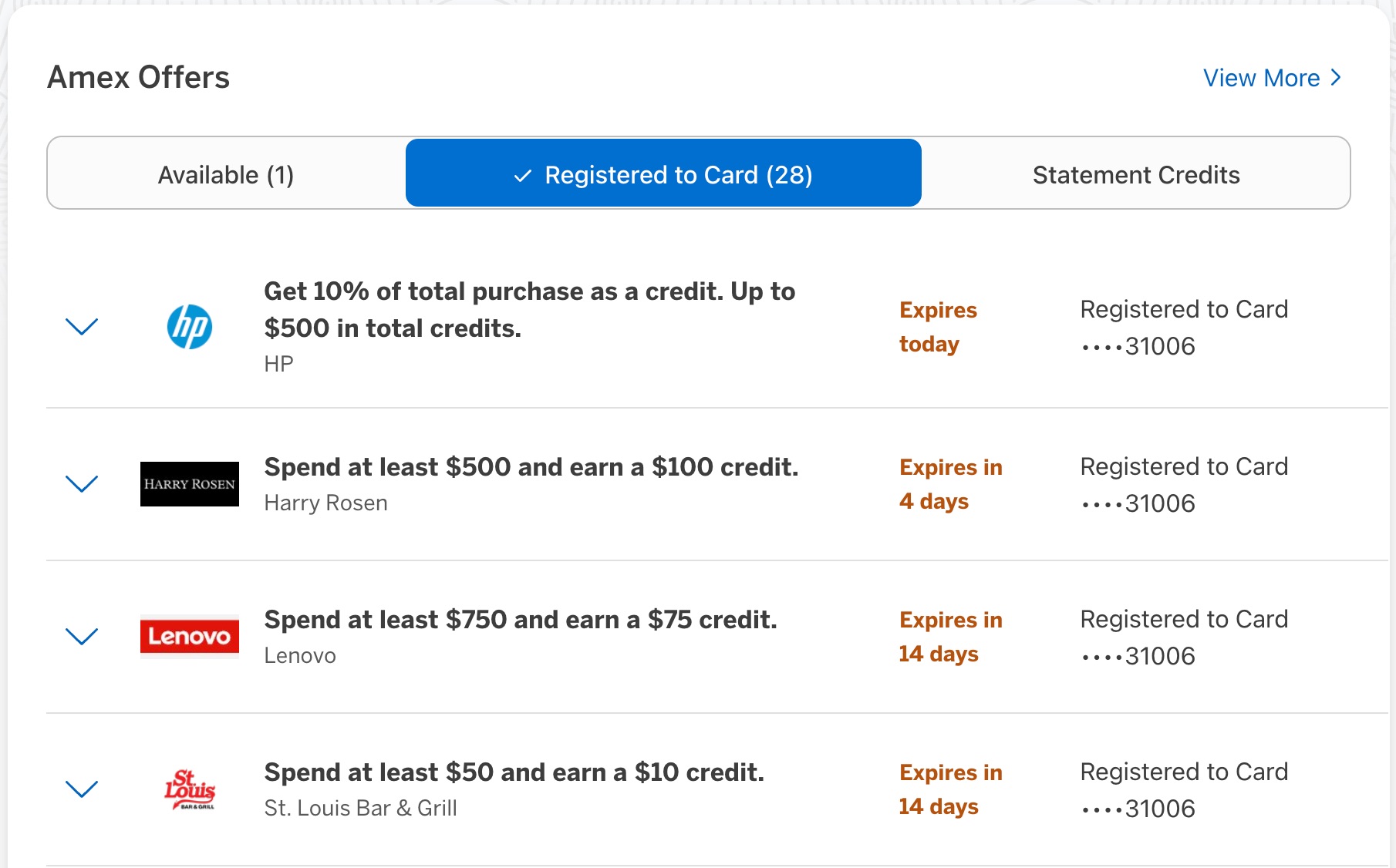

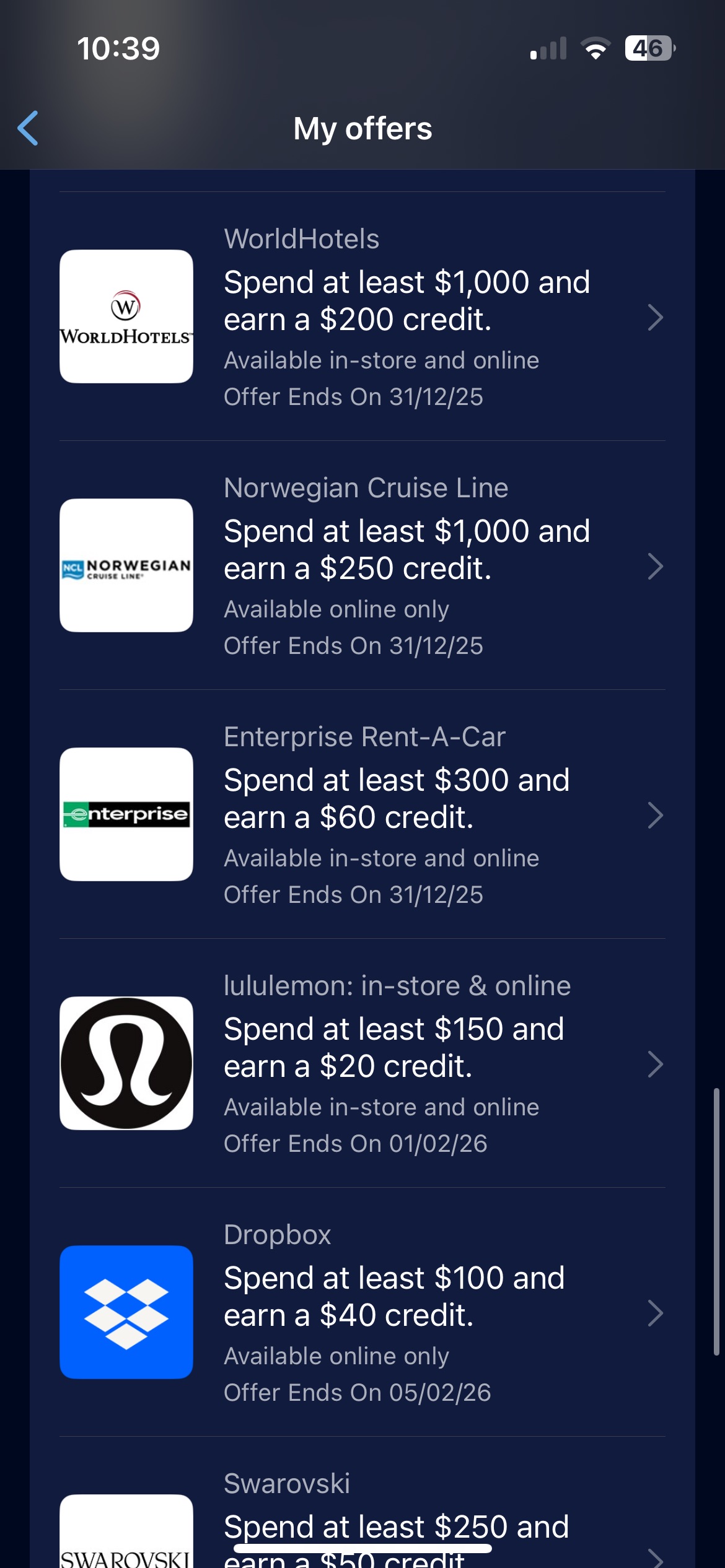

Listed below are a number of examples:

Most gives require the qualifying spend in a single transaction, though some are cumulative and allow you to hit the brink over a number of purchases.

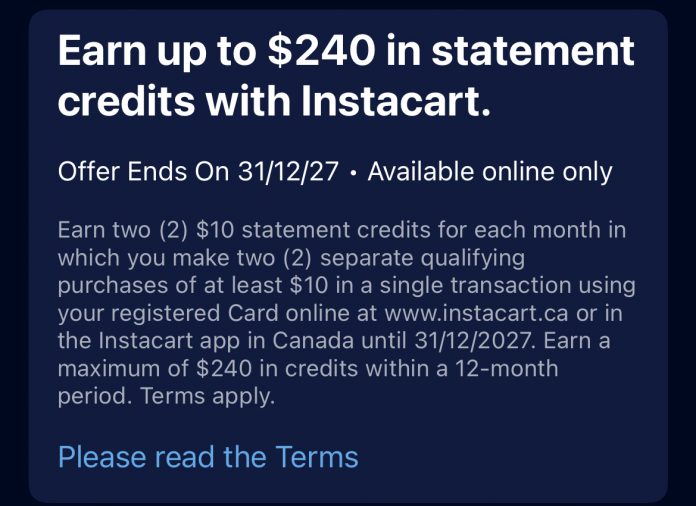

There are additionally generally recurring bonuses, like Store Small or Instacart credit.

These often aren’t cumulative on a single transaction, so you possibly can’t earn two $10 Instacart credit on one $20 buy.

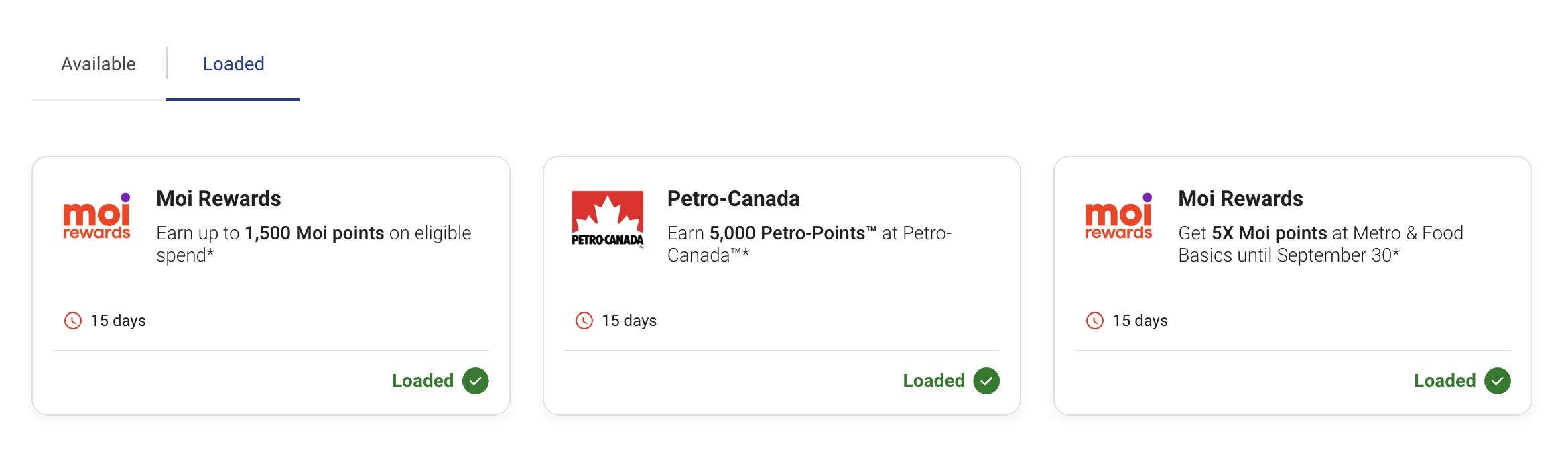

Boosted earn charges work a bit in a different way, paying out a bonus till you attain a set most. Previous examples embrace:

- Enterprise Platinum 10x factors (expired): earn 10 bonus factors per greenback spent on all purchases, as much as 25,000 bonus factors or $2,500 spent

- Amazon 5x factors: earn 5 bonus factors per greenback spent at Amazon, as much as 1,500 bonus factors

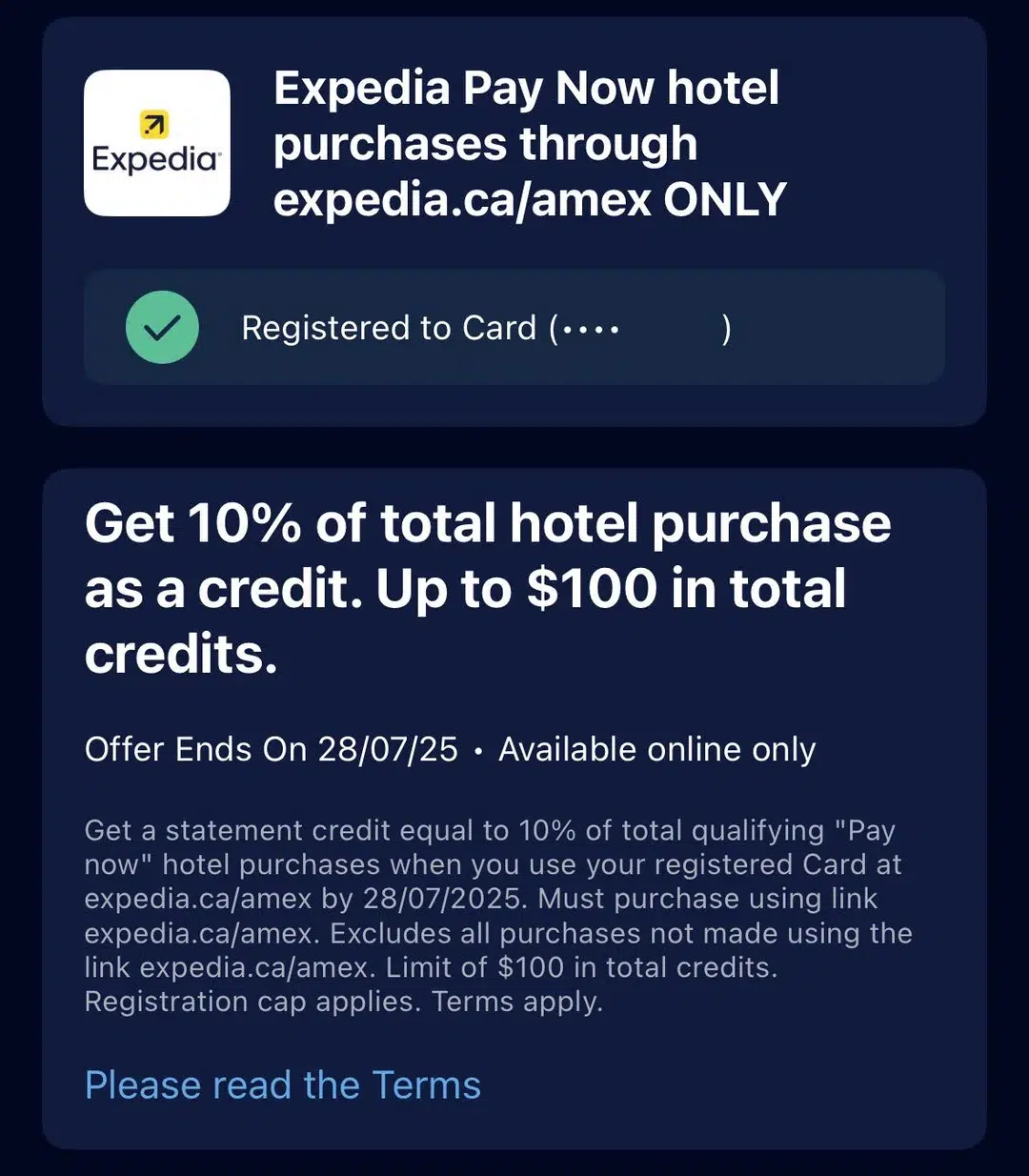

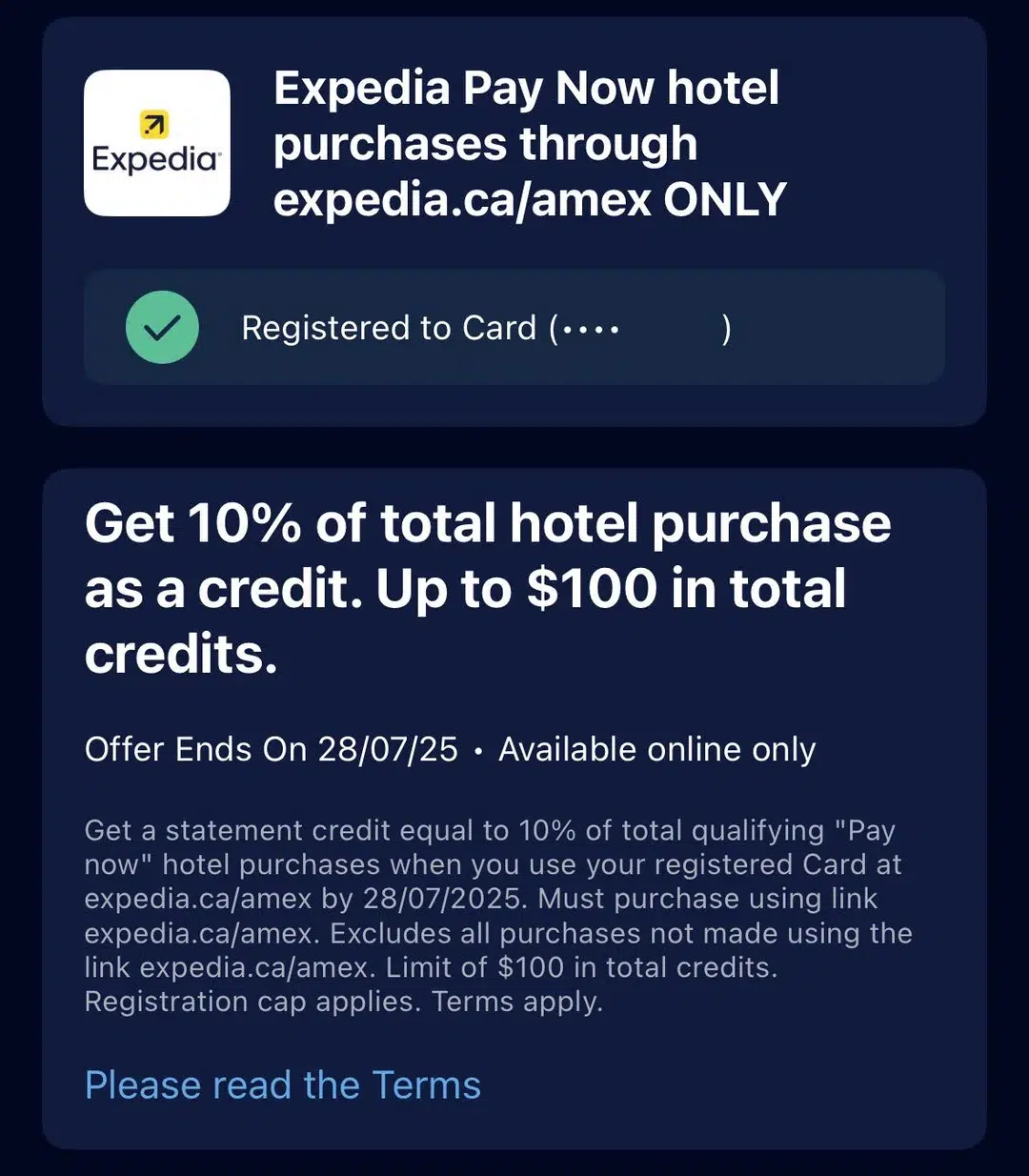

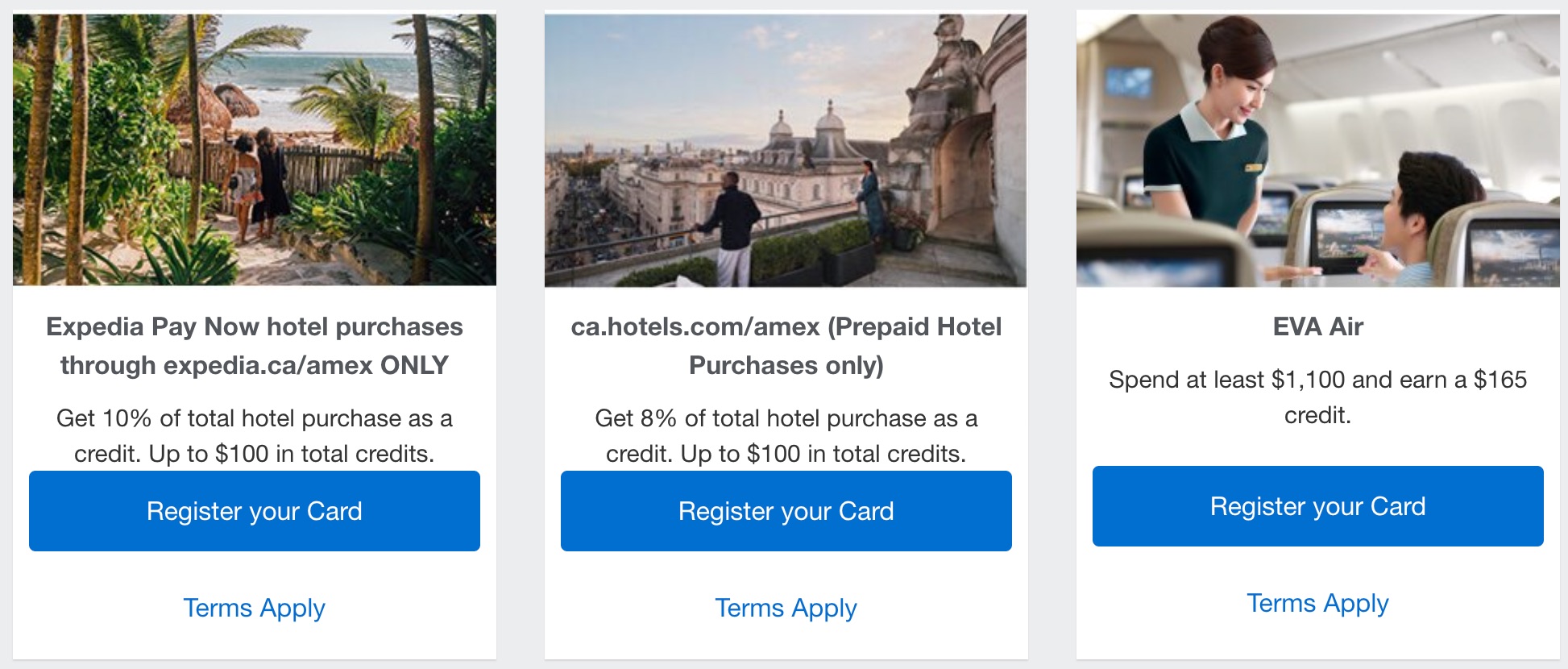

You may additionally see gives for a proportion money again as much as a specified most, such because the Expedia supply.

Every supply might require spending at a selected service provider, inside a service provider class, or wherever. Sometimes, the phrases specify the way you pay (contactless, on-line, or cellular pockets).

As at all times, test the effective print. Affords can have a registration cap, a registration deadline, and a completion deadline.

Generally there’s a particular hyperlink for on-line purchases. Whereas enforcement might be lax, utilizing the hyperlink reduces the prospect of points later.

Who Is Eligible for Amex Affords?

Amex Canada

Some Amex Affords, like Instacart credit, are provided to all cardmembers with a sure product. When the ever-popular Store Small promotion runs, it’s accessible for all cardholders with any Amex card.

Nevertheless, many others are solely provided to focused cardholders. The United Airways $250 credit score and the Marriott Spend $500 get $100 again come to thoughts as two current gives which had been fairly fascinating however sadly appears to be extra focused recently.

The concentrating on algorithm is opaque, nevertheless it positive appears like Amex weighs components similar to your spending patterns, service provider combine, card sort, tenure, and possibly how usually you truly use previous gives.

Different gives could also be accessible on quite a lot of completely different merchandise, however every member may see them on completely different playing cards. For instance, I would get a proposal on my Enterprise Gold Card, whilst you might get the identical one in your Aeroplan Card as a substitute.

In any occasion, Amex Affords often don’t begin to present up on a brand new card till after the primary few month-to-month assertion cycles. There’s no tried and true methodology to get extra Amex Affords, however usually talking, the extra you spend, the extra promotions you’ll obtain.

Amex US

You’ll additionally get Amex Affords in your US bank cards. In actual fact, this system is approach stronger there than in Canada, with as much as 100 gives accessible on every card at any given time.

As a result of they accomplice with shops with a serious American presence, it’s tougher to derive worth from many of those gives except you’re procuring within the US.

As with all issues stateside, phrases and circumstances are typically enforced extra strictly, so that you may battle to, say, use a “.com” supply with an organization’s “.ca” on-line retailer.

As a substitute, hold a watch out for profitable gives with journey suppliers, similar to Marriott, Hilton, cruise strains, and different luxurious resort properties.

In case you’ve heard about a proposal that you really want however which isn’t accessible to you, strive activating a number of gives. Your record of obtainable gives will instantly refill to 100 if there are others accessible, and ideally you’ll be provided the one you’re searching for.

Scotiabank

You probably have a Scotiabank Amex card – issued by Scotiabank however utilizing the Amex fee community – you’re additionally eligible for Amex Affords!

Since Scotiabank playing cards don’t use the Amex Financial institution of Canada on-line interface, there’s a separate touchdown web page to register Amex Affords onto your Scotiabank playing cards.

Not all Amex Affords can be found for Scotiabank cardholders, and never all cardholders are eligible for a similar gives.

Be aware that you could’t register Amex-issued Amex playing cards this manner. In case you weren’t focused for an give you wished, your greatest guess is to hope that the supply is accessible on this web page, and register a Scotiabank Amex as a substitute.

Learn how to Use Amex Affords

You may view your Amex Affords on the primary dashboard of your Amex on-line profile. Scroll down beneath your current transactions and you’ll’t miss it.

You can too entry your Amex Affords via a devoted display screen within the cellular app.

Overview the record of obtainable gives and register those you intend to make use of. Most Amex Affords are opt-in, so clicking “Add to Card” earlier than you spend is the entire recreation.

Generally, Amex can even show different promotions right here which don’t have to be activated, like an idle cardholder profit or a referral bonus that they’re attempting to promote.

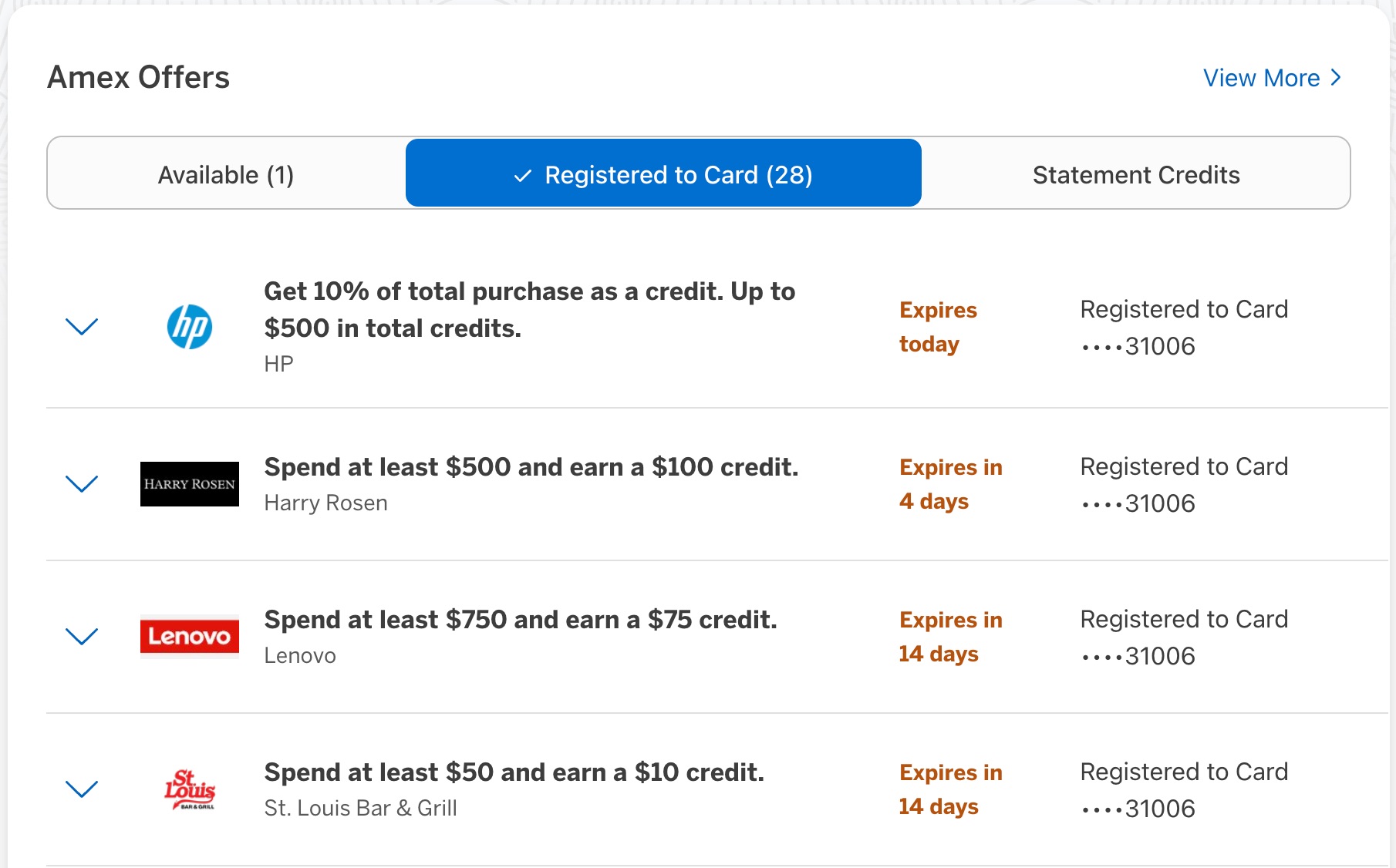

Flip to the “Registered” tab to trace what you’ve already added, spot expiry dates, and plan purchases. As your Amex lineup grows, this tab is your reminiscence.

At all times use the precise card that has the supply connected. Your Platinum received’t set off an Instacart credit score that’s sitting in your Cobalt. I’ve made that mistake greater than as soon as, and no, Amex received’t sympathy-credit it.

You probably have multiple Amex card, navigate between them to see every card’s distinct promotions.

For “Spend X, Get Y” thresholds, assertion credit often put up inside a number of days, even when the phrases say in any other case.

For boosted earn charges, bonus factors put up alongside base factors as soon as the transaction finalizes. Scotiabank-issued Amex credit are likely to take a bit longer to point out up.

As soon as an Amex Provide has been efficiently redeemed, it might keep in your account, disappear out of your account, or transfer to the Assertion Credit tab.

It doesn’t appear to have any bearing on something, and generally it occurs earlier than your bonus arrives. Simply ensure you’ve met the {qualifications} correctly and don’t be alarmed should you don’t obtain your rewards immediately.

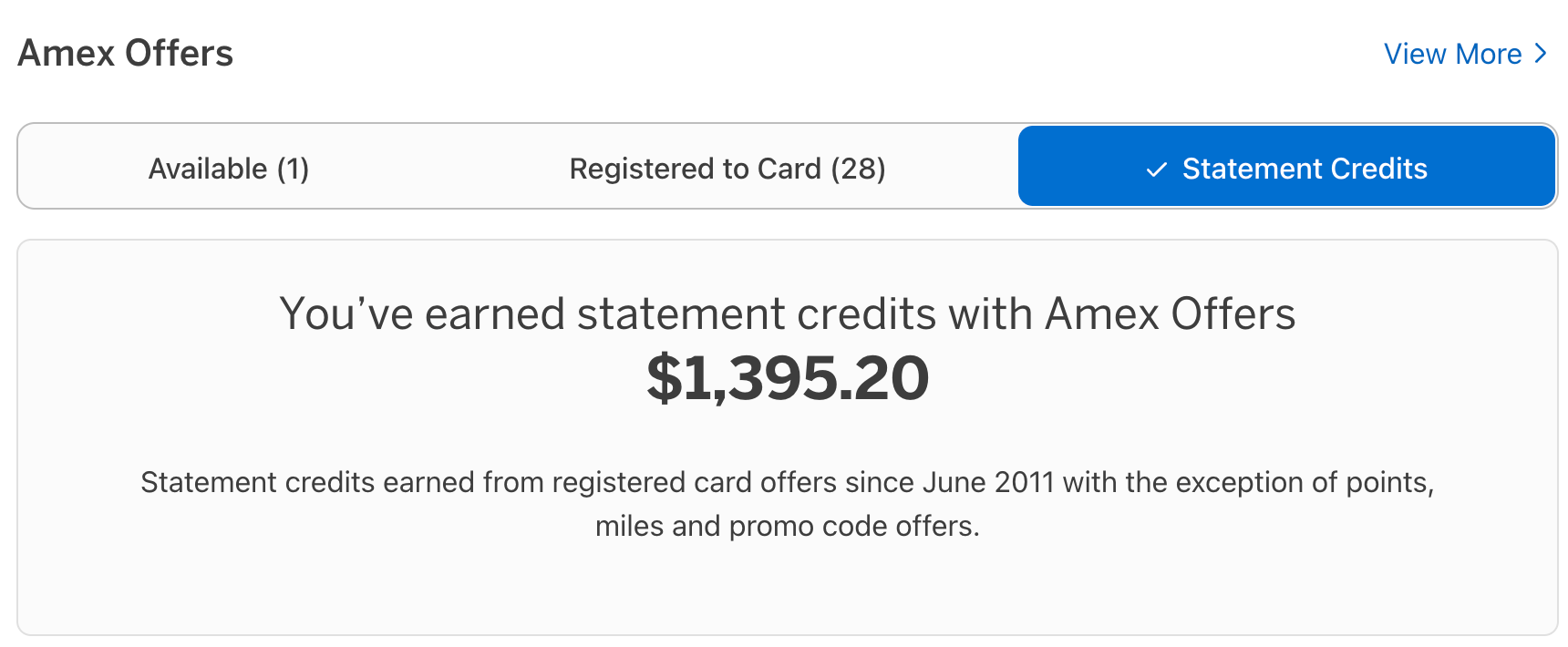

You additionally test to see how a lot you’ve earned from Amex Affords with every card by clicking on the “Assertion Credit” tab.

It’s a helpful intestine test earlier than renewal to resolve if the cardboard remains to be pulling its weight.

Why You Ought to Use Amex Affords

Signup bonuses on new bank cards obtain loads of consideration. They’re quickest approach to earn high-value rewards, and the strongest return each on the annual charges you pay and on the spending you set via the cardboard.

Nonetheless, you possibly can’t construct an entire technique on new playing cards. That’s the place advantages for present cardholders are available in.

You may snag actual way of life worth at a reduction. I picked up a Dell monitor few years in the past, because of an Amex Provide I wouldn’t have in any other case thought of, and I’m nonetheless glad I did.

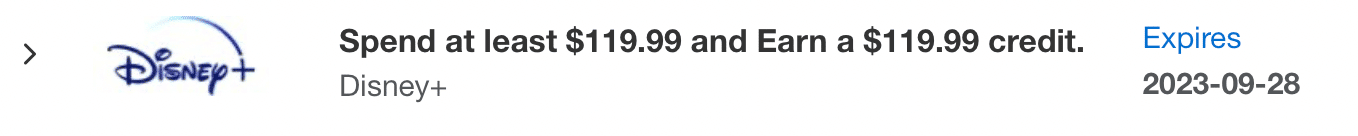

Likewise, when a Disney+ credit score confirmed up, despite the fact that I don’t actually watch a lot TV, I subscribed and gifted it to my little cousin – simple approach to carry pleasure to somebody you’re keen on with out out-of-pocket spend.

Amex’s premium bank cards, together with the Platinum, Enterprise Platinum, and Aeroplan Reserve, reliably get the highest-value and most-flexible Amex Affords.

In case you can anticipate these 12 months after 12 months, you possibly can successfully deal with them as a press release credit score to offset the price of your annual payment. That actually makes it lots simpler to maintain a card with a excessive annual payment long-term for the continued advantages.

Moreover, Amex’s robust ties to Marriott Bonvoy encourage frequent Amex Affords for spending at a Marriott property. This will considerably offset your journey prices, particularly when the worth of resort factors is dropping.

Merely put, hold tabs in your Amex Affords. Whether or not you retain a card long-term or cancel earlier than the second annual payment, there’s no motive to disregard simple worth.

And sure, the well-known “Spend $10, get $5” Store Small period inspired some… creativity. I’ve cut up a tennis racket and a protein powder haul into $10 swipes to max the credit.

It labored and it was enjoyable, but in addition a bit embarrassing and time-consuming. Do it sparingly and off-peak when you possibly can; the larger one-shot gives often do many of the heavy lifting anyway.

For probably the most half, Amex remains to be the one main Canadian financial institution providing significant rewards on particular purchases.

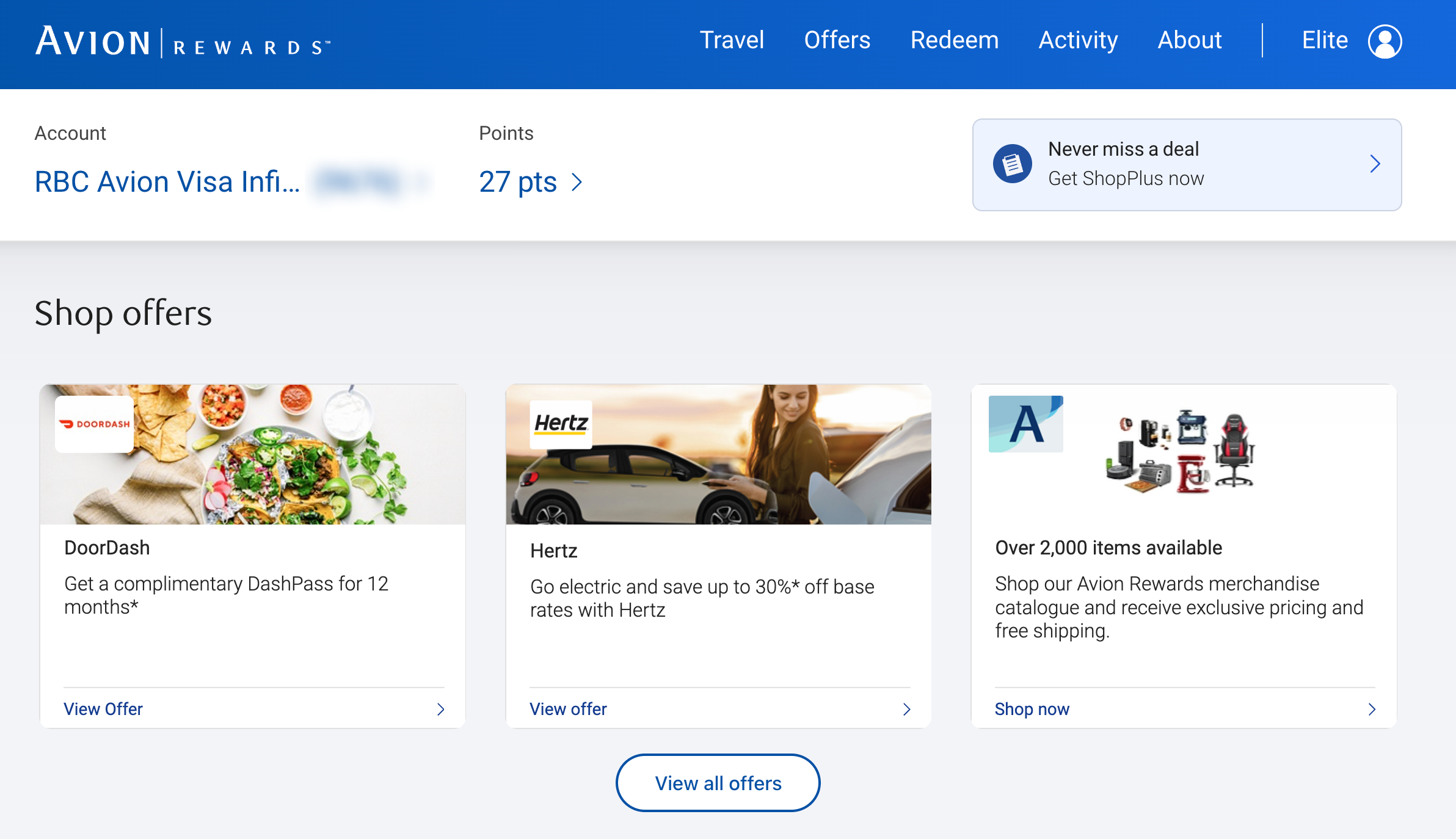

RBC has an analogous idea known as Avion Affords. You’ll discover them underneath the “Affords For You” hyperlink in your card web page or within the Avion Rewards web site and app.

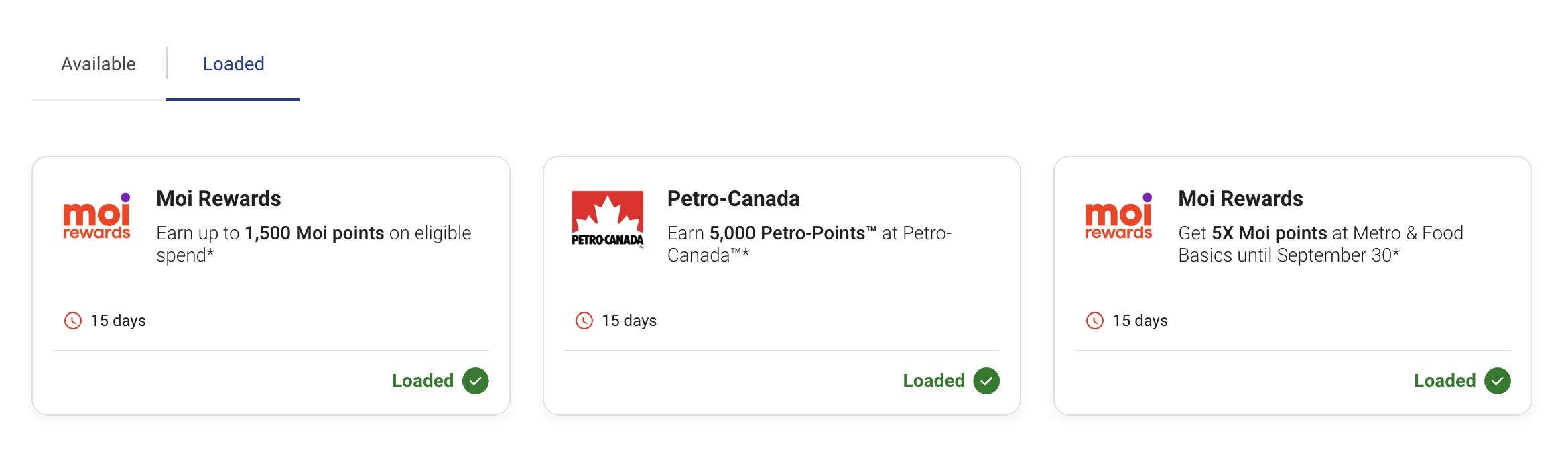

These gives are much like Amex’s, with a mixture of lump sum rewards, further rewards per greenback spent, and particular partnerships (similar to a complimentary DoorDash DashPass). Some gives are routinely registered, whereas others are opt-in.

Nevertheless, RBC doesn’t have as many money again gives, and the worth of the kickbacks is often orders of magnitude lower than what Amex gives.

In my expertise, standouts have included credit with HP, Microsoft, and Sporting Life; extra generally, you’ll see modest bumps at on a regular basis spots like Metro, Meals Fundamentals, Petro-Canada, and Rexall.

Previously, we’ve additionally seen Air Canada mimic Amex Affords on their co-branded playing cards with TD and CIBC. In the summertime of 2021, Air Canada had a “Spend X, Get Y” supply for money rebates on Air Canada purchases.

Registration was carried out through Aeroplan, not the banks, as we see a better integration of loyalty packages with bank cards.

Smaller fintech startups like Brim and Neo have made partner-based bonuses the muse of their rewards packages. I’m lukewarm at greatest in direction of the idea, although it appears to be the favored strategy among the many innovators within the funds area.

Hopefully these and different packages will take cues from Amex and ship actual worth to their members, similar to excessive rebates with interesting manufacturers or 100% rebates for generalized purchases.

Conclusion

Amex Affords are one more smart way that American Categorical gives significant worth for its members.

They arrive in all sizes and shapes, and any cardholder needs to be looking out for these further methods to squeeze a bit extra worth out of their bank card technique.

Whereas immediately’s gives are extra focused and fewer beneficiant than years previous, no different Canadian financial institution matches the depth or frequency; used properly, they could be a robust motive to maintain your Amex playing cards long-term.