American Specific has nice provides accessible on its duo of premium Aeroplan co-branded bank cards – the American Specific Aeroplan Reserve Card and the American Specific Aeroplan Enterprise Reserve Card – with as much as 130,000 and 140,000 Aeroplan factors up for grabs, respectively.

This time, the elevated provides come paired with equally elevated minimal spending necessities; nevertheless, you’ll be handsomely rewarded in your efforts.

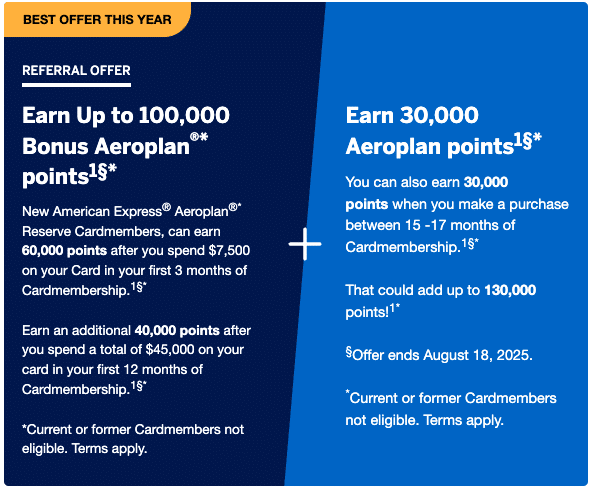

American Specific Aeroplan Reserve Card: 130,000 Aeroplan Factors!

The American Specific Aeroplan Reserve Card, Amex’s flagship premium Aeroplan co-branded card, comes with a welcome bonus of as much as 130,000 Aeroplan factors. That is the second highest supply we’ve seen on the cardboard since its debut in 2020.

With the present supply, the factors are distributed as follows:

- Earn 60,000 Aeroplan factors upon spending $7,500 within the first three months

- Earn 40,000 Aeroplan factors upon spending $45,000 within the first 12 months

- Earn 30,000 Aeroplan factors upon making a purchase order in months 15–17

The entire minimal spending requirement of $45,000 within the first 12 months works out to a median of $3,750 per 30 days.

At Prince of Journey, our favorite instrument to pair with minimal spending necessities is Chexy, a Canadian platform that lets you pay a bunch of payments – together with lease, tuition, utility payments, automotive lease funds, property taxes, and rather more – with a bank card and earn factors.

There’s a 1.75% processing price for every fee (which will be additional diminished by referring associates to Chexy), however when you think about the worth of the factors you earn from spending and welcome bonuses, it’s straightforward to justify.

The cardboard has an annual price of $599, and it comes with plenty of different perks, together with SQM rollover advantages, an additional 12 months of eUpgrade validity, the Annual Worldwide Companion Go, most well-liked pricing reductions on Aeroplan redemptions, robust insurance coverage, and a few compelling Amex Affords all year long to additional offset in opposition to your annual price.

By way of the returns on on a regular basis spending, the American Specific Aeroplan Reserve Card provides the next three-tiered construction:

- 3 Aeroplan factors per greenback spent on Air Canada and Air Canada Holidays

- 2 Aeroplan factors per greenback spent on eating and meals supply

- 1.25 Aeroplan factors per greenback spent on every little thing else

It’s value noting that the 3x incomes fee on Air Canada purchases is the best amongst Canadian Aeroplan co-branded bank cards. In case you’re a frequent flyer, that is the perfect card to make use of for getting Air Canada flights.

This supply is legitimate by way of to August 18, 2025, so you’ll want to apply earlier than then in case you’re eligible. There’s no minimal earnings requirement to be eligible to use.

American Specific Aeroplan Reserve Card

- Earn 60,000 Aeroplan factors upon spending $7,500 within the first three months

- Plus, earn an extra 40,000 Aeroplan factors upon spending $45,000 within the first 12 months

- And, earn 30,000 Aeroplan factors upon making a purchase order in months 15–17 as a cardholder

- At all times earn 3x Aeroplan factors on Air Canada purchases and 2x Aeroplan factors on eating and meals supply

- Aeroplan most well-liked pricing, free first checked bag, precedence check-in and boarding on Air Canada flights

- Limitless Air Canada Maple Leaf Lounge entry in North America

- Bonus Aeroplan factors for referring household and associates

- No minimal earnings requirement

- Annual price: $599

Amex Aeroplan Enterprise Reserve Card: 140,000 Aeroplan Factors!

The American Specific Aeroplan Enterprise Reserve Card is providing the next variety of factors than its private counterpart, albeit paired with increased spending necessities.

Whenever you apply for the cardboard, you may earn as much as 140,000 Aeroplan factors, structured as follows:

- Earn 65,000 Aeroplan factors upon spending $10,500 within the first three months

- Earn 45,000 Aeroplan factors upon spending $75,000 within the first 12 months

- Earn 30,000 Aeroplan factors upon making a purchase order in months 15–17

The entire minimal spending requirement of $75,000 within the first 12 months works out to a median of $6,250 per 30 days.

That is the second-highest welcome supply that we’ve seen on the cardboard since its debut in 2020.

The cardboard comes with lots of the identical advantages and options because the Amex Reserve card, together with the power to earn 1,000 Standing Qualifying Miles (SQM) and 1 Standing Qualifying Phase (SQS) per $5,000 spent on the cardboard.

In case you are inclined to have a excessive quantity of spending, you may simply quick monitor your strategy to assembly a number of the necessities for Aeroplan Elite Standing, after which you may plan out your paid flights to fulfill the Standing Qualifying {Dollars} (SQD) requirement in a extra predictable method.

Plus, the SQM that you simply earn rely in the direction of Threshold Rewards, which might supply profitable advantages to Air Canada frequent flyers (together with the power to earn a banked 12 months of top-tier Tremendous Elite standing and extra).

By way of the returns on on a regular basis spending, the American Specific Aeroplan Enterprise Reserve Card provides the next three-tiered construction:

- 3 Aeroplan factors per greenback spent on Air Canada and Air Canada Holidays

- 2 Aeroplan factors per greenback spent on motels and automotive leases

- 1.25 Aeroplan factors per greenback spent on every little thing else

This supply can also be legitimate by way of to August 18, 2025, so you’ll want to apply earlier than then in case you’re eligible.

American Specific Aeroplan Enterprise Reserve Card

- Earn 65,000 Aeroplan factors upon spending $10,500 within the first three months

- Plus, earn 45,000 Aeroplan factors upon spending $75,000 within the first 12 months

- And, earn 30,000 Aeroplan factors upon making a purchase order in months 15–17

- Additionally, earn 3x Aeroplan factors on Air Canada purchases and 2x Aeroplan factors on motels and automotive leases

- Aeroplan most well-liked pricing, free first checked bag, precedence check-in and boarding on Air Canada flights

- Limitless Air Canada Maple Leaf Lounge entry

- Bonus Aeroplan factors for referring household and associates

- Qualify for the cardboard as a sole proprietor

- Annual price: $599

American Specific Aeroplan Card: 40,000 Aeroplan Factors

Whereas the premium Aeroplan playing cards naturally have the best accessible bonuses, the American Specific Aeroplan Card shouldn’t be missed.

Presently, the cardboard is providing as much as 40,000 Aeroplan factors for brand new candidates, which could possibly be a cheaper strategy to pad your Aeroplan steadiness than premium playing cards, because it doesn’t include a hefty annual price.

Whenever you apply for the cardboard, you’ll eligible to earn the next:

- 30,000 Aeroplan factors upon spending $3,000 within the first three months as a cardholder

- 10,000 Aeroplan factors upon spending $1,000 in month 13 as a cardholder

Certainly, the enchantment of the Amex Aeroplan Card is the decrease annual price, making this supply a strong selection for anybody whose bank card technique revolves round preserving annual charges low and manageable.

Moreover, the Amex Aeroplan Card is a cost card, not a bank card. In contrast to the Reserve and Enterprise Reserve, that are bank cards, it doesn’t affect Amex’s restrict of holding 4 bank cards per individual at a time.

In case you’re already tight in opposition to the cap, the core Aeroplan Card could be a good way to pad your Aeroplan steadiness with out going over your restrict.

There’s no listed expiry date for this supply, so you’ll want to make the most of it sooner quite than later if it is smart for you.

American Specific Aeroplan Card

- Earn 30,000 Aeroplan factors upon spending $3,000 within the first three months

- Plus, earn an extra 10,000 Aeroplan factors if you spend $1,000 in month 13

- At all times earn 2x Aeroplan factors on Air Canada purchases

- Aeroplan most well-liked pricing, free checked bag on Air Canada flights

- Bonus Aeroplan factors for referring household and associates

- Annual price: $120

Conclusion

American Specific has nice welcome provides out on the American Specific Aeroplan Reserve Card and American Specific Aeroplan Enterprise Reserve Card, value as much as 130,000 and 140,000 factors, respectively.

On each playing cards, you’ll have to satisfy a big minimal spending requirement over the course of the primary 12 months; nevertheless, you’ll be rewarded in your efforts.

Then again, the American Specific Aeroplan Card has a smaller welcome bonus, nevertheless it’s paired with a smaller spending requirement and a a lot decrease annual price.