Apart from bank card welcome bonuses, maximizing your return on every day spending, after which maybe some superior manoeuvres, one further methodology to accumulate loyalty factors in some circumstances is by outright shopping for them from the loyalty program.

Whereas it doesn’t fairly have the identical satisfying feeling of “travelling for nearly free” that you simply would possibly get from a number of the different methods to earn factors, and it’s not going to be a technique that works always, a circumstance could come up wherein buying factors may very well be , if not excellent, deal.

Most of those conditions depend on airways and lodges placing on promotions that permit you to buy factors at a reduction from the common charge, and these promotions come and go often, with their durations various from as little as a couple of days to a complete month.

Let’s have a look at a couple of conditions wherein it would make sense to purchase factors outright, and hopefully you’ll be capable to apply this evaluation subsequent time you obtain certainly one of these particular presents in your inbox.

1. Purchase Factors to High Up Your Account for a Redemption

Think about that you simply’ve deliberate out a significant redemption with a sure loyalty program, however you’re simply shy of getting sufficient miles to ebook it.

You’ve discovered your required routing, positioned all of the award availability, and arrange the remainder of your journey to completely align with these flights. All you’re lacking is that closing couple hundred or couple thousand miles earlier than you’ll have sufficient to ebook the entire thing.

If it’s a program like Aeroplan the place you possibly can immediately switch over your Amex MR factors to top-up, then that will be the most suitable choice. In any other case, if there’s no fast and straightforward resolution to earn that further small quantity of miles, then it might be in your greatest curiosity to buy them outright, because you’d (presumably) nonetheless be getting nice worth in your redemption even when it’s important to spend some cash.

And even in the event you’re nonetheless means off having sufficient miles for a significant redemption, shopping for these further miles to make the journey occur can nonetheless be a viable choice in comparison with the choice of paying money out-of-pocket.

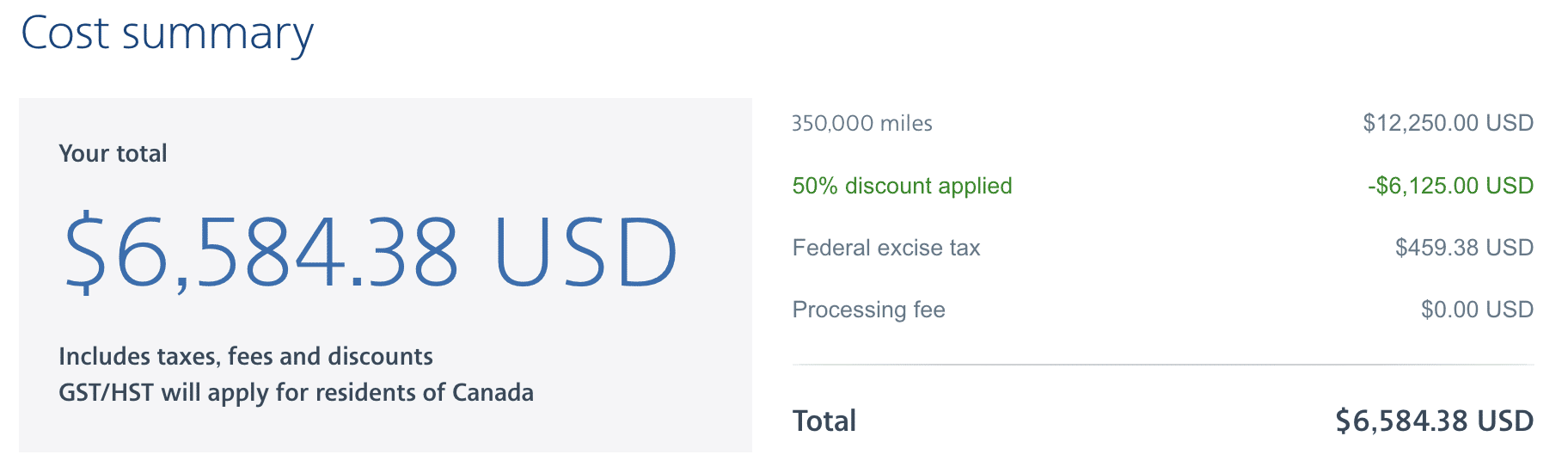

For instance, take into account American Airways AAdvantage, which often means that you can purchase miles throughout a sale. On either side of the border, coming throughout AAdvantage miles will be tough, because the switch ratio from RBC Avion isn’t ideally suited and there aren’t many different switch companions.

If you happen to’re simply shy of getting sufficient miles for a redemption on, say, Qatar Airways Qsuites or Qantas First Class, it might be very worthwhile to think about topping up your account.

Ideally, there’s a suggestion accessible for when you could purchase factors, which might simply wind up saving you some cash ultimately. If that is so, then topping up your account turns into much more engaging.

In any other case, you’ll must pay the prevailing charge, which is often 3.5 cents per level (USD).

Now, buying factors at this charge normally isn’t deal. Nevertheless, when you have a compelling use of AAdvantage miles wherein you’re assured of getting greater worth than 3.5cpp, then that’d be a distinct story.

For instance, in the event you have been simply shy of miles for a Qsuites redemption, you would prime up your account and nonetheless be getting outsized worth out of your factors. The opposite choice of paying money for the flight is nearly definitely going to be astronomically greater, so topping up your account is probably going the most suitable choice.

After all, this instance depends on the loyalty account holder already having an present stability of miles, so it’s not essentially generalizable to everybody’s scenario.

However, it demonstrates an occasion wherein, given an present want to ebook a sure flight and the in any other case prohibitive money costs, it could make good sense to take up American Airways AAdvantage’s supply to purchase miles, particularly at a reduction from the usual worth.

2. Purchase Factors to Save Cash on Premium Flights

The above instance assumes that you’ve an present stability with a sure loyalty program, and that you simply’re shopping for factors to make up the distinction for a selected utilization of the factors. Nevertheless, what in the event you’re fully new to a loyalty program and haven’t even collected a single level but? Would it not nonetheless make sense to purchase factors?

Relying in your journey habits, it definitely might. Particularly, in the event you’re somebody who’d in any other case pay money for premium class flights or five-star lodges and resorts, then it would properly be deal to purchase factors at a reduction and use these factors to ebook your required flight, as an alternative of paying the total retail charge.

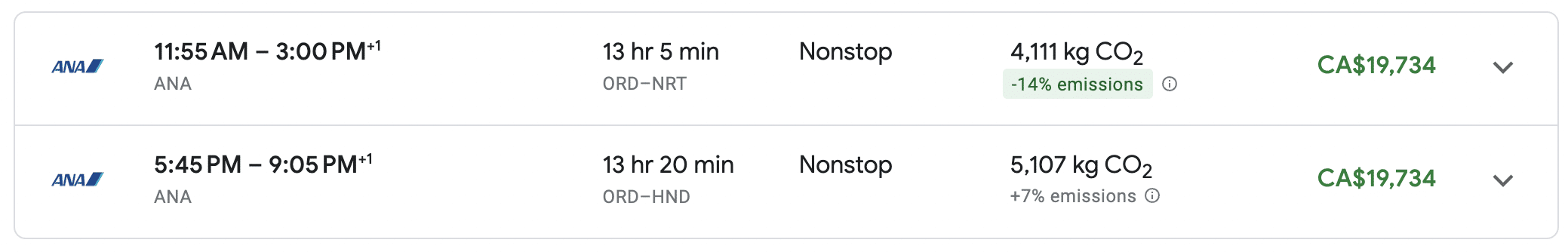

Take the instance of Virgin Atlantic Flying Membership, which has some very well-known candy spots in premium cabins. Specifically, ANA First Class and ANA enterprise class are a number of the most compelling makes use of of Virgin Factors.

A one-way flight from the US to Japan in ANA First Class comes with a hefty price ticket – one which most individuals wouldn’t pay for out-of-pocket.

Nevertheless, in the event you purchase sufficient Virgin Factors throughout certainly one of Virgin Atlantic’s promotions to cowl the price of an ANA First Class flight, you’d solely must spend round $1,335 (USD), which is a big low cost in comparison with shopping for a full-fare First Class ticket.

We are inclined to see promotions a couple of instances all year long, so in the event you’ve had your eyes set on an expensive flight to Japan, preserve an eye fixed out for a suggestion after which be able to act.

After all, you’ll must make it possible for there’s award availability in your desired flights earlier than you pursue this technique, so it’s greatest to verify for availability first earlier than making a significant factors buy like this.

3. Purchase Factors to Save Cash on Premium Inns

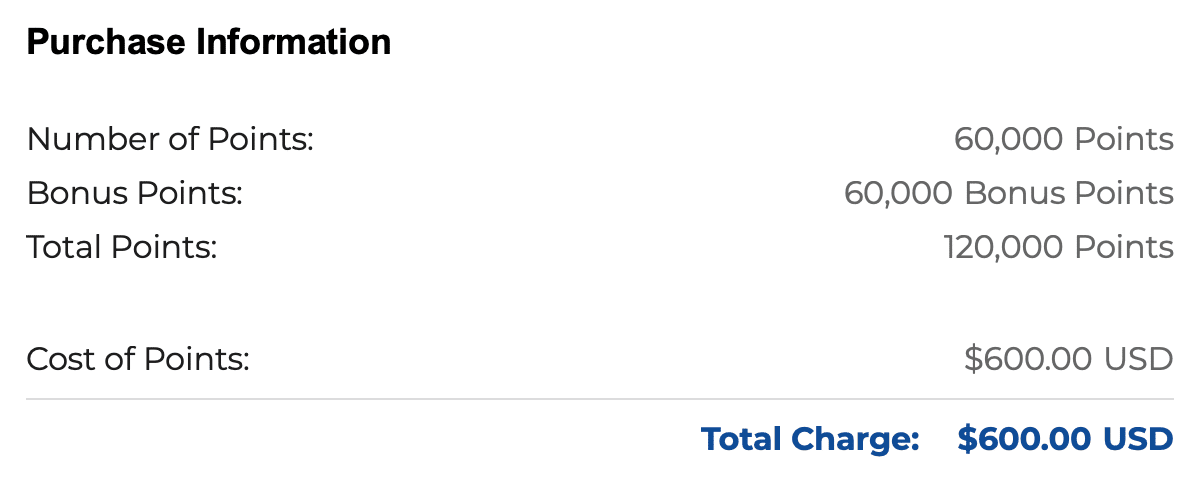

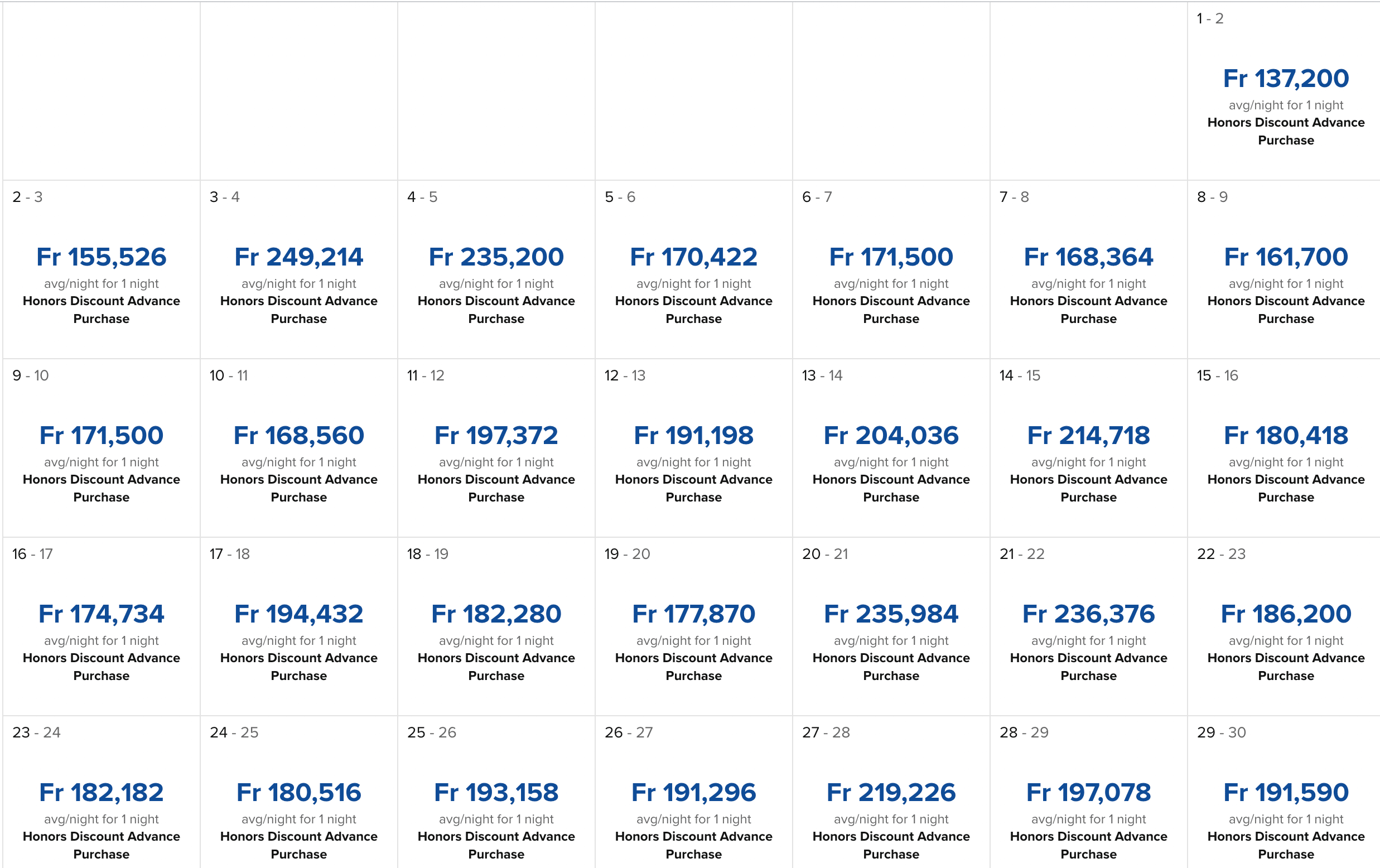

The same thought additionally works properly with luxurious lodges and resorts. Let’s check out Hilton Honors’s recurring 100% bonus promotion, which tends to run all through many of the 12 months.

Hilton often sells factors at 1 cent per level (USD), however with this promotion, they’re promoting factors at 0.5 cents per level (USD).

If you happen to needed to remain on the Conrad Bora Bora Nui, a free evening would price you 120,000 Hilton Honors factors. Due to this fact, you would buy 60,000 factors underneath this promotion and get Hilton to match it, which might be sufficient for one evening on the Conrad Bora Bora Nui for less than $600 (USD).

Certainly, that’s nonetheless a big splurge. However in comparison with retail charges, it’s a fairly good-looking low cost. (Notice that 100,000 XPF is equal to round $900 USD).

However it could truly get even higher, if we tie it again to the primary instance of shopping for factors to prime up your account. Let’s say you’ve been buying the US-issued Amex Hilton bank cards, and have already gathered a wholesome 320,000 Hilton Honors factors.

Now in the event you have been to purchase 80,000 factors underneath the promotion and get Hilton to match the extra 80,000, you’ll have sufficient factors for not 4, however 5 nights on the Conrad Bora Bora Nui, as a result of Hilton presents a Fifth Evening Free profit on factors redemptions.

In order that $800 (USD) outlay goes in the direction of further nights at among the best resorts in Bora Bora. If you happen to’re the kind to make use of your factors for aspirational once-in-a-lifetime journeys, then the chance to purchase factors underneath profitable promotions to succeed in your targets shouldn’t be ignored.

As with shopping for factors for aspirational flights, you must make sure you find award availability prior to creating a factors buy, after which act shortly to safe your reservation.

4. Purchase Factors to Entry Factors Currencies That Are More durable to Earn

Shopping for factors will also be a helpful method to earn factors in packages that don’t supply one other handy method to rack up a big stability.

For instance, World of Hyatt is understood for providing high-value resort redemptions at its luxurious properties, however this system doesn’t have a Canadian-issued co-branded bank card.

(It’s definitely doable to undergo the method of getting US bank cards and ultimately making use of for a Chase Hyatt bank card, however that’s a laborious course of that may take a number of years’ time.)

If you happen to’d wish to lock in a high-value Hyatt factors redemption extra imminently, you possibly can take into account shopping for Hyatt factors throughout certainly one of their frequent factors gross sales.

This lets you earn as much as 55,000 factors per 12 months per account just by buying them from this system, and you’ll reliably redeem these factors for greater than their acquisition worth to attain some good reductions on Hyatt’s top-tier lodges.

5. Purchase Factors on a Speculative Foundation, Sparingly

One query which may come to thoughts is “Must you purchase factors and not using a redemption in thoughts?”

Whereas it might be tempting to purchase some factors after they’re on sale, it’s nearly by no means a good suggestion to take action in the event you don’t have a selected plan for utilizing these factors inside, say, the subsequent 6–12 months.

You might need a dream journey brewing at the back of your thoughts, but when the supply doesn’t work out or there’s a devaluation to this system’s award chart, your miles may not find yourself getting used as you had initially deliberate.

In some instances, you possibly can benefit from a limited-time supply to purchase factors at far decrease than their goal worth. Every time this occurs, you might have an opportunity at scoring an impressive deal on a higher-value redemption sooner or later.

For instance, in July 2025, Aeroplan factors have been being offered with a 110% bonus. The efficient buy worth grew to become 1.88 cents per level (CAD), which is way decrease than our valuation of Aeroplan factors at 2.1 cents per level (CAD).

In instances similar to these, some Aeroplan members could be snug with taking a chance by shopping for factors and not using a particular use in thoughts. In the event that they’re in a position to then apply these factors at the next worth, then the result’s optimistic – however there’s no assure of that end result when making the preliminary speculative buy, which is why it’s a chance on the finish of the day.

The Logistics of Shopping for Factors

If you happen to’re fascinated with buying factors, make sure you preserve a couple of issues in thoughts concerning the precise course of itself.

First off, in the event you’re shopping for factors from a US-based loyalty program, like American Airways AAdvantage or Atmos Rewards, you then’ll normally be hit with gross sales taxes in the event you enter a Canadian billing handle through the check-out course of.

As you possibly can think about, this will shortly eat into the already tightened worth that you simply’re getting from shopping for factors within the first place. Fortunately, the best way round that is easy: use a US bank card and a US billing handle to purchase factors from these packages.

One other consideration is which bank card you must use when buying factors, and the reply will rely on which class of transactions the acquisition in the end falls underneath. Some packages course of your factors purchases as a transaction with the airline or resort itself, wherein case it’d fall underneath the “journey” class, and could be eligible for class bonuses like 2x the factors on the Amex Gold Rewards Card or the Amex Platinum Card.

Nevertheless, most packages use a third-party vendor like Factors.com to finish the transaction, wherein case it’s only a general-category buy like another, so you need to use any card on which you’re trying to full a minimal spend.

Among the many above examples, American Airways AAdvantage processes factors purchases straight as an airline buy, whereas Atmos Rewards, Hilton Honors, and Aeroplan undergo Factors.com.

Lastly, you’ll wish to be 100% sure that the flight or resort for which you’re shopping for factors is certainly accessible if you need it to be. You could run into “phantom” award area, which might be a really disappointing end result in the event you’d simply spent a big sum of money on a speculative factors buy and might’t full your reserving.

Conclusion

Shopping for factors means that you can seize the worth in factors packages with out essentially placing within the work to earn these factors at a really low price. The worth of shopping for factors varies relying on every particular scenario, nevertheless it’s all the time good to think about your choices and preserve updated with any present factors gross sales.

It’s key to crunch the numbers and preserve monitor of earlier promotions to make sure you’re not overpaying, too. You’ll wish to be 100% certain that you’re getting extra worth out of your bought factors than what you pay for them, in any other case it’s in all probability not value it.

Whether or not you’re brief a pair hundred factors for that huge redemption or trying to economize on aspirational flights or lodges, there are quite a few conditions wherein shopping for factors may very well be advantageous.