Rove Miles is a comparatively new rewards program that permits you to earn a versatile factors foreign money from on-line procuring and journey bookings, then redeem these miles for flights and motels or switch them to airline and lodge companions.

Consider it as a mash-up of a web based procuring portal, an OTA, and a transferable factors program — however with no need a co-branded bank card to get in on the motion.

On this introductory information, we’ll cowl what Rove Miles is, the way it works, the place it shines (and the place it doesn’t), and the way a points-savvy traveller may incorporate it alongside conventional packages.

What Is Rove Miles?

Rove Miles is a standalone loyalty program launched in 2025 that points its personal rewards foreign money, merely referred to as Rove Miles.

It positions itself as a “common airline mile,” aggregating a number of airline and lodge packages beneath one roof and making it simpler for folks, particularly these with out premium bank cards, to earn and use miles for journey.

In some ways, Rove behaves like a hybrid of journey instruments most Canadians already use. Half procuring portal, half journey reserving web site, half transferable foreign money platform — simply with its tough edges nonetheless exhibiting.

For those who’ve used Aeroplan eStore, Rakuten, Expedia, or a fixed-value rewards program like Scene+ factors, you’ll acknowledge the construction immediately.

The intention is evident: make incomes journey rewards accessible to individuals who aren’t prepared for, or aren’t eligible for, the same old lineup of rewards bank cards.

At its core, Rove permits you to:

- E-book motels and earn as much as 25x Rove Miles (as much as 50x throughout promotions) per greenback spent.

- E-book flights and earn 1–10x Rove Miles per greenback spent.

- Earn miles through a web based procuring portal and Chrome extension at over 7,000–13,000 retailers, relying on the supply and timing.

- Redeem miles for flights and motels instantly via Rove, or switch them to 13 airline and lodge companions.

The large promoting level: all of this stacks on high of your normal airline miles, lodge factors, and bank card rewards, so you’re “triple‑dipping” on many transactions.

How is Rove Completely different from Different Packages?

On the earn aspect, Rove behaves rather a lot like Rakuten, TopCashBack, or airline procuring portals mixed with OTAs like Expedia and Resorts.com.

The twist is what you earn. Somewhat than locking you right into a single airline or providing easy money again, Rove funnels your rewards right into a transferable foreign money with airline and lodge companions.

That places it extra in keeping with bank-issued transferable packages, simply with out the financial institution card.

You click on via, earn a share again in Rove Miles as an alternative of money or a particular airline foreign money, and might ebook flights and motels instantly on Rove’s web site.

The distinction right here is that with Rove, you earn Rove Miles on high of the airline loyalty factors you’d earn when you booked via different channels. Usually, you may try one thing related by clicking via a money again portal like Rakuten after which reserving through Expedia.

Traditionally, nonetheless, the money again earned via these portals is commonly slim sufficient that it’s not well worth the added complexity. If plans go sideways, you possibly can simply find yourself caught between the OTA and the airline, every pointing on the different.

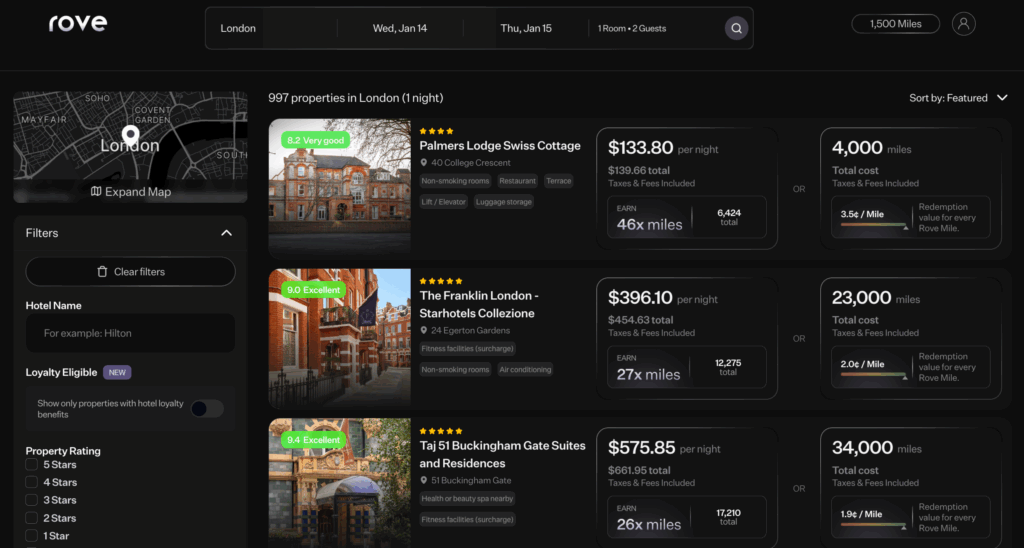

Lodge bookings are the place Rove actually stands out.

As miles and factors collectors and elite standing chasers, one of many most important causes we keep away from OTAs is that bookings via third-party platforms sometimes don’t earn elite qualifying nights or factors.

For instance, if you’re a Marriott Platinum member and ebook a JW Marriott Parq via Expedia, you aren’t solely ineligible for Platinum advantages like complimentary breakfast, government lounge entry, or late checkout, however you additionally gained’t earn factors or elite qualifying nights.

For this reason we select to ebook instantly with motels, even when OTAs provide barely cheaper charges. The worth misplaced from forfeiting elite advantages and progress towards standing normally outweighs the financial savings.

That is the issue Rove is trying to resolve.

Loyalty-Eligible Lodge Bookings

Rove has launched a loyalty-eligible reserving possibility that lets you obtain elite advantages and qualifying exercise even when reserving via Rove’s portal.

Furthermore, fee is settled instantly with the lodge, regardless of the reserving being made via Rove. This implies you possibly can nonetheless earn elevated rewards when utilizing lodge co-branded bank cards, such because the Marriott Bonvoy® American Categorical® Card, Hilton Honors Aspire Card, or World of Hyatt Credit score Card.

The trade-off is that loyalty-eligible charges do are typically barely greater than comparable charges supplied instantly on lodge web sites.

That mentioned, after some experimentation, the distinction appeared pretty modest, and the general worth proposition could make sense when you issue within the Rove Miles earned on the keep.

In brief, Rove behaves like financial institution transferable currencies

Rove is arguably most akin to issues like Citi ThankYou or, in some respects, Marriott Bonvoy, in response to third‑celebration reviewers. It has a roster of airline and lodge companions, principally with 1:1 switch ratios, and a devoted portal for looking out and reserving flights and motels.

Nevertheless, there are some notable variations:

- You don’t earn Rove Miles from on a regular basis card spend; there aren’t any monetary merchandise affiliated with Rove, so that you earn them from procuring and reserving via Rove.

- Rove contains some companions that different main currencies don’t, which might create distinctive worth propositions for particular routes or cabins.

For a Canadian factors collector who already has packages like Aeroplan, Amex Membership Rewards, and RBC Avion within the toolkit, Rove seems extra like a diversification and stacking device than a foundational foreign money, nevertheless it has attention-grabbing angles.

How Does Rove Make This Attainable?

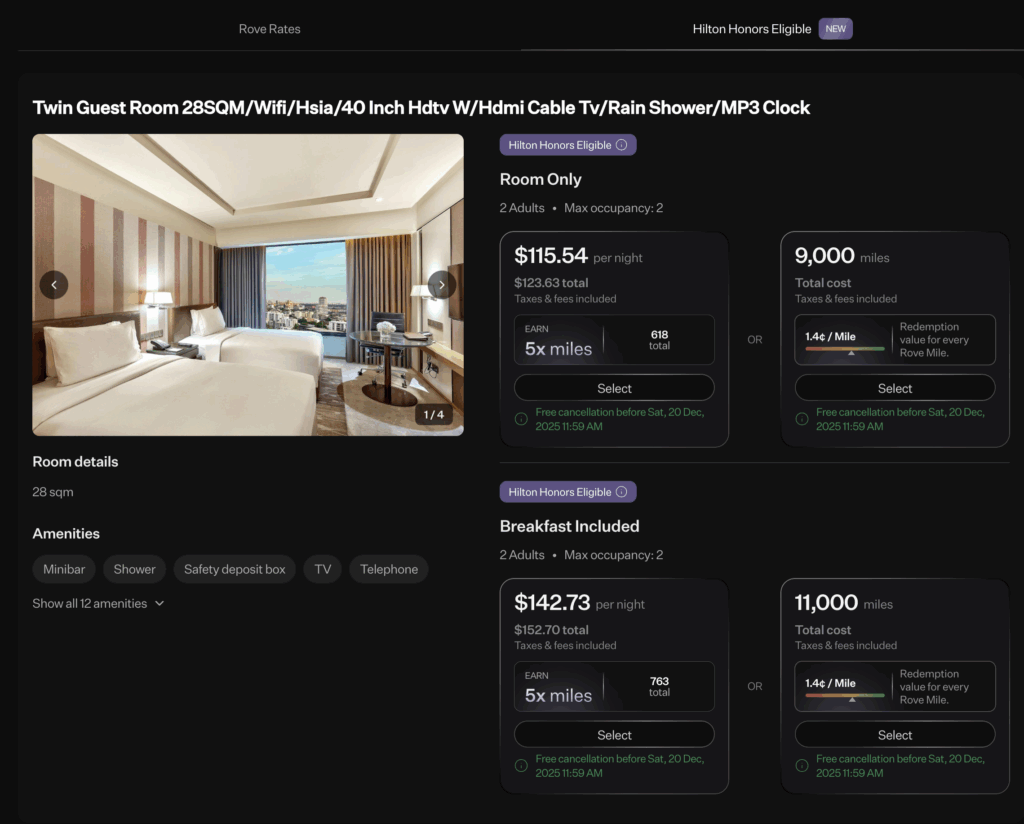

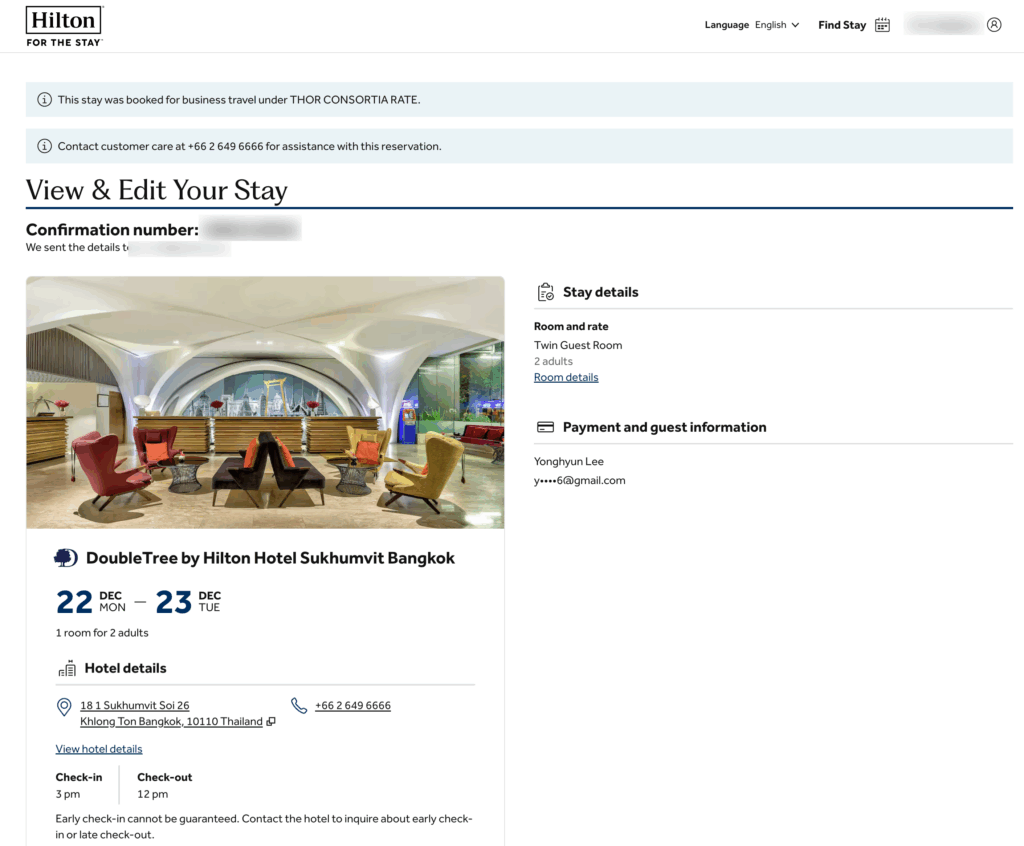

Out of curiosity, I went a step additional and made an precise reserving via Rove, though the keep itself has not but been accomplished. (I’ll report again as soon as my keep is full).

I booked DoubleTree Bangkok Ploenchit simply to check the platform.

Throughout the reserving course of, you’re offered with two forms of charges: Rove charges and loyalty-eligible charges.

Rove charges are sometimes barely cheaper and earn greater Rove Miles multipliers, however they don’t include lodge loyalty advantages. These might swimsuit travellers with out elite standing or these staying at impartial or boutique properties.

Since I maintain Hilton Honors Diamond standing and wished to obtain my normal advantages, I chosen the loyalty-eligible charge.

After finishing the reserving, the reservation appeared instantly in my Hilton account.

One attention-grabbing commentary was that the reserving confirmed up as a Hilton for Enterprise charge. From prior expertise, this charge sort is commonly 5–7% cheaper than publicly obtainable member charges, which can assist clarify how Rove can afford to supply elevated mileage earnings.

That mentioned, with out full visibility into Rove’s business preparations with lodge chains, there’s a cheap query round how these bookings are structured behind the scenes.

The very last thing we need to witness is our accounts being closed because of unintended misuse.

Hopefully, I’ll have the ability to comply with up with Rove on to make clear how these loyalty-eligible bookings are arrange and whether or not they’re absolutely sanctioned by lodge companions.

The best way to Earn Rove Miles

Rove affords two main methods to earn miles: on-line procuring and journey bookings.

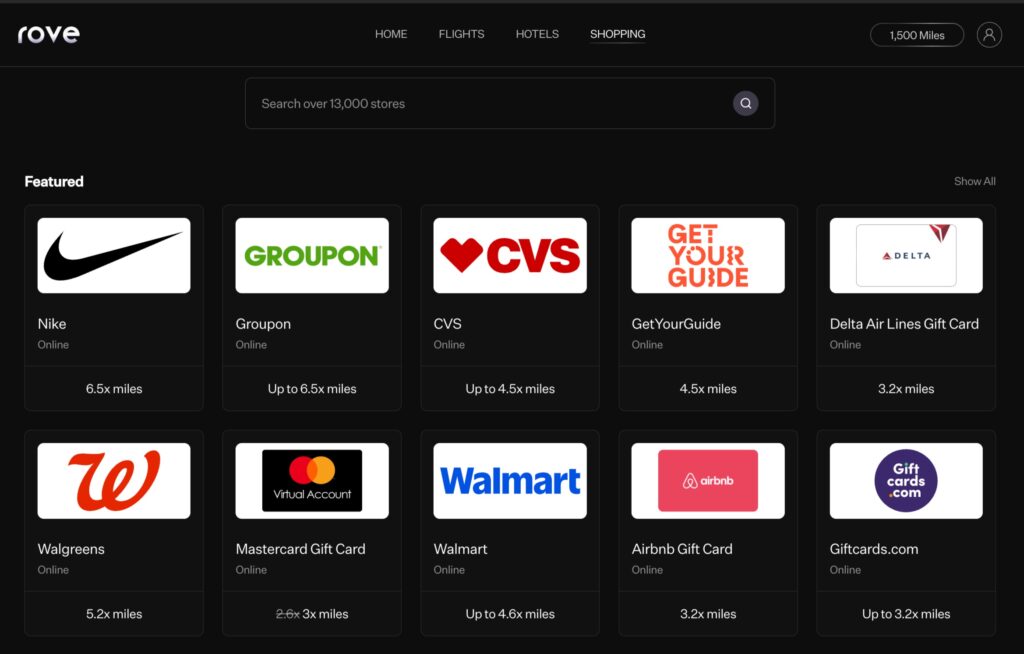

On-line Buying

Rove operates a web based procuring portal and Chrome extension that features equally to Aeroplan eStore or Rakuten.

You possibly can browse collaborating retailers instantly via Rove’s web site or activate earnings robotically through the browser extension when visiting eligible retailers.

Rove claims participation from hundreds of retailers, with figures starting from 7,000 to over 13,000 relying on the supply. Earn charges fluctuate by retailer and class, and Rove has periodically run promotions, together with elevated earn charges on reward playing cards.

As with different procuring portals, you continue to earn rewards in your bank card, and in some instances can stack issuer affords or service provider promotions on high of Rove Miles earnings.

Lodge Bookings

Resorts are the place Rove advertises its most eye-catching earn charges and the place the platform arguably delivers essentially the most attention-grabbing worth.

Once you ebook motels via Rove, you possibly can earn as much as 25x Rove Miles per greenback spent at over 200,000 properties worldwide. Precise earn charges depend upon the property, charge sort, and any energetic promotions, however they’re typically meaningfully greater than what you’d see via conventional OTAs or financial institution journey portals.

One vital distinction is between commonplace “Rove Miles” charges and loyalty-eligible charges. Rove Miles charges are typically barely cheaper and earn greater Rove Miles multipliers, however don’t qualify for lodge loyalty advantages or elite credit score.

Loyalty-eligible charges, however, assist you to earn lodge factors, elite qualifying nights, and obtain on-property advantages, offered you enter your loyalty quantity throughout checkout.

For non-refundable lodge bookings, Rove Miles are sometimes credited shortly after reserving moderately than after the keep is accomplished, which may be helpful when you plan to reuse these miles on a subsequent journey.

Crucially, for loyalty-eligible bookings, fee is settled instantly with the lodge. This implies you possibly can nonetheless earn bonus factors from lodge co-branded bank cards, making it potential to stack lodge factors, elite credit score, bank card rewards, and Rove Miles on a single keep.

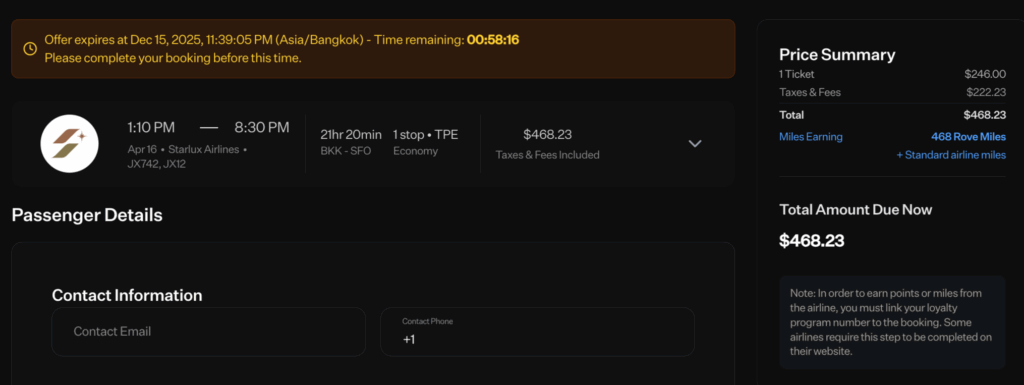

Flight Bookings

Rove additionally lets you earn miles on flight bookings made via its platform, with marketed earn charges starting from 1x to 10x Rove Miles per greenback spent.

In follow, the bottom earn charge seems to start out at 1x, with greater multipliers obtainable in sure instances relying on the airline, route, or promotional construction. Not like motels, the precise earn charge is just not all the time seen at first look and should solely seem later within the reserving circulate.

After reserving a flight via Rove, you obtain each a Rove reserving reference and the airline’s PNR. You possibly can then retrieve the reserving instantly on the airline’s web site or app and add your frequent flyer quantity if it’s not already hooked up.

Rove confirms that flight bookings earn airline miles and elite credit score as normal, that means you possibly can stack airline miles, bank card rewards, and Rove Miles on the identical ticket. Whereas flight earn charges via Rove are typically much less spectacular than motels, the power to layer an additional rewards foreign money on high of an in any other case regular money reserving can nonetheless add incremental worth.

The best way to Redeem Rove Miles

After getting earned a stash of Rove Miles, you’ve got two most important redemption paths: reserving journey instantly via Rove, or transferring to companion packages.

Direct Reserving through the Rove Portal

For flights, Rove affords dynamic pricing, sometimes delivering round 1.3–1.5 cents per mile in worth. You redeem miles instantly, obtain a typical airline ticket, and test in as normal.

For motels, Rove helps redemptions at over 200,000 properties worldwide. Redemption values are sometimes greater than flights, with some bookings providing upwards of two cents per mile. Rove shows a cents-per-mile indicator throughout search to assist determine stronger-value redemptions.

Redeem on Flights

Once you search flights with miles toggled on, Rove exhibits you choices labelled as “direct reserving” and “switch reserving.” Direct bookings are flights that Rove itself tickets, utilizing a dynamic mileage worth sometimes within the vary of 1.3–1.5 cents per mile in worth. You redeem Rove Miles instantly, get a reserving affirmation and PNR, after which test in with the airline like some other ticket.

The enchantment of direct reserving is simplicity: no want to know companion award charts or routing guidelines, you simply choose the flight and pay with miles on the displayed charge. Rove typically runs switch or redemption bonuses that sweeten the worth additional.

Redeem on Resorts

Lodge redemptions via Rove are typically extra compelling than flights.

Rove lets you redeem miles at over 200,000 properties worldwide, with reported common values starting from roughly 1.5 to over 2 cents per mile, relying on the property and timing. In some instances, greater values are potential, significantly at costly properties throughout peak durations.

One useful characteristic is Rove’s cents-per-mile indicator, which seems throughout the search course of and provides you a fast sense of whether or not a redemption is comparatively sturdy or weak. This nudges customers away from poor-value redemptions and makes it simpler to check choices with out doing handbook math.

At checkout, you possibly can sometimes select to pay completely in miles or use a mixture of money and miles. As with most dynamic lodge portals, not each redemption will probably be a great deal, however the interface makes it pretty simple to determine when utilizing miles is smart.

Transfers to Airline and Lodge Companions

The extra superior (and infrequently extra profitable) means to make use of Rove Miles is to switch them to companion loyalty packages and ebook awards there.

Rove helps transfers to 13 airline and lodge packages, protecting all three main alliances and the Accor lodge ecosystem. Assist‑centre documentation and Rove’s weblog listing companions comparable to:

- Air France–KLM Flying Blue

- Air India Maharaja Membership

- Aeromexico Rewards

- Cathay Pacific Asia Miles (coming subsequent month)

- Etihad Visitor

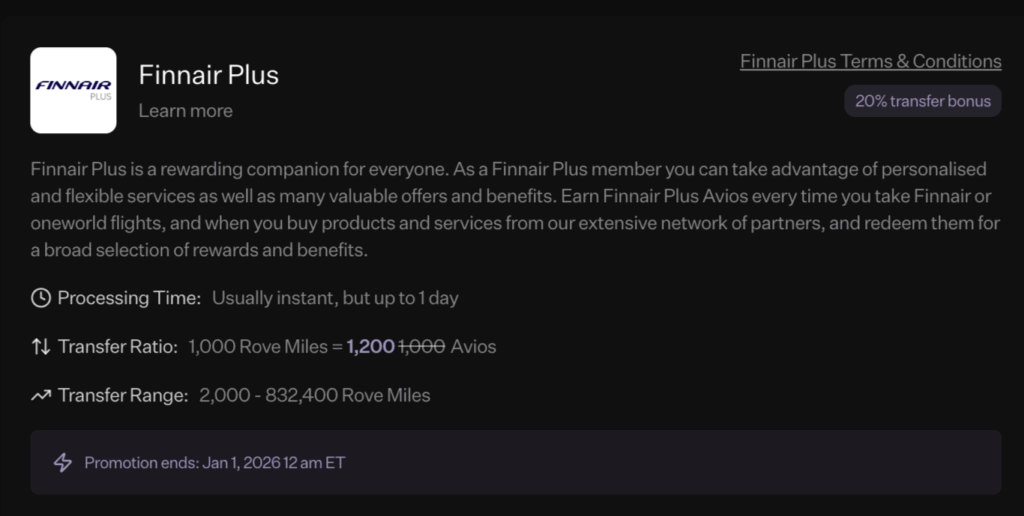

- Finnair Plus

- Hainan Airways Fortune Wings Membership

- Lufthansa Miles & Extra

- Vietnam Airways Lotusmiles

- Qatar Airways Privilege Membership

- Thai Airways Royal Orchid Plus

- Turkish Airways Miles&Smiles

- ALL Accor Reside Limitless

All companions switch at a 1:1 ratio besides Accor Reside Limitless, which makes use of a 1.5:1 ratio (1.5 Rove Miles to 1 Accor level). That weaker ratio can nonetheless make sense in particular “candy spot” eventualities or throughout Accor promotions, however it’s much less easy worth than 1:1 airline transfers.

Rove additionally sometimes runs switch bonuses, which might meaningfully enhance the worth you get out of your miles. For instance, on the time of writing, Rove is promoting a 20% switch bonus while you switch Rove Miles to Finnair Plus Avios, which successfully turns a 1:1 switch into 1:1.2 whereas the promo is reside.

Rove does uniquely provide switch entry to some packages that aren’t accessible with a typical transferable financial institution foreign money, such because the Aeromexico Rewards and Lufthansa Miles & Extra, and Vietnam Airways Lotusmiles.

That provides Rove some area of interest redemption angles which may enchantment to superior travellers. And if, by some probability, they ever onboard Atmos Rewards, that will be big information for Canadians, since we at present don’t have any solution to earn it after MBNA phased out its co-branded card.

How A lot Are Rove Miles Price?

Like most versatile rewards currencies, the worth of Rove Miles relies upon completely on the way you redeem them.

Rove’s personal supplies recommend that miles can ship stable worth when used for journey, significantly on lodge bookings and premium cabin flights booked through companion packages. Impartial estimates are typically extra conservative, typically inserting Rove Miles someplace in the course of the transferable currencies moderately than on the very high.

From a Canadian factors perspective, essentially the most smart means to consider Rove Miles is thru its switch companions.

When transferring to airways like Finnair Plus Avios, which we sometimes worth at round 2.0 cents per level, or Flying Blue, which we worth nearer to 2.2 cents per level, Rove Miles can comfortably attain that very same vary when used properly.

On the lodge aspect, redemptions via Rove’s personal portal are likely to land a bit decrease, however nonetheless above what you’d anticipate from fixed-value journey factors in lots of instances.

Taking into consideration airline companion transfers, lodge redemptions via the Rove portal, and the occasional switch bonus, a cheap working valuation for Rove Miles is round 2.0 cents per mile.

That places Rove Miles forward of easy cash-back or fixed-value journey currencies, whereas nonetheless leaving room for upside when you goal sturdy airline redemptions.

As with every transferable program, lower-effort redemptions will normally sit close to the underside of that vary, whereas considerate companion bookings can push worth greater.

Strengths and Limitations of Rove Miles

Rove Miles has just a few clear strengths that make it price listening to, significantly as a stacking and diversification device.

The obvious upside is incomes potential, particularly on motels. Incomes as much as 25x Rove Miles per greenback spent is properly above what most OTAs or financial institution journey portals provide, and when mixed with lodge factors, elite qualifying nights, and bank card rewards on loyalty-eligible bookings, the returns can add up rapidly.

Stackability is one other key benefit. In lots of instances, Rove Miles are earned on high of airline miles, lodge factors, and bank card rewards, making Rove an incremental layer moderately than a alternative for current packages.

Add in a rising listing of airline and lodge companions, together with some area of interest choices which might be in any other case troublesome for Canadians to entry, and Rove affords real flexibility when it comes time to redeem.

That mentioned, there are limitations to bear in mind.

Loyalty-eligible lodge charges are sometimes barely greater than reserving instantly, which implies you must do a fast worth test moderately than assuming Rove is all the time the most cost effective possibility.

As with every third-party reserving platform, there may be additionally added complexity if plans change, since Rove introduces an additional layer between you and the airline or lodge.

Lastly, the platform itself remains to be clearly a piece in progress. In follow, the web site isn’t absolutely optimized but, search outcomes may be gradual to load, and loyalty-eligible charges can typically take a number of makes an attempt to look.

These aren’t deal-breakers, however they’re reminders that Rove remains to be early in its growth.

Used thoughtfully, Rove Miles works greatest as a complementary device moderately than one thing to depend on solely.

Who Ought to Contemplate Utilizing Rove Miles?

Rove Miles will enchantment to totally different travellers in several methods, relying on the place they’re of their factors journey.

For inexperienced persons or travellers with out entry to premium bank cards, Rove affords a comparatively approachable entry level into versatile journey rewards. You possibly can earn significant miles via on-line procuring and paid journey with no need to use for a brand new card or meet minimal spend necessities.

For intermediate customers, Rove works properly as a stacking device. For those who already earn airline miles, lodge factors, and bank card rewards, Rove can sit quietly within the background and add an additional layer of worth on purchases and bookings you’d be making anyway.

For superior factors fanatics, the enchantment is extra area of interest. Rove’s lodge earn charges, loyalty-eligible bookings, and entry to sure switch companions that aren’t simply reachable via Canadian financial institution packages can create situational worth, particularly when switch bonuses can be found.

For many Canadians, Rove is unlikely to exchange core packages like Aeroplan or bank-issued transferable currencies. As an alternative, it makes essentially the most sense as a complementary program — one that you simply use selectively, when the incomes charges, stacking potential, or companion choices justify the additional step.

Conclusion

Rove Miles is greatest understood as a supplemental rewards foreign money moderately than a standalone technique.

When incomes charges are sturdy, loyalty-eligible bookings can be found, or switch bonuses come into play, it may add significant incremental worth on high of rewards you’re already incomes elsewhere.

It’s nonetheless an evolving program, and one which rewards a little bit of consideration and selective use. However for travellers keen to run the numbers and choose their spots, Rove Miles is a program price protecting on the radar.