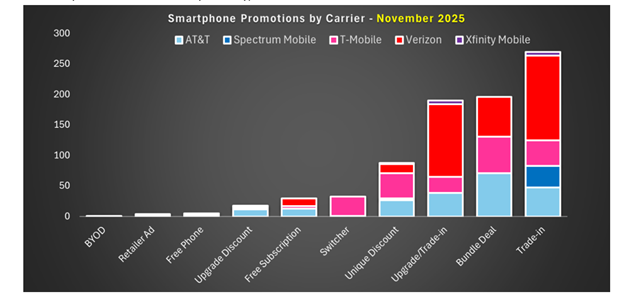

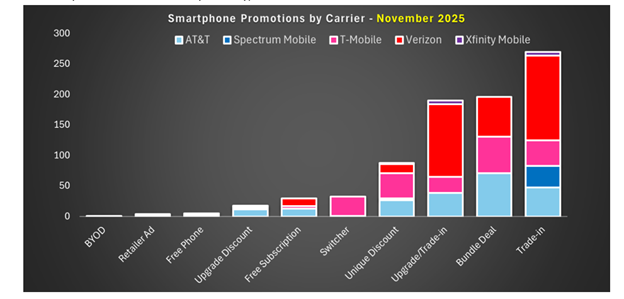

In November 2025, a complete of 835 promotions had been launched, spanning ten distinct promotional codecs throughout Verizon, AT&T, T-Cellular, Spectrum Cellular, and Xfinity Cellular.

Verizon led all carriers in promotional quantity, adopted by AT&T and T-Cellular, whereas Spectrum Cellular and Xfinity Cellular continued to refine their MVNO-driven worth methods.

Gadget prioritisation skewed closely towards premium OEMs: Samsung accounted for some 521 promotional listings, whereas Apple noticed roughly 207, underscoring the business’s continued reliance on high-end flagships to steer service tier upgrades and long-term account worth.

Black Friday exercise proved comparatively muted. Verizon and T-Cellular targeted on commonplace ecosystem-based bundle gives round Samsung, Apple, and Google merchandise, whereas Xfinity Cellular supplied predictable trade-in and new line offers centered on main OEMs. Quite than dramatic vacation undercutting, carriers maintained strategic restraint, signaling confidence in year-round promotional architectures quite than single-week blowouts.

Strategic promotional posture

- Verizon pursued most ARPU enlargement and multi-device locking. Its promotions paired substantial machine reductions with value-added service bundles to anchor prospects in premium, high-yield plans.

- AT&T leaned into consistency, equity, and broad eligibility, positioning clear, accessible gives as a differentiator.

- T-Cellular balanced aggressive machine incentives with a deliberate push towards Expertise Past and Expertise Extra premium tiers.

- Spectrum Cellular and Xfinity Cellular used trade-in gives and tiered premium plans to push prospects towards machine purchases and higher-value service plans. Their strict plan guidelines serve twin functions: rewarding loyal prospects whereas safeguarding in opposition to margin compression.

Throughout all carriers, trade-in promotions stay the linchpin for relieving shopper price burdens and stimulating cyclical machine upgrades. Bundle ecosystems that includes service and units are more and more used as worth differentiators quite than easy incentives.

A key structural theme is the prominence of plan-tier gating. Verizon’s Limitless Plus, T-Cellular’s Expertise Past/Extra, and Xfinity’s Premium Limitless all show a coordinated business pivot towards ARPU-focused tier migration. These constraints funnel prospects into higher-value service stacks whereas holding promotional prices managed.

On the similar time, transparency is rising as a aggressive asset. AT&T’s open eligibility and Spectrum Cellular’s simplified trade-in phrases mirror a rising recognition: prospects are more and more fatigued by restrictions, hidden necessities, and complicated improve circumstances.

The November 2025 promotional panorama makes one reality clear: carriers are now not promoting discounted units—they’re engineering ecosystems designed to lock in retention, elevate ARPU, and minimise churn. The machine deal is merely the entry level. For shoppers, the setting gives richer trade-in values and extra significant bundles, however navigating eligibility, plan tiers, and improve constraints stays a big problem.

In the end, carriers that may win within the subsequent aggressive cycle are these capable of pair daring incentives with clear phrases, frictionless switching, and value-anchored service bundles that reinforce long-term loyalty