There are numerous situations wherein utilizing money for a lodge keep simply makes extra sense than redeeming factors.

In reality, there are various properties all over the world that don’t also have a loyalty program within the first place. These embody unbiased properties, boutique inns, cottages, and trip houses.

In these conditions, it’s good to know that you just don’t at all times must pay full value. There are methods to save cash and even snag some further perks, usually at no further price.

Redeem Mounted-Worth Factors Currencies

Even should you can’t redeem lodge loyalty factors instantly for a lodge keep, that doesn’t imply you’re caught paying completely out of pocket.

It is because most bank card applications situation factors that may be redeemed towards journey bills at a set worth, which can assist offset the price of your keep.

Certainly, nearly all banks in Canada have the choice to redeem factors for journey purchases–or on the very least, as assertion credit that may assist offset the price of your journey bills.

Nevertheless, it’s necessary to needless to say redeeming factors this manner may not at all times provide one of the best worth.

With transferable factors currencies, resembling American Specific Membership Rewards and RBC Avion you possibly can usually get higher worth by transferring your factors to airline or lodge companions and strategically redeeming them, moderately than by redeeming them for assertion credit.

Then again, with applications resembling TD Rewards, BMO Rewards, CIBC Aventura, Scene+, and Nationwide Financial institution À la carte Rewards, redeeming your factors towards lodge stays or different journey bills may simply be one of the best, most beneficial use of these factors.

American Specific Membership Rewards

Usually talking, you’ll get essentially the most worth out of your American Specific Membership Rewards (MR) factors by transferring them to a partnered loyalty program, resembling Air Canada Aeroplan, The British Airways Membership, or Marriott Bonvoy, to call a couple of.

Nevertheless, should you’re trying to e book a lodge keep that may’t in any other case be booked with factors instantly, you need to use a bank card that earns American Specific MR factors to pay for the lodge, and you’ll then use your factors stability to cowl the associated fee.

You’ll be able to redeem MR factors towards any buy made on the cardboard at a charge of 1 cent per level (all figures in CAD). Because of this should you paid $200 for a lodge room, you possibly can redeem 20,000 MR factors for a $200 assertion credit score to cowl the price of that keep.

What’s extra, American Specific often has focused promotions, via which you possibly can redeem your MR factors for assertion credit at a charge as excessive as 1.5 cents per level.

In these conditions, the worth you get from redeeming factors creeps greater, and even approaches the worth you may get with switch companions. If any of those promotions come up, it’s value contemplating the way you may be capable of profit, until you have got a greater instant use to your factors.

American Specific Platinum Card

- Earn 80,000 MR factors upon spending $10,000 within the first three months

- Plus, earn 30,000 MR factors upon making a purchase order in months 15–17 as a cardholder

- Earn 2x MR factors on all eating and journey purchases

- Obtain an annual $200 journey credit score

- Obtain an annual $200 eating credit score

- Switch MR factors to Aeroplan, The British Airways Membership, Flying Blue, and different frequent flyer applications for premium flights

- Limitless airport lounge entry for you and one visitor at Precedence Cross, Plaza Premium, Centurion, and different lounges

- Credit and rebates for each day bills all year long with Amex Provides

- Bonus MR factors for referring household and associates

- Annual charge: $799

American Specific Membership Rewards Credit score Playing cards

| Credit score Card | Finest Supply | Worth | |

|---|---|---|---|

|

130,000 MR factors $799 annual charge |

130,000 MR factors | $1,794 |

Apply Now |

|

70,000 MR factors $250 annual charge |

70,000 MR factors | $1,676 |

Apply Now |

|

110,000 MR factors $799 annual charge |

110,000 MR factors | $1,581 |

Apply Now |

|

40,000 MR factors $199 annual charge |

40,000 MR factors | $846 |

Apply Now |

|

15,000 MR factors $156 annual charge |

15,000 MR factors | $372 |

Apply Now |

|

10,000 MR factors $0 annual charge |

10,000 MR factors | $242 |

Apply Now |

|

$99 annual charge $99 annual charge |

$99 annual charge | $0 |

Apply Now |

RBC Avion

Much like American Specific Membership Rewards, you’ll are inclined to get essentially the most worth out of your RBC Avion factors by transferring them out to airline companions, resembling The British Airways Membership, Cathay Pacific Asia Miles, WestJet Rewards, or American Airways AAdvantage.

Whereas RBC additionally lets you redeem your Avion factors for an announcement credit score, the redemption charge is 17,200 factors = $100, or 0.58 cents per level, which isn’t essentially an excellent deal, and must be averted.

As an alternative, if you wish to use your RBC Avion factors to offset the price of a lodge keep at a greater charge, you possibly can e book your keep via the RBC Rewards journey portal.

By the journey portal, you’ll be capable of redeem Avion factors at 1 cent per level, or 20,000 Avion factors = $200.

Nevertheless, needless to say this redemption charge is unique to Avion Elite factors, which can be found provided that you maintain an eligible Avion card.

When selecting this feature, you’ll simply need to examine the value of the keep as seen on RBC’s journey portal to different reserving choices to be sure to’re being provided an identical charge.

Generally, reserving instantly with inns and different journey distributors ends in higher pricing.

RBC® Avion Visa Infinite†

- Earn 35,000 Avion factors upon approval^

- Earn further 20,000 Avion factors upon spending $5,000 within the first six months^

- Earn 1.25x Avion factors on qualifying journey purchases

- Switch Avion factors to British Airways Govt Membership and different frequent flyer applications for premium flights†

- Redeem Avion factors for flights with the RBC Air Journey Redemption Schedule†

- Minimal earnings: $60,000 private or $100,000 family

- Annual charge: $120

- Supplementary card charge: $50

| Credit score Card | Finest Supply | Worth | |

|---|---|---|---|

|

55,000 Avion factors^ $120 annual charge |

55,000 Avion factors^ | $1,080 |

Apply Now |

|

55,000 RBC Avion factors^ $120 annual charge |

55,000 RBC Avion factors^ | $1,080 |

Apply Now |

|

As much as 70,000 RBC Avion factors† $399 annual charge |

As much as 70,000 RBC Avion factors† | $826 |

Apply Now |

|

35,000 RBC Avion factors $175 annual charge |

35,000 RBC Avion factors | $700 |

Apply Now |

|

35,000 RBC Avion factors $120 annual charge |

35,000 RBC Avion factors | $580 |

Apply Now |

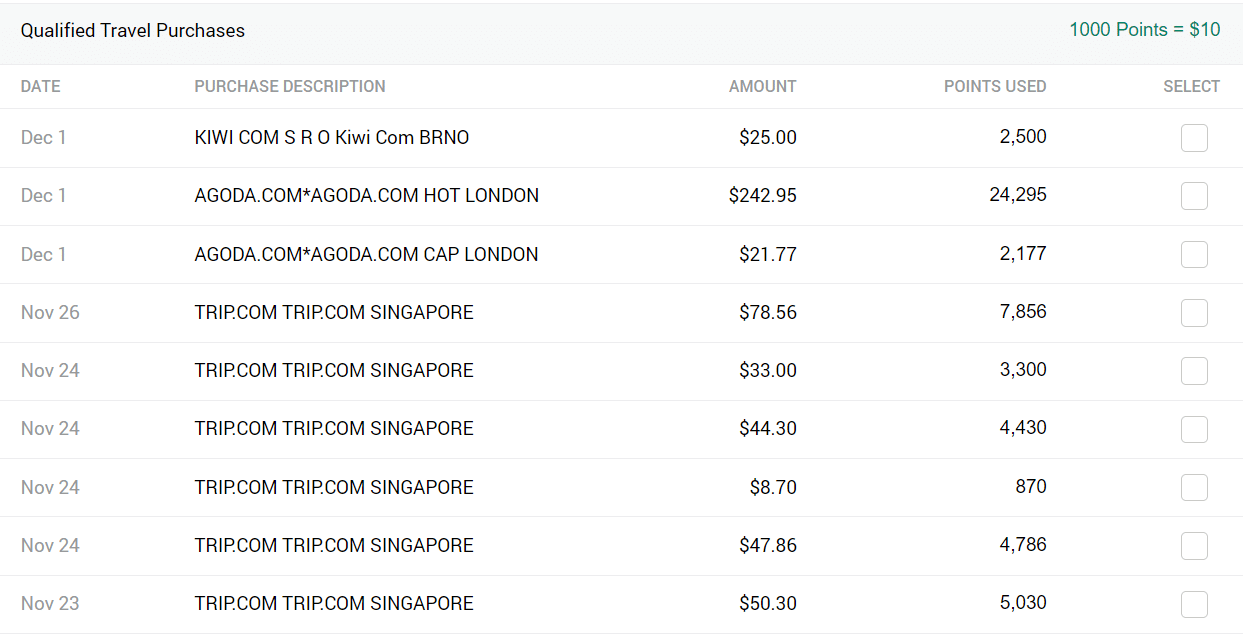

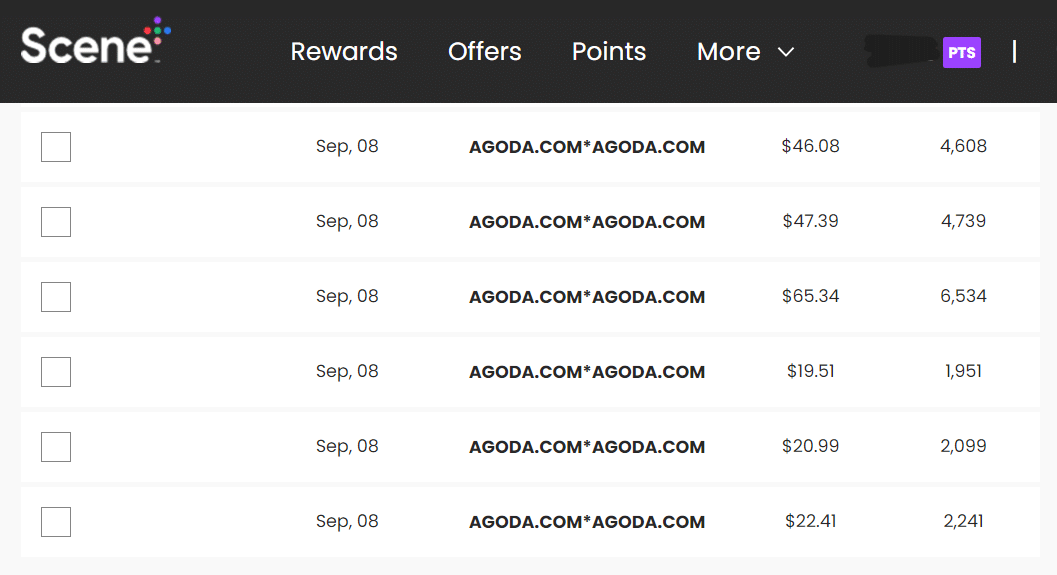

Scotiabank Scene+

Scotiabank’s Scene+ factors can be utilized to offset any journey you’ve beforehand bought along with your Scene+ bank card at a charge of 1 cent per level, or 20,000 factors for a $200 lodge keep.

The very best half? You’re free to e book instantly with any vendor, and redeem your factors on the highest potential worth.

This implies you possibly can store round for one of the best value, reap the benefits of cashback portals like Rakuten for further financial savings, or e book instantly with inns to earn elite qualifying nights towards standing. Then, you possibly can offset the associated fee afterward by redeeming your Scene+ factors.

Scotiabank can be residence to Canada’s greatest bank cards with no overseas transaction charges, which signifies that you’ll get monetary savings when travelling and nonetheless be capable of offset the associated fee utilizing your factors.

Scotiabank Gold American Specific® Card

- Earn 30,000 Scene+ factors upon spending $2,000 within the first three months

- Plus, earn an further 20,000 Scene+ factors upon spending $7,500 within the first yr

- Earn 6x Scene+ factors at Sobeys, IGA, Safeway, FreshCo, and extra

- Plus, earn 5x Scene+ factors on groceries, eating, and leisure

- Additionally, earn 3x Scene+ factors on fuel, transit, and choose streaming companies

- Redeem factors for an announcement credit score for any journey expense

- No overseas transaction charges

- Benefit from the unique advantages of being an American Specific cardholder

- Annual charge: $120 (waived for the primary yr)

Scotiabank Scene+ Credit score Playing cards

| Credit score Card | Finest Supply | Worth | |

|---|---|---|---|

|

50,000 Scene+ factors First 12 months Free |

50,000 Scene+ factors | $575 |

Apply Now |

|

80,000 Scene+ factors $399 annual charge |

80,000 Scene+ factors | $261 |

Apply Now |

|

45,000 Scene+ factors $150 annual charge |

45,000 Scene+ factors | $220 |

Apply Now |

|

40,000 Scene+ factors $199 annual charge |

40,000 Scene+ factors | $176 |

Apply Now |

|

5,000 Scene+ factors $0 annual charge |

5,000 Scene+ factors | $60 |

Apply Now |

TD Rewards

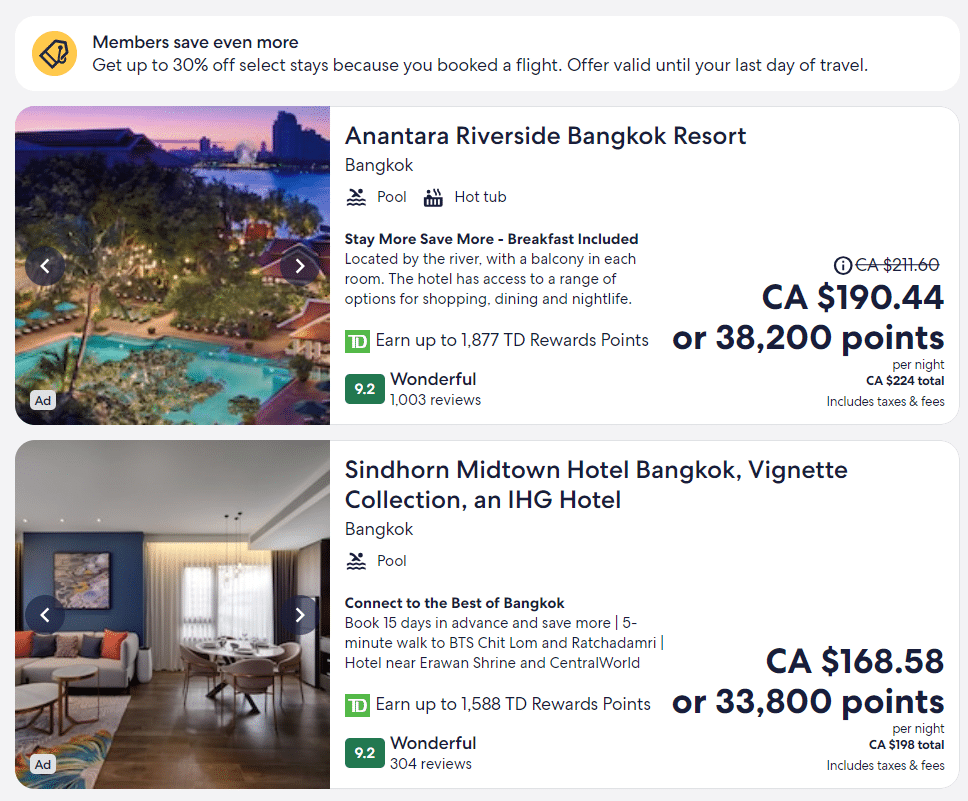

TD Rewards lets you redeem factors for journey via Expedia for TD or journey booked by yourself.

In case you e book a lodge keep via the Expedia for TD on-line portal, you’ll get a charge of 0.5 cents per level, or 40,000 TD Rewards factors to cowl $200 lodge keep.

Nevertheless, should you e book a lodge keep by yourself along with your TD Rewards bank card, you’ll have the choice to redeem your TD Rewards factors at a barely decrease charge of 0.44 cents per level by way of the Pay Off Purchases characteristic. In different phrases, you’ll want 50,000 TD Rewards factors to cowl a $220 lodge keep.

So long as you’re getting the identical value for a similar product, it is best to endeavour to redeem your factors via the Expedia for TD portal, since doing so ends in one of the best worth.

TD First Class Journey® Visa Infinite* Card

- Earn 20,000 TD Rewards Factors upon making your first buy†

- Earn 145,000 TD Rewards Factors upon spending $7,500 inside 180 days of account opening†

- Plus, earn a Birthday Bonus of as much as 10,000 TD Rewards Factors†

- Plus, earn 8x TD Rewards Factors† on eligible journey purchases whenever you e book via Expedia® for TD†

- Get an annual TD Journey Credit score† of $100 whenever you e book via Expedia® for TD†

- Use your rewards for any journey bookings out there on Expedia® for TD†

- 4 complimentary lounge visits via the Visa Airport Companion Program†

- Minimal earnings: $60,000 private or $100,000 family

- Annual charge: $139, rebated for the primary yr†

- Supply efficient as of September 4, 2025†

CIBC Aventura

Much like TD, the CIBC Aventura program additionally lets you redeem Aventura Factors towards journey bills, or to redeem factors via CIBC’s in-house journey company, at completely different charges.

By redeeming Aventura factors via the journey company, you’ll get a set worth of 1 cent per level, or 20,000 Aventura factors for a $200 lodge keep.

Alternatively, you possibly can e book a lodge with via any platform you select, then redeem Aventura factors additionally at a charge of 1 cent per level towards that journey buy.

Nevertheless, not like Scene+ factors—which provide you with as much as three hundred and sixty five days to use factors towards a journey buy—Aventura factors should be redeemed whereas the cost remains to be pending.

So, make sure you have got sufficient factors able to cowl the price of your journey buy whenever you make the reserving.

CIBC Aventura® Visa Infinite* Card

- Earn 15,000 CIBC Aventura Factors after making your first buy†

- Earn 30,000 CIBC Aventura Factors after spending $3,000 within the first 4 month-to-month assertion durations†

- Earn 2x CIBC Aventura Factors on all purchases via the CIBC Rewards Centre†

- Earn 1.5x CIBC Aventura Factors on eligible fuel, groceries, EV charging, and drugstore purchases†

- 4 complimentary lounge visits per yr with the Visa Airport Companion Program†

- NEXUS software charge rebate of as much as $200 (CAD)†

- 12-month Skip+ free trial and different unique advantages whenever you hyperlink your CIBC Aventura® Visa Infinite* Card with Skip†

- Minimal earnings: $60,000 private or $100,000 family†

- Annual charge: $139 (rebated for the primary yr)†

CIBC Aventura Credit score Playing cards

| Credit score Card | Finest Supply | Worth | |

|---|---|---|---|

|

As much as 70,000 CIBC Aventura Factors First 12 months Free |

As much as 70,000 CIBC Aventura Factors | $1,050 |

Apply Now |

|

45,000 CIBC Aventura Factors† First 12 months Free |

45,000 CIBC Aventura Factors† | $480 |

Apply Now |

|

45,000 CIBC Aventura Factors† First 12 months Free |

45,000 CIBC Aventura Factors† | $480 |

Apply Now |

|

As much as 80,000 CIBC Aventura Factors $499 annual charge |

As much as 80,000 CIBC Aventura Factors | $276 |

Apply Now |

|

10,000 CIBC Aventura Factors† $0 annual charge |

10,000 CIBC Aventura Factors† | $99 |

Apply Now |

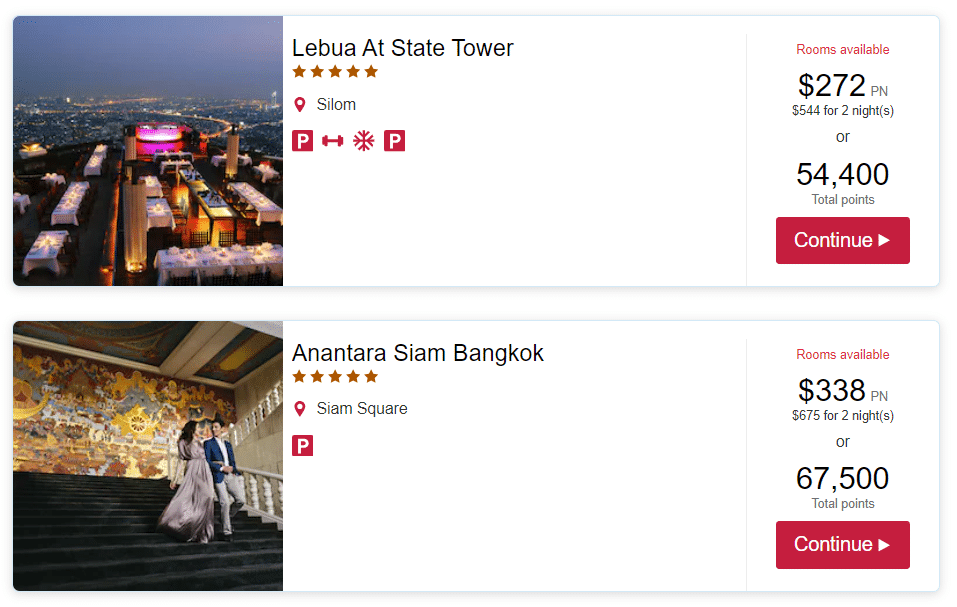

BMO Rewards

With BMO Rewards, you’ll get a worth of precisely 0.67 cents per level, whether or not you redeem your factors towards your individual lodge reserving charged to your BMO bank card, otherwise you redeem for a reserving made via BMO’s in-house journey company.

With both route, it’ll price you 29,850 BMO Rewards factors to cowl a $200 lodge keep.

If you need to select between the 2, it’s greatest to e book instantly with inns, because you might be able to get pleasure from further advantages via your elite standing or by reserving via a most well-liked associate program.

The Finest Methods to E-book Unbiased Resorts on Factors

Nationwide Financial institution À la carte Rewards

As with the opposite applications we’ve talked about, Nationwide Financial institution’s À la carte Rewards can be used to cowl journey bills. When redeeming factors via Nationwide Financial institution’s on-line journey portal, you’ll get a worth of 1 cent per level, that means you possibly can redeem 20,000 factors for a $200 lodge keep.

If you wish to redeem À la carte Rewards factors towards your individual lodge reserving, redeeming fewer than 55,000 factors will get you 0.83 cents per level, and redeeming greater than 55,000 factors will get you 0.92 cents per level.

Based mostly on these charges, you’ll want 24,096 À la carte Rewards factors to cowl your $200 lodge keep.

Nationwide Financial institution® World Elite® Mastercard®

- Earn 5,000 À la carte Rewards factors after enrolling bank card cost insurance coverage†

- Earn 10,000 À la carte Rewards factors upon spending $5,000 within the first three months†

- Earn 10,000 À la carte Rewards factors upon spending $10,000 within the first six months†

- Earn 20,000 À la carte Rewards factors upon spending $15,000 within the first 12 months†

- Plus, Earn 5x À la carte Rewards factors on grocery and restaurant spend†

- Get journey insurance coverage on award journey, in addition to medical protection on longer journeys for ages as much as 75†

- Obtain $150 in annual credit for airport parking, baggage charges, seat choice charges, lounge entry, and airline ticket upgrades†

- Minimal earnings: $80,000 private or $150,000 family

- Annual charge: $150

Nationwide Financial institution World Elite Mastercard

Use Journey Credit

One other method you could save in your lodge prices whenever you’re reserving a money keep is through the use of journey credit score provided as a perk on choose bank cards to offset the ultimate value.

There are a variety of playing cards that provide annual credit that can be utilized to e book your subsequent lodge keep. These playing cards, and their related credit, embody the next:

Credit score Playing cards with Journey Credit

| Credit score Card | Finest Supply | Worth | |

|---|---|---|---|

|

130,000 MR factors $799 annual charge |

130,000 MR factors | $1,794 |

Apply Now |

|

70,000 MR factors $250 annual charge |

70,000 MR factors | $1,676 |

Apply Now |

|

110,000 MR factors $799 annual charge |

110,000 MR factors | $1,581 |

Apply Now |

|

As much as 165,000 TD Rewards Factors† First 12 months Free |

As much as 165,000 TD Rewards Factors† | $900 |

Apply Now |

|

As much as 60,000 BMO Rewards factors First 12 months Free |

As much as 60,000 BMO Rewards factors | $370 |

Apply Now |

|

As much as 80,000 CIBC Aventura Factors $499 annual charge |

As much as 80,000 CIBC Aventura Factors | $276 |

Apply Now |

|

As much as 120,000 BMO Rewards factors $599 annual charge |

As much as 120,000 BMO Rewards factors | $0 |

Apply Now |

Of the above credit, some are pretty versatile, whereas others require that you just bounce via a hoop or two. Because of this a few of the credit can help you redeem towards any lodge expense, whereas others require that you just e book via sure journey portals related with the cardboard issuer.

E-book with Most popular Accomplice Applications

Just about each main lodge model, whether or not they have a loyalty program or not, has what’s known as a most well-liked associate program.

Most popular associate applications provide a choice of advantages to supply an elevated expertise throughout your keep, that are just like these loved by friends with elite standing.

It’s value noting that with a view to e book a lodge via a most well-liked associate program, you do have to e book via a journey advisor, and it’s not potential to e book by yourself.

E-book Luxurious Resorts with Prince Assortment

Whereas the precise perks differ by program and by property, the advantages that may be accessed via bookings utilizing most well-liked associate applications usually embody the next:

- Each day breakfast for 2

- $100 (USD) lodge credit score

- Welcome amenity

- Room improve (topic to availability)

- Early check-in and/or late check-out (topic to availability)

- Further property-specific promotions

Notably, the associated fee to entry and luxuriate in these advantages is the identical value you’d pay should you booked with the lodge instantly at one of the best versatile charge.

So, should you’re going to pay for a lodge with money as a substitute of factors, it’s nearly at all times in your greatest curiosity to e book via most well-liked associate applications to get pleasure from further advantages at no further price.

And because you’re charged instantly by the lodge, you’ll nonetheless be capable of offset the entire price of your keep through the use of fixed-value factors from playing cards listed above, and also you’ll get pleasure from any advantages related along with your elite standing.

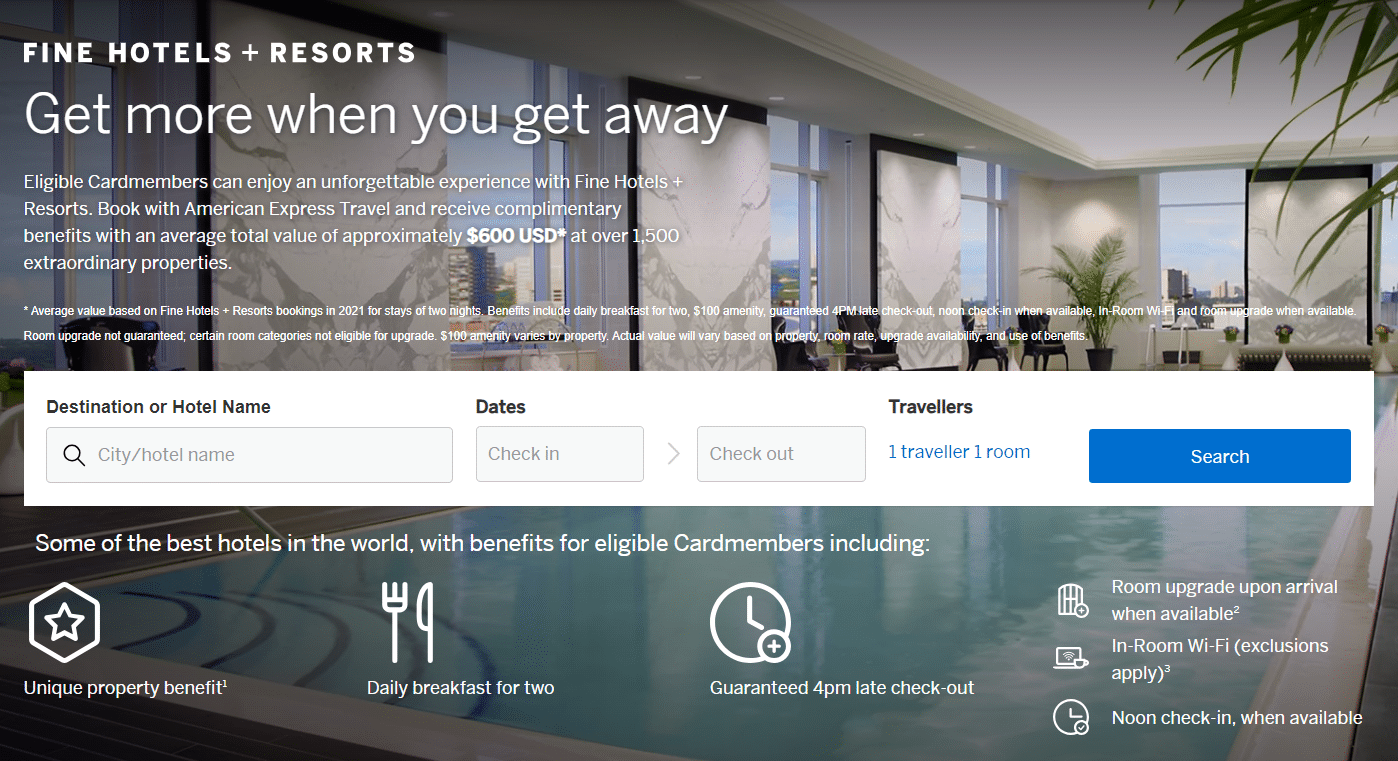

E-book with American Specific Nice Resorts + Resorts

When you’ve got an American Specific Platinum Card or a Enterprise Platinum Card from American Specific, you have got entry to the American Specific Nice Resorts + Resorts (FHR) program.

By the FHR program, you possibly can e book luxurious inns and luxuriate in a few of the identical advantages as you’d should you booked via a most well-liked associate program.

Nevertheless, not all luxurious inns can be found to be booked via the FHR program, and for these which are, it could be higher to e book via the lodge’s personal most well-liked associate program, as it would provide higher advantages.

In any case, it’s value evaluating the out there advantages and prices via all reserving choices to make sure you’re getting one of the best mixture potential.

And should you’d like to make use of your MR factors to offset the price of your keep, you possibly can select to take action when you’ve been charged.

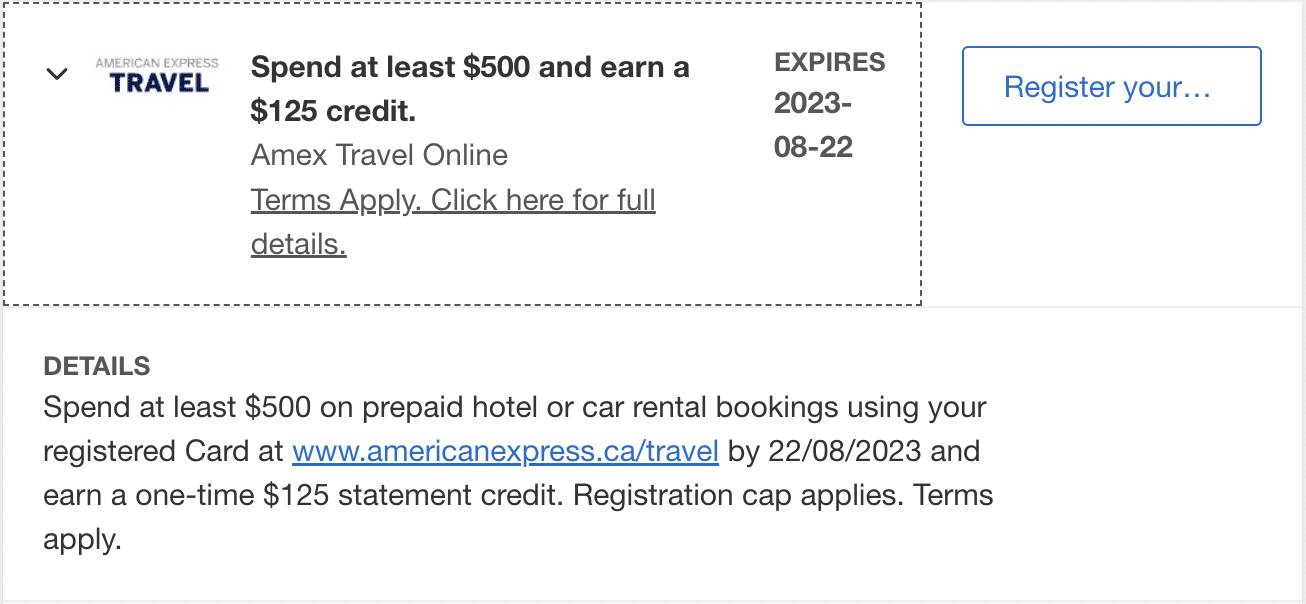

Leverage Amex Provides

American Specific has frequent promotions known as Amex Provides which are accessible to present American Specific cardholders.

Usually talking, you’ll have to register for a proposal, and then you definitely’ll obtain an announcement credit score for fulfilling a minimal spending requirement at an eligible vendor.

The kinds of gives that you just’ll discover differ tremendously and alter on a regular basis. Nevertheless, lodge promotions are pretty widespread, with some promotions specializing in a particular lodge model, and others providing perks for spending accomplished via Amex Journey.

Some examples of previous Amex Provides embody:

So long as you meet the minimal spending threshold to set off the assertion credit score, Amex Provides basically provide a significant low cost on lodge stays.

Relying on the Amex Supply’s phrases and circumstances, it’s also possible to doubtlessly stack the provide with elevated advantages from a most well-liked associate program. And if you want, it’s also possible to use Amex MR factors to offset the price of the keep.

For instance, let’s suppose you registered for the Spend $500, Get $100 at Canadian Marriott inns Amex Supply.

You then make an eligible $500 reserving at, say, the St. Regis Toronto, by way of Marriott STARS. By the popular associate program, you’ll get free breakfast for 2, a $100 (CAD) property credit score to make use of throughout your keep, precedence for room upgrades, and extra.

Because you’re charged instantly by the lodge, you’d wind up with a $100 assertion credit score after your keep from the Amex Supply, which made the efficient price simply $400. Then, you possibly can use MR factors to additional offset the price of the keep, which might carry the entire price down even additional, even perhaps to $0.

Each time there’s an Amex Supply for inns, it’s actually value seeing should you can stack any extra perks or gives to get extra for much less.

Finest Fee Ensures

Lastly, should you’re ever reserving a lodge with money, and particularly if you’re looking for the most affordable charge potential, it is best to know that almost all main applications provide greatest charge ensures.

With greatest charge ensures, most inns will value match your room charges should you occur to discover a higher eligible charge elsewhere. Not solely will they match the speed, however you’ll usually obtain an extra low cost or a present of factors, relying on which lodge chain you’re staying with.

Each lodge that has a greatest charge assure coverage with completely different phrases and circumstances, so be sure that to learn up on these variations earlier than you make your subsequent reserving.

Conclusion

In case you aren’t planning on redeeming factors for a lodge keep, or should you’d prefer to e book a lodge that may’t be booked with factors from a loyalty program, there’s nonetheless quite a lot of methods you possibly can squeeze worth out of your subsequent journey.

This may be accomplished by leveraging fixed-value factors currencies from bank cards, profiting from any journey credit you could have as a card profit, getting essentially the most out of a luxurious lodge keep via most well-liked associate applications, or via promotions that come up.

Earlier than you e book your subsequent lodge stick with money, make sure you plan forward, as you’ll doubtless discover a couple of methods to optimize your keep.