TD Canada Belief has simply rolled out a brand new characteristic known as “Customized provides” in its cellular app—and if you happen to’ve used Amex Affords or RBC Avion Affords earlier than, the idea will really feel very acquainted.

You’ll now discover focused offers that may be activated on a TD card of your selection, and when you make a qualifying buy, you’ll obtain an announcement credit score or money again.

Some provides work by click-through procuring (just like Rakuten or the Aeroplan eStore), whereas others merely reward you for spending in a selected class or at a particular model.

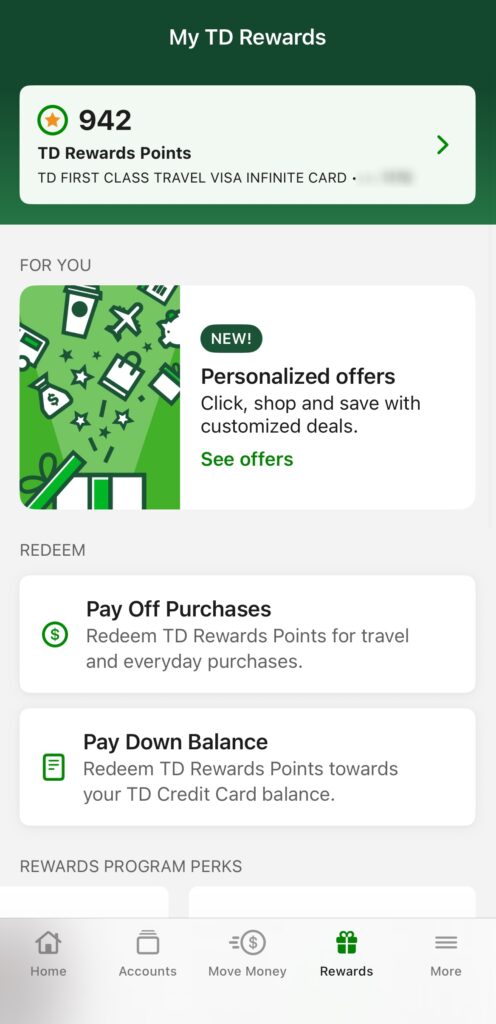

What’s TD “Customized provides”?

It’s a rotating set of worldwide or focused, opt-in offers obtainable within the TD cellular banking app below Rewards → Customized provides.

On first launch, you’ll be prompted to select curiosity classes to assist curate what you see.

Affords are available two flavours:

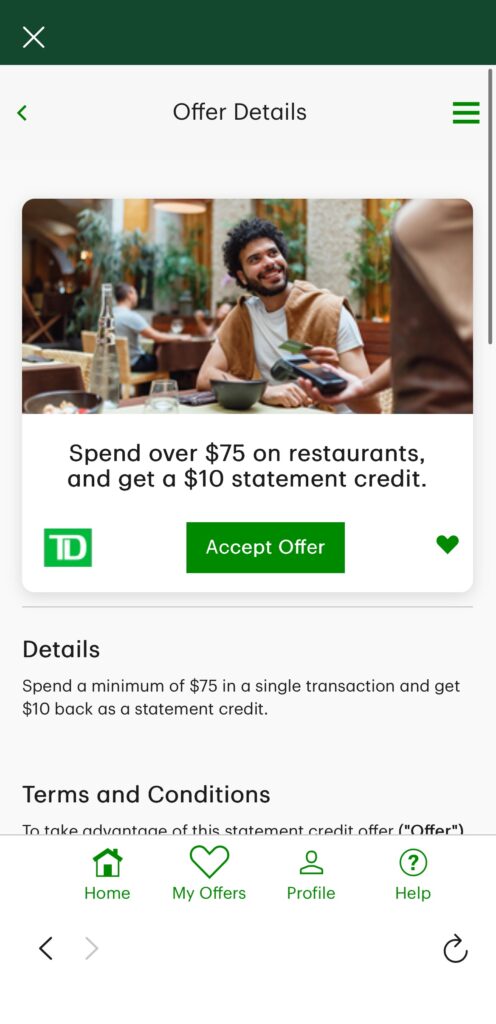

- Activate-then-spend: Make a qualifying buy and obtain an announcement credit score.

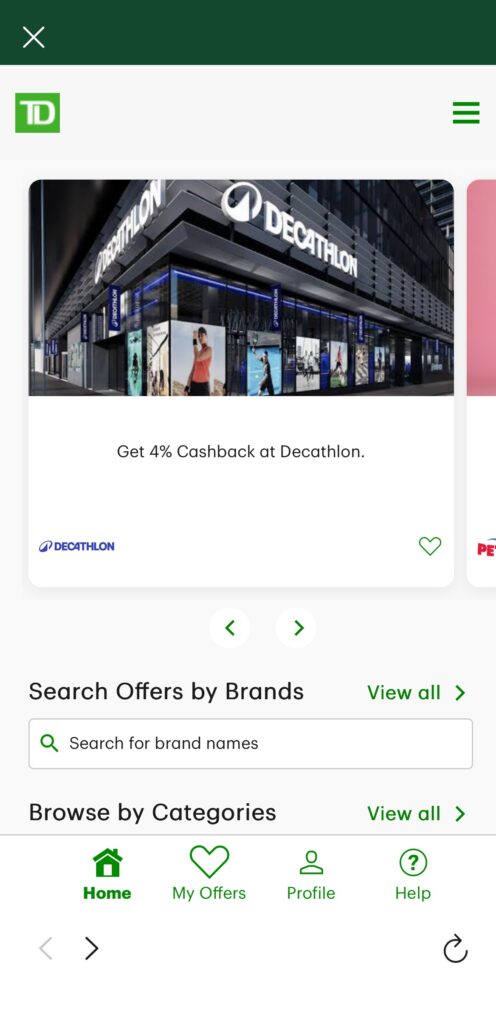

- Store-through button: Click on by in-app and earn money again on the acquisition quantity (assume Rakuten or the Aeroplan eStore mannequin).

Early provides embody:

- Spend over $75 on eating places, and get a $10 assertion credit score

- Get 4% Cashback at Decathlon

- Get 4% Cashback at Simons

The place To Discover In The TD App

- Open the TD cellular banking app and go to Rewards.

- Faucet See provides below Customized provides.

- Decide your pursuits to assist curate offers (e.g., Journey, Sports activities & Open air, House & Backyard).

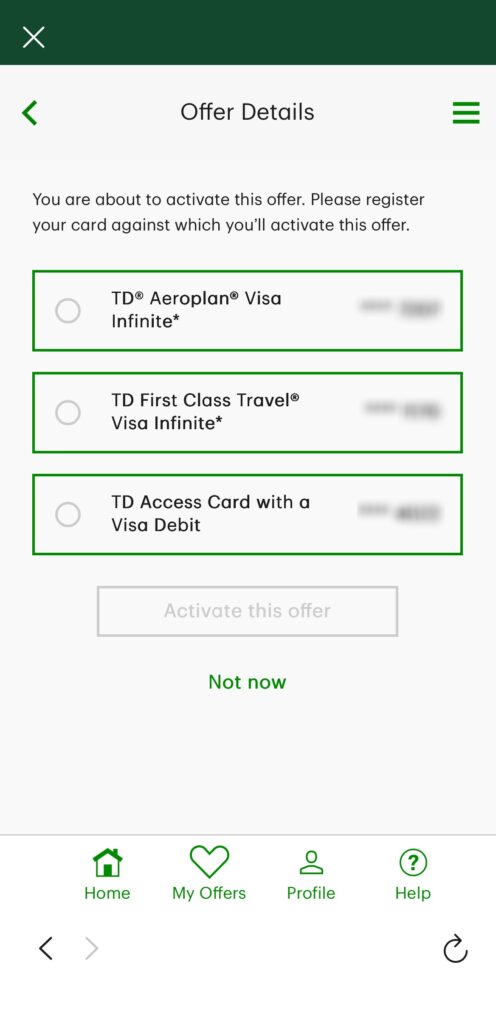

- Open a suggestion and activate it on a particular card (e.g., TD Aeroplan Visa Infinite, TD First Class Journey Visa Infinite, or perhaps a TD Entry Card with Visa Debit).

- Pay with the similar card you activated.

- You may “coronary heart” provides to favorite them and floor them quicker later.

My Preliminary Ideas

It’s nice to see TD stepping up with added worth for cardholders. The power to decide on which TD card to connect a suggestion to is genuinely helpful, particularly whenever you wish to pair a suggestion with the cardboard that has one of the best earn price or insurance coverage for that buy.

The trade-off, in fact, is that you just’ll want to trace which card every provide is tied to. That’s a bit extra tedious than RBC Avion Affords, which generally connect on the account stage and set off on any eligible RBC card as soon as activated.

Debit card help is the standout. Letting clients activate on TD Visa Debit makes the platform accessible to newcomers and youths who aren’t but prepared for bank cards. It’s a pleasant contact, and never one thing you see with Amex Affords.

It’s nonetheless early, however the potential is there. I’d like to see extra travel-related provides pop up, one thing like “Spend X, get Y again” on lodge manufacturers similar to Marriott.

Add that to present classes like eating places and groceries, and this might turn into a go-to platform. The app interface is clear, the onboarding is easy, and the early provides are fairly respectable.

Conclusion

TD “Customized provides” turns your pockets right into a mini rebate machine: activate a suggestion on the cardboard of your selection, pay as standard, and revel in automated assertion credit or money again.

It’s a user-friendly characteristic that stands out for its flexibility and debit card inclusion—one thing uncommon within the financial institution provide house.

So long as TD retains the provides related and refreshed, this might simply turn into a part of your weekly routine, proper alongside your Amex and RBC stacks.