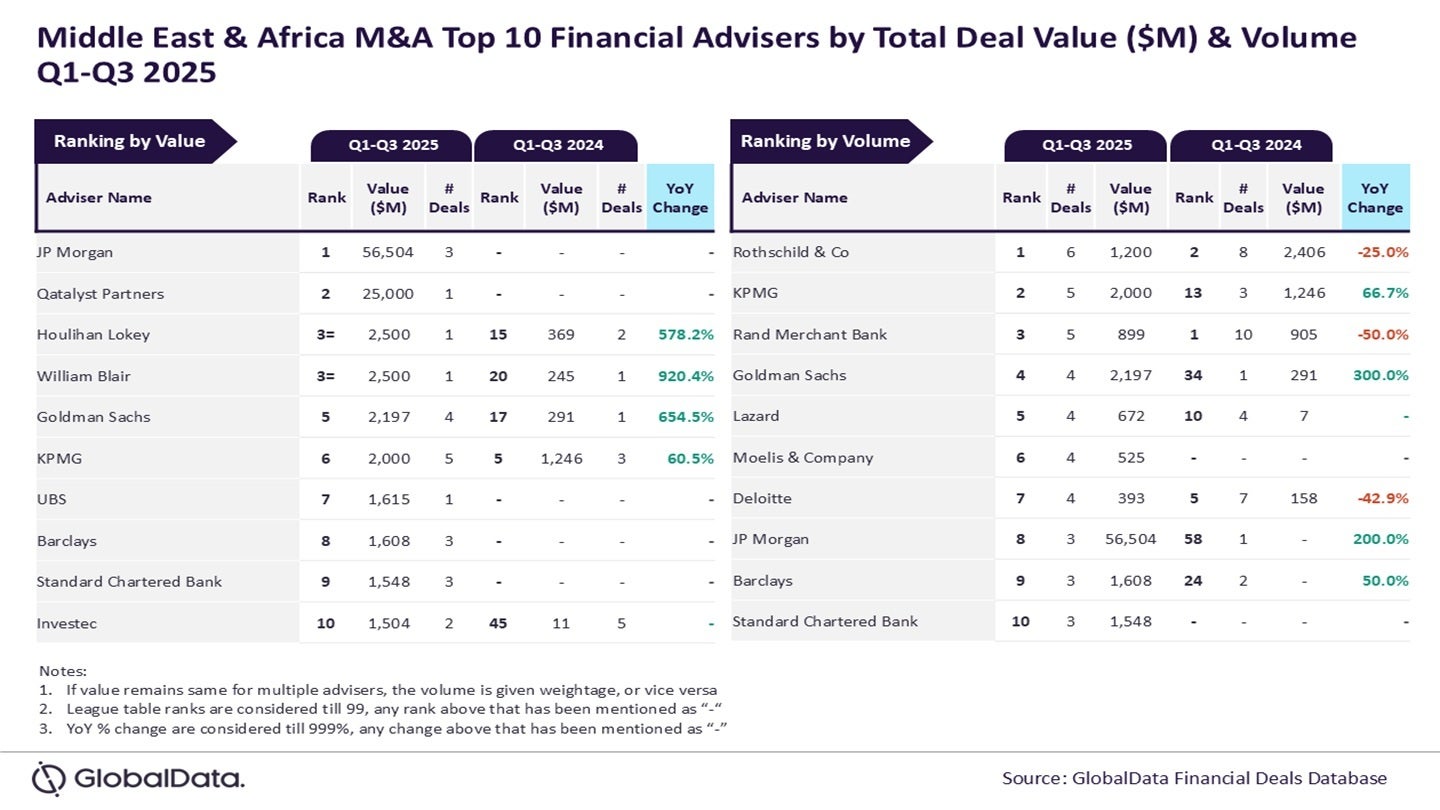

JP Morgan and Rothschild & Co have emerged as the highest mergers and acquisitions (M&A) monetary advisers within the Center East & African (MEA) area through the first three quarters (Q1-Q3) of 2025 by worth and quantity, respectively.

As per the evaluation of the monetary offers database of GlobalData, a number one information and analytics agency, JP Morgan’s advisory providers have been linked to transactions totalling $56.5bn.

Entry deeper trade intelligence

Expertise unmatched readability with a single platform that mixes distinctive information, AI, and human experience.

Alternatively, Rothschild & Co’s involvement in six offers has positioned it on the forefront of the amount rankings.

GlobalData lead analyst Aurojyoti Bose stated: “Rothschild & Co noticed its rating by deal quantity enhance from the second place throughout Q1-Q3 2024 to the highest place throughout Q1-Q3 2025.

“In the meantime, JP Morgan, which was not among the many high 10 by worth throughout Q1-Q3 2024, led the chart by this metric throughout Q1-Q3 2025. Involvement in a deal for the acquisition of Digital Arts by a consortium of traders for round $55bn performed a pivotal function for JP Morgan in securing the highest spot by worth.”

Within the worth dimension, Qatalyst Companions claimed the second spot with its advisory function in offers value $25bn.

Houlihan Lokey and William Blair are tied, every having suggested on $2.5bn value of offers, and Goldman Sachs adopted with $2.2bn in suggested deal worth.

On the amount entrance, KPMG took the second spot with 5 offers, trailed by Rand Service provider Financial institution, additionally with 5 offers however with decrease deal worth. Goldman Sachs and Lazard every had a hand in 4 offers. Lazard took the fifth spot on account of decrease deal worth.

GlobalData’s league tables are based mostly on the real-time monitoring of hundreds of firm web sites, advisory agency web sites and different dependable sources out there on the secondary area. A devoted staff of analysts screens all these sources to collect in-depth particulars for every deal, together with adviser names.

To make sure additional robustness to the info, the corporate additionally seeks submissions of offers from main advisers.