On October 8, 2025, Verizon introduced its pending acquisition of Starry, a set wi-fi entry (FWA) supplier that specialises in leveraging mmWave spectrum to serve multi-dwelling items (MDUs) in city markets.

The deal may show a savvy little bit of enterprise, buttressing Verizon’s FWA push with its efforts within the MDU house whereas additionally permitting the operator to see some return on its hefty funding in mmWave spectrum.

The issue is that the announcement’s timing – coming simply two days after Verizon shocked the market with a sudden CEO change – means many of the deal’s positives might be misplaced within the wash.

The top of Starry’s decade-long rollercoaster trip

Some will recognise Starry from its transient flip as an business darling close to the beginning of the present decade. Based in 2014 and launched publicly in 2016, Starry did pioneering work in utilising licensed high-band spectrum (particularly, within the 24 GHz and 37 GHz ranges) to offer FWA service, together with an on-demand add pace increase function launched in August 2022.

After debuting on the New York Inventory Change in March 2022 and receiving $269m in Rural Digital Alternative Fund (RDOF) awards from the federal authorities 5 months later (August 2022), Starry’s trajectory took an abrupt flip. Its scale ambitions ran in opposition to broader macroeconomic headwinds. Launching an formidable growth simply as inflation skyrocketed within the US, and funding {dollars} turned scarce for area of interest telecom bets, resulted in Starry failing to outrun its collectors. Inside a couple of months, Starry could be hoist by its personal petard.

By October 2022, Starry was defaulting on its RDOF awards. The corporate entered chapter simply 4 months later (February 2023), solely to emerge in August 2023 as a smaller, streamlined outfit centered on serving its 5 core markets: Boston (MA), New York (NY), Los Angeles (CA), Denver (CO), and Washington, DC. Disabused of its earlier notions of attaining scale, Starry spent the intervening two years maturing its mmWave FWA structure.

Verizon’s pending Starry acquisition lacks the appreciable footprint and subscriber positive aspects of the opposite M&A actions which were introduced by the key US operators in 2024 and 2025. Whereas the monetary phrases of the deal stay undisclosed, Starry’s 100,000 subscribers are a veritable drop within the ocean in comparison with the US’s bigger broadband suppliers.

That stated, it’s vital to notice that what Verizon is de facto buying is Starry’s technical and operational acumen in delivering FWA through mmWave – not solely a spectrum vary with distinctive deployment issues, but additionally a useful resource Verizon simply so occurs to have in abundance.

Verizon shores up MDU play amid C-suite shakeup

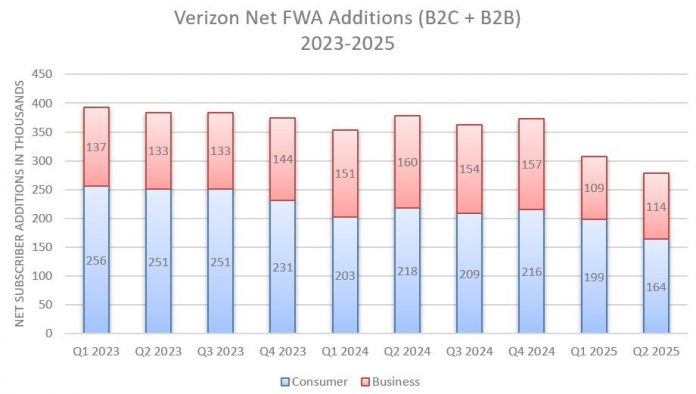

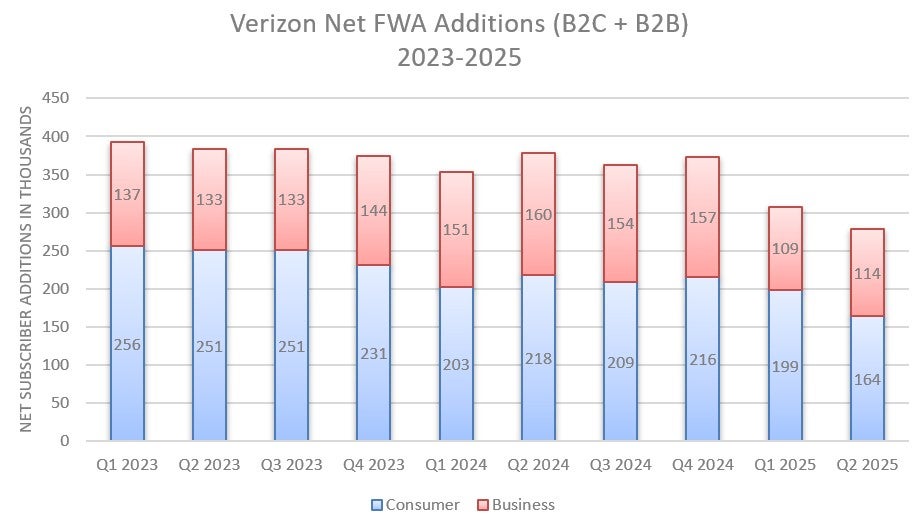

The deal happens after Verizon’s FWA subscriber acquisition cadence has slacked off over the previous few quarters and as enterprise subscribers make up an more and more heavy portion of its FWA subscriber combine. Any traction Verizon can acquire within the MDU house with its mmWave providing will hold the tap open on the residential alternative with out including visitors burden to its mid-band community.

Supply: GlobalData, firm earnings studies

Verizon execs have been teasing a brand new MDU FWA answer since October 2024. By April 2025, the corporate was claiming that the long-teased answer had been launched in 15 markets. Then-CEO Hans Vestberg famous throughout Verizon’s Q1 2025 earnings name that the providing would “ramp up” over the course of the yr, providing a number of companies starting from typical FWA efficiency to “fiber-like” speeds.

In fact, information of the Starry deal additionally hit the wires simply two days after Verizon introduced that its board of administrators had appointed former PayPal CEO Dan Schulman to take over for Vestberg “efficient instantly.”

This timing doesn’t simply threaten to scrub the announcement from the information cycle; the sequence paints the image of an organization throwing irons within the fireplace simply as some inside chaos units in, elevating questions on its near-term capability and long-term willingness for follow-through.

Whereas this buy ought to actually add gasoline to Verizon’s MDU efforts, the query now will probably be whether or not the outcome permits Verizon to internet substantial return out of its mmWave holdings.

The propagation traits for mmWave are relatively totally different than for low- or mid-band ranges, providing increased speeds however far much less vary and penetration, and Verizon was the most important spender within the Federal Communications Fee’s largest mmWave public sale. The brand new C-suite regime will probably be placing a premium on environment friendly returns.